We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Administration guide for employers

The information of this administration guide is provided to assist employers to get familiar with the common administrative handling and relevant MPF forms for Hang Seng Mandatory Provident Fund – SuperTrust Plus.

The information contained in this administration guide may refer to the Mandatory Provident Fund Schemes Ordinance (“MPFSO”), other applicable legislation/regulations and guidelines published by the Mandatory Provident Fund Schemes Authority (‘MPFA’) and all the information contained herein is intended for general reference only. The provisions of the MPFSO, relevant legislation/regulations, guidelines or announcements published by the MPFA shall prevail. The administration guide should not be treated or relied upon as legal advice or a substitute for the MPFSO, the related legislation/regulations and guidelines published by the MPFA. You are advised to refer to them for details. If in doubt, you should seek independent professional advice.

The administration guide will be updated from time to time without any notice. The information will be updated, as soon as practicable, with reference to any changes of the administrative handling and relevant MPF forms of Hang Seng Mandatory Provident Fund ― SuperTrust Plus as well as the MPF legislation and guidelines published by the MPFA.

The information is provided by the Administrator of Hang Seng MPF, The Hongkong and Shanghai Banking Corporation Limited

Version: July 2019

![]() Employer’s obligation

Employer’s obligation

You are required to enrol your non-casual employees into your MPF scheme unless they are exempt person.

Non-casual employees are:

- aged between 18 and below 65

- employed for a continuous period of 60 days or more

- full-time and part-time

![]() Enrolment deadline

Enrolment deadline

You are required to enrol your employees into an MPF scheme within the 60-day permitted period (first 60 days of employment).

If the last day of the 60-day permitted period falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the deadline for enrolment will be extended to the following day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day.

Please click here for the special dates for making enrolment for newly employed non-casual employees.

![]() Consequence of failure of enrolment

Consequence of failure of enrolment

Failure to enrol employees in an MPF scheme is liable to a financial penalty and even imprisonment. Please visit MPFA’s website at www.mpfa.org.hk for further details.

You should provide your new employees with:

Guide them through Hang Seng Mandatory Provident Fund ― SuperTrust Plus, the Constituent Fund choices, management fees under the scheme and member services.

- Employee Application Form

Employees should complete and return the signed Employee Application Form(HA61), otherwise, the contributions will be invested in accordance with the Default Investment Strategy (‘DIS’)* and the relevant MPF correspondence cannot be sent to your employees. After we received and processed their application form, the contributions will be allocated according to employee’s investment option specified on the application form. The relevant MPF correspondence will also be sent to your employee’s residential address in accordance with the information provided on the application form.

- Change of Additional Voluntary Contribution Arrangement Form (HA55) (if applicable)

Employees can give or change their regular additional voluntary contribution instructions.

There are different ways to enrol a new employee:

1.2.1 Employee Application Form

You can return the completed Employee Application Form, which must be signed by employer’s authorised signatory and employee to us for the setting up of an MPF account for your employee before enrolment deadline.

1.2.2 Paper-based remittance statement

You can enrol your employees into the Hang Seng Mandatory Provident Fund ― SuperTrust Plus by providing their personal details, such as name, sex, date of birth, identity type/number, member type, date joined scheme and class number etc in ‘New Employees Section’ of the remittance statement.

Please note: Although you have enrolled your new employees into the Hang Seng Mandatory Provident Fund ― SuperTrust Plus by paper-based remittance statement, you still need to return the completed and signed Employee Application Form of your employees to us so that we can set up a complete MPF account for your employees.

1.2.3 Electronic remittance statement via Hang Seng Business e-Banking (BIB) MPF and Payroll Services

You can enrol your employees into the Hang Seng Mandatory Provident Fund ― SuperTrust Plus by providing their personal details, such as name, sex, date of birth, identity type, identity number, member type, date joined scheme and class number etc under the page on ‘Prepare MPF Remittance Statement and Payroll - Add/Amend New Employee’ via Hang Seng BIB MPF and Payroll Services.

Please note: Although you have enrolled your new employees into the Hang Seng Mandatory Provident Fund ― SuperTrust Plus by electronic remittance statement via Hang Seng BIB MPF and Payroll Services, you still need to return the completed and signed Employee Application Form of your employees to us so that we can set up a complete MPF account for your employees.

Please click here for the Hang seng Business e-Banking MPF and Payroll Services User Guide, or call our Hang Seng MPF Employer Direct on (852) 2288 6822 for enquiries or how to apply the Hang Seng BIB MPF and Payroll Services.

1.2.4 Other electronic means

If you have developed the direct file interface with Hang Seng MPF, you can enrol your employees into the Hang Seng Mandatory Provident Fund ― SuperTrust Plus through the interface file by providing required information and using the agreed format.

Please note: Although you have enrolled your new employees into the Hang Seng Mandatory Provident Fund ― SuperTrust Plus by other electronic means, you still need to return the completed and signed Employee Application Form of your employees to us so that we can set up a complete MPF account for your employees.

Points to note for enrolling a new employee:

If you have enrolled your new employees into Hang Seng Mandatory Provident Fund ― SuperTrust Plus through the ways other than using the Employee Application Form, you still need to return the completed and signed Employee Application Form of your employees to us so that we can set up a complete MPF account for your employees. Please note that the contribution of your new employees will be invested in accordance with the DIS under this circumstance.

You should provide the Employee Application Form to your employees as soon as possible, so as to allow sufficient time for them to study the Constituent Funds available in the Hang Seng Mandatory Provident Fund ― SuperTrust Plus and decide on their own investment portfolio.

Please ensure your employees complete, sign (including the ‘Declaration and authorisation’ in member section of the application form) and return the Employee Application Form to you. If your employees do not wish to make a fund choice or do not provide a valid investment option and/or do not sign on the application form, all contributions will be invested in accordance with the DIS*. If there is no valid residential address provided by the employees on the application form, the relevant MPF correspondence cannot be sent to them.

Employer is also required to confirm the accuracy and completeness of the enrolment information by signing in the designated areas(s) on the Employee Application Form. However, if you are not an individual, the application form has to be signed by a duly authorised signatory. Please ensure you complete and sign the ‘Employer section’ on the application form, a company chop only is not accepted in lieu of such.

In the circumstances that the Employee Application Form is not properly completed and signed by employer and employee, we may refuse to process the enrolment of the employee(s) concerned.

If your employees fail to return the completed and signed Employee Application Form to you, you still have to enrol your employees before the end of the permitted period and make the full contributions to fulfill your obligation as an employer.

You should always enrol your employees with their Hong Kong Identity (HKID) Card.

The HKID card number should be used as the identification number of an MPF account. Passport number should be given only if your employees do not possess a HKID card. Please enclose a copy of the passport and provide the place of issue.

When you handle the MPF administrative issues (such as reporting and payment of MPF contributions, reporting termination details, handling severance payments or long service payments) for your employees, please provide their identification number which should be the same as the one registered in our records.

Please note that, using a non-registered identification number for any instruction for an MPF account may result in unnecessary error or delay in processing.

If there is any update on the identification number, please provide a written notice together with a copy of relevant supporting documents to us for processing and you should also use the updated information on managing your MPF contribution issue afterwards.

Accuracy of the date of birth of your employees is very important as it determines the start day of contributions when the employee at the age of 18 and the end day of contributions when the employee at the age of 65 and the date of annual de-risking process of your employee if the contributions of your employee are invested according to the DIS.

If your employee’s HKID card contains the year of birth only and there is no other form of identity to prove the exact date of birth, 31 December should be used as the day and month.

If the HKID card contains the year and month but not the date and there is no other form of identity to prove the exact date of birth, the last day of the month should be used.

You may set up different pay centres for different payroll cycles. Please ensure you enrol your employees into a correct pay centre, report and make the contributions to the correct MPF account of your employees.

To set up additional pay centre, please complete and return 'Pay Centre Set Up Form' (HA03).

* Contributions and/or any transfer-in monies will be invested in accordance with the DIS, then the DIS will be effected automatically if the Employee Application Form is incomplete, has not been signed, returned, or processed at the time when we process the contribution allocation. The DIS aims to balance the long term effects of risk and return through investing in two Constituent Funds, namely the Core Accumulation Fund and the Age 65 Plus Fund, according to the pre-set allocation percentages at different ages. The DIS will manage investment risk exposure by automatically reducing the exposure to higher risk assets and correspondingly increasing the exposure to lower risk assets as the member gets older.

![]() For employee with a completed employee application form processed

For employee with a completed employee application form processed

After we received and processed the Employee Application Form, the contributions will be invested according to the valid investment option specified by the employee on the application form.

A 'Notice of Participation' (or an ‘MPF Membership Certificate’ before 1 August 2015) and an enrolment confirmation notice in sealed envelope will normally be sent to you for distribution to your employees. Please distribute the documents to your employees within seven working days upon receipt.

A member benefit statement will be delivered to your employee directly.

![]()

Employees who have been enrolled into your MPF scheme via paper-based remittance statement, electronic remittance statement or other electronic means but without returning a completed and signed Employee Application Form or an incomplete Employee Application Form has been returned, the setup of the MPF account for your employees will be regarded as incomplete.

You should return the completed and signed Employee Application Form of the employee to us so that we can set up a complete MPF account.The Notice of Participation and the enrolment confirmation notice, future benefit statement of the employee will be sent to you for distribution to the employee. Please note that other relevant MPF correspondences cannot be sent to your employees. Moreover, the contributions will be invested in accordance with the DIS*.

Please complete and return the signed Employee Application Form to us for setting up a complete record.

* Contributions and/or any transfer-in monies will be invested in accordance with the DIS, then the DIS will be effected automatically if the Employee Application Form is incomplete, has not been signed, returned, or processed at the time when we process the contribution allocation. The DIS aims to balance the long term effects of risk and return through investing in two Constituent Funds, namely the Core Accumulation Fund and the Age 65 Plus Fund, according to the pre-set allocation percentages at different ages. The DIS will manage investment risk exposure by automatically reducing the exposure to higher risk assets and correspondingly increasing the exposure to lower risk assets as the member gets older.

![]() Enrolling your employees within the regulatory deadlines to avoid penalties for failure to comply with the

Enrolling your employees within the regulatory deadlines to avoid penalties for failure to comply with the

![]() Ensure the information provided on the Employee Application Form is completed and accurate, and signed

Ensure the information provided on the Employee Application Form is completed and accurate, and signed

![]() Return the completed and signed Employee Application Form of your new employees as soon as possible

Return the completed and signed Employee Application Form of your new employees as soon as possible

![]() Pay the contributions in full by deadline

Pay the contributions in full by deadline

You have to submit the contribution details and make the contribution payment for your employees once every payroll cycle (also known as contribution period) in full on or before the relevant contribution day.

In general, for monthly-paid non-casual employees, the contributions are to be paid by the employer on or before the 10th day of each calendar month, following the end of the contribution period. For example, the contributions for the contribution period of 1-31 January should be paid on or before 10th of February.

However, if the contribution day falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the contribution day will be postponed to the following working day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day.

![]() Calculate the mandatory contributions correctly

Calculate the mandatory contributions correctly

Under the MPF legislation, employers and employees are each required to make the mandatory contributions of 5% of the employee’s relevant income^. In other words, the amount of mandatory contributions for each employee is comprised of two portions, employer’s mandatory contributions for the employee and employee’s mandatory contributions from their own pocket. You may refer to the table below for easy reference.

| Regular mandatory contributions for each employee | |

| Employer’s mandatory contributions | Employee’s mandatory contributions |

| = 5% of the relevant income of the employee | = 5% of the relevant income of the employee |

^In calculation, please take special note that the amount of mandatory contributions is subject to the minimum and maximum relevant income levels . MPFA reviews the minimum and maximum relevant income levels regularly and please always refers to the latest minimum and maximum relevant income levels published at MPFA website at www.mpfa.org.hk.

![]() Report the contribution details

Report the contribution details

When you are remitting the mandatory contributions to us, do not forget to complete and submit a remittance statement either in paper or electronic format, with the payment. The remittance statement should include the contribution details such as the relevant contribution period, relevant income and contribution amounts of each of your employees.

If there is any discrepancy between the contribution amount calculated according to the relevant income and the contribution amount reported by you on the remittance statement, we would base on the relevant income provided on the remittance statement to calculate and allocate the contributions to your employees’ MPF accounts accordingly.

![]() Consequence of failure of paying contributions in full and on time

Consequence of failure of paying contributions in full and on time

Failure to pay mandatory contributions in full and on time to a MPF service provider incurs a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment. You may refer to the MPFA’s website at www.mpfa.org.hk for further details.

Hang Seng MPF provides the following reporting options for you to submit remittance statement. You can simply indicate your choice of reporting option in the Employer Application Form and we will arrange accordingly.

2.2.1 Paper-based remittance statement

For the first time of remittance statement submission, you have to fill in the contribution details of your existing employees in the ‘Existing Employees Section’. The information required including but not limited to employee’s name, HKID card/Passport number, contribution period and relevant income, amount of mandatory contributions and voluntary contributions (if any).

Once we have processed your contributions, the latest contribution details of your reported employees will be pre-printed in the ‘Existing Employees Section’ for the remittance statement afterwards. Only if there are changes in the relevant income or employment status of your existing employees, you would need to update the details in the ‘Existing Employees Section’ of the pre-printed statement.

For new employees, you need to complete the ‘New Employees Section’ and arrange for first contributions. You may refer to ‘2.6 First contributions' section below for the details.

Do not forget to sign under ‘Declaration’ section and provide company chop on the paper-based remittance statement.

Any completed remittance statement together with cheque payment (if applicable) can be sent to us through the designated channels (‘authorised channels’) to the administrator for processing. Authorised channels include mailing to:

The Hongkong and Shanghai Banking Corporation Limited

PO Box 73770 Kowloon Central Post Office

Or you may also place your MPF documents to 'Hang Seng MPF Drop-in Boxes' at designated Hang Seng Bank branches.

'Hang Seng MPF Drop-In Box' has been set up at designated Hang Seng Bank branches for collection of MPF documents submitted by customers, such as paper remittance statement and cheque payment (if any). Submission of the MPF documents via ‘Hang Seng MPF Drop-In Box’ will be forwarded to the administrator for processing directly.

Please note that channels other than the authorised channels specified above are regarded as unauthorised channels. Submission of the MPF documents to the unauthorised channels include but not limited to:

(1) the staff at service counters at the branches,

(2) the branches without ‘Hang Seng MPF Drop-In Box’, or

(3) other collection boxes in the branches (for examples, the collection boxes for cheque payment).

CAUTIONS

Please be aware that employers and/or self-employed persons should NOT hand in any MPF documents (in particular for those paper remittance statement and cheque payment (if any) which must be submitted on time according to the MPF legislation) to unauthorised channels.

Any submission of the MPF documents to unauthorised channels will not be forwarded to the administrator for processing directly and it may take a longer time for the documents to be transferred to the administrator. While the receipt date by the administrator will be stamped only when the documents reached the administrator, employers and/or self-employed persons please be cautious that this will result in delay in receiving and processing the paper remittance statement or other instructions by the administrator. Any failure to pay mandatory contributions in full and on time to a trustee incurs a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment by the MPFA. You may refer to the MPFA's website www.mpfa.org.hk for further details of offences and penalties.

2.2.2 Electronic remittance statement through Hang Seng Business e-Banking (BIB) MPF and Payroll Services

You can ride on our Hang Seng BIB MPF and Payroll Services to manage contribution arrangements. What you need to do is to create records of your employees and provide the required information of each employee including but not limited to date joined scheme, date of birth, amount of relevant income and voluntary contribution (if any). The mandatory contribution amount will be automatically calculated based on the employee’s relevant income provided by you. A full list showing the contribution details of each employee will be generated for your preview and validation before submission.

To understand more about how Hang Seng BIB MPF and Payroll Services can help you, you may refer to the Hang Seng Business e-Banking MPF and Payroll Services User Guide.

2.2.3 Other electronic means

You may use a format which is mutually agreed between both of us, or you may use external payroll administration software to manage your MPF administration. Given that the required contribution details are included in such electronic format which is compatible with ours, we will accept it for the contribution processing.

2.2.4 Blank remittance statement

In case you fail to receive the pre-printed remittance statement or encounter any problem in submitting the contribution details via the electronic platform, you are advised to make use of the blank form of the remittance statement, ‘Remittance Statement – Non-Daily Contribution’, for the reporting. You can click here to download or call our customer service representative to obtain a copy.

Do not forget to sign under ‘Declaration’ section and provide company chop on the paper-based remittance statement.

Points to note for reporting contributions

When you are reporting the contribution details to us, do not forget to include all your new and existing employees onto the remittance statement even their relevant income is zero.

Paper-based remittance statement should be signed by the authorised person of the employer. If there is any change in authorised person or change in authority level, you may notify us by returning a completed

'HAY1 – Authorised Signatures Specimen (Employer)' form to us. You may update, by using this form, the authority level and limit in making contribution payments, benefit payments and placing reserve account fund switching transaction.

Please ensure sufficient postage and allow sufficient mailing time prior to the contribution day if you send the remittance statement to us by post. Failure to pay mandatory contributions in full and on time to a MPF service provider incurs a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment.

Regardless of whether the contributions are for your existing employees or are the first contributions for your new employees, if you are due to make the mandatory contributions, but their records are not yet being shown in the paper-based or electronic remittance statement, you must report the mandatory contributions for your employees under the 'New Employee Section' of the remittance statement and settle the contributions on time. You should not wait until their records are being shown in the remittance statement to make the contributions. If you fail to receive the paper-based or electronic remittance statement, you can report the contribution details by blank remittance statement and pay the contributions in full. Failure to receive the pre-printed remittance statement or software problems may not be a sufficient reason for appealing the surcharges.

Submission of remittance statement should always come with the payment of the MPF contributions. You can choose to pay the contributions either by cheque or direct debit authorisation. Please be reminded to submit a clear, correct and complete remittance statement and pay the mandatory contributions in full for your employees on or before contribution day. You may refer to the ‘8.1 General Support’ section below for details on submission of MPF document.

2.3.1 Cheque payment

If you are using cheque payment to settle the contributions, it is very important for you to issue and submit a valid cheque with clear and correct information. The contributions can be paid by a crossed cheque with Employer ID and contribution period marked at the back. You may refer to the following payee name for reference:

Cheque payable to:

'Hang Seng MPF SuperTrust Plus' / 'HSBC Provident Fund Trustee (Hong Kong) Limited A/C Hang Seng Mandatory Provident Fund - SuperTrust Plus'

Other payment types includes bearer cheque, cash, cashier order or demand draft is NOT accepted as the method of payment for the contributions. Any incorrect or incomplete information on the cheque will be treated as invalid cheque and it will NOT be accepted. Employers are required to re-submit a crossed cheque with correct information to us on or before the contribution day. Below are some examples for your attention.

| Items | Invalid cheque |

| Payee name | Incorrect / missing |

| Date | Outdated/ Post-dated/ Missing/Incomplete/ Illegible |

| The amount in words and figures | Not match/missing/ incorrect |

| Authorised signature / Drawer’s chop | Missing |

| Amendment | Missing signature and drawer’s chop |

2.3.2 Direct debit authorisation

You can also choose to pay your contributions through direct debit. Simply complete and return the ‘Direct Debit Authorisation’(HA14) form for our processing.

Points to note for payment methods

![]() Confirmation of MPF contributions

Confirmation of MPF contributions

A ‘Confirmation of MPF contribution’ will be sent to you by mail if we receive the contribution details via paper-based remittance statement or other electronic means. It lists out the actual amount of mandatory contributions, voluntary contributions (if any) made by employer and employees.

A ‘Fund purchase confirmation’ in electronic format will be sent to you by email if we receive the contribution details via electronic remittance statement of Hang Seng BIB MPF and Payroll Services. It lists out the actual amount of mandatory contributions and voluntary contributions (if any) made by employer and employees.

![]() Overpayment

Overpayment

The calculation of overpayment is based on the relevant income that you reported for the employees on the Remittance Statement. Overpayment is the part of paid contributions amount which exceed the required

mandatory contribution amount of the employee’s relevant income.If there is any overpayment, we will issue an ‘Overpaid/Overstated Mandatory Contribution Report’ to you. Any overpaid/overstated amount will not be invested into employer or employee’s account. Employer can choose to use the uninvested overpaid amount to offset future contributions or request for a refund from us. However, if we do not receive any instruction from you, the uninvested overpaid amount will be kept in your MPF scheme account without interest.

![]() Non-paid / Underpayment

Non-paid / Underpayment

Paying contributions in full on or before the contribution day is vital. In case of outstanding mandatory contributions, either contributions are underpaid or non paid, we are obliged to report the case to the MPFA in accordance to MPF legislation.

The following situation will be considered as non-paid:

The calculation of underpayment is based on the relevant income that you reported for the employees on the Remittance Statement. If the paid amount is less than the required mandatory contribution of employee’s relevant income, it will be treated as underpayment.

For those employers who have not paid the contributions, we will send them a ‘Mandatory Contribution Reminder’ by mail to remind them to settle the payment as soon as possible.

For underpayment, we will send a ‘Mandatory Contribution Discrepancy Bill’ to employers for providing the missing details and arrange remittance of the shortfalls.

Both non-paid and underpaid mandatory contributions are classified as default contributions. MPFA may impose a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment. Even the non-paid and underpaid mandatory contributions were subsequently settled after the contribution day (usually regarded as ‘late payment’), MPFA may also impose 5% surcharge on the late payment. Employers may also be liable for the financial penalty, fine and imprisonment.

Points to note for overpayment/ non-paid/ underpayment

After making timely contribution with remittance statement, employers have to provide each employee with a pay record within seven working days after the payment. The pay record should show the employee’s relevant income, date of contribution paid to the trustee and the contribution amount for both mandatory and voluntary (if any) made by both employer and employee. If an employer fails to do so, a penalty may be imposed by MPFA. For details, please refer to MPFA website www.mpfa.org.hk.

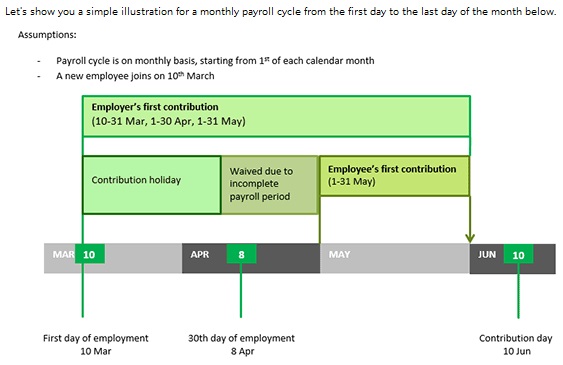

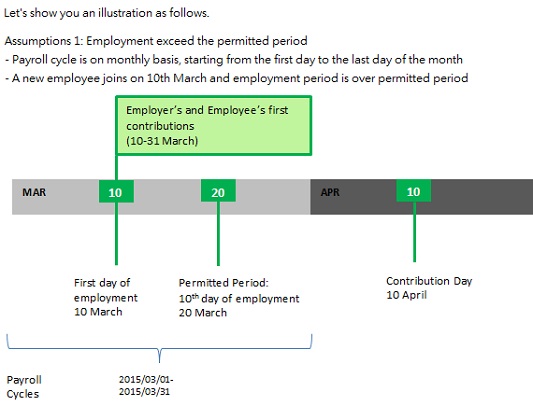

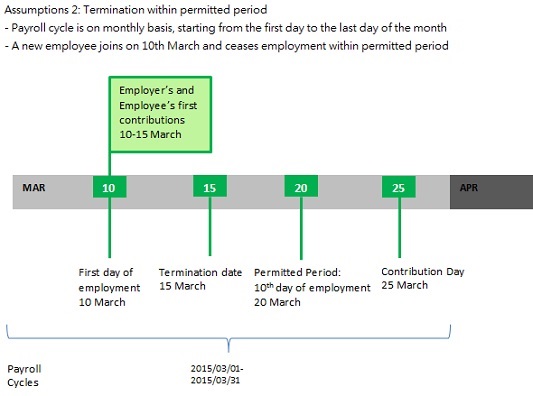

As an employer, you have to make contributions for your employees from the first day of their employment. Your new employees, however, enjoy a ‘30-day contribution holiday’. That means, every new employee is not required to make contributions for the first 30 days of employment. Employee is also not required to make contribution for (i) any incomplete payroll period that immediately follows the 30-day period (if the employee’s wage period is monthly or shorter than monthly); or (ii) the calendar month in which the 30th day of employment falls (if the employee’s wage period is longer than monthly).

The first contributions for new employees, including both employer’s and employee’s portions, have to be made on or before the 10th day of the calendar month after the last day of the calendar month on which the 60th day of employment falls. If the contribution day falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the contribution day will be postponed to the following working day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day. However, it is not necessary to arrange MPF for the employees who have employed for less than 60 days.

Please click here for the special dates for making first-time contributions for newly employed non-casual employees.

Non Casual employees who reach the age of 18 and 65 or expatriates working in Hong Kong with the employment visa and ceased 13-month exemption period.

Employees who are below 18 years old or expatriates from overseas who enter Hong Kong for employment for less than 13 months are exempted1 from joining MPF scheme. When these employees reached 18 years old or ceased 13-month exemption period1 respectively, the employer have to enrol them in an MPF scheme and make the relevant mandatory contributions accordingly. The permitted period and ‘30-day contribution holiday’ apply to these employees in this situation.

Employees who reached 65 years old and continued to be employed are not required to make the mandatory contributions starting from the date reaching the age of 65. The mandatory contributions for the concerned contribution period should be calculated up to the date before the employees reach the age of 65.

To report the contribution details for these employees by paper-based Remittance Statement, please fill in the ‘relevant income’ and ‘mandatory contributions’ as follows:

• In column on ‘Relevant income (HKD)’

Provide the full relevant income (that is not the prorated relevant income) of the employee for the concerned reporting payroll periods.

• In column on 'Mandatory contributions (HKD)'

Provide the actual mandatory contribution amount which should be paid by employer and employee respectively for the concerned reporting contribution periods.

You may also refer to the table below for some examples in reporting the relevant income and mandatory contributions for the employees under the above three scenarios:

| Scenarios | Dates (YYYY/MM/DD) |

Payroll period (YYYY/MM/DD) |

Contribution period (YYYY/MM/DD) |

Relevant income (HKD) |

Employer’s mandatory contributions (HKD) |

Employee’s mandatory contributions (HKD) |

| Employee who reaches the age of 18 on | 2015/05/11 | 2015/05/01 to 2015/05/31 |

2015/05/11 to 2015/05/31 |

23,0002 | 23,000 x 21/31x 5% =779.033 |

Not applicable4 |

| 2015/06/01 to 2015/06/30 |

2015/06/01 to 2015/06/30 |

23,000 | 23,000 x 5% =1,150 |

Not applicable4 | ||

| 2015/07/01 to 2015/07/31 |

2015/07/01 to 2015/07/31 |

23,000 | 23,000 x 5% =1,150 |

23,000 x 5% =1,150 |

||

| Expatriates working in Hong Kong with employment visa and ceased the 13-month exemption period1 on | 2015/05/11 | 2015/05/01 to 2015/05/31 |

2015/05/11 to 2015/05/31 |

23,0002 | 23,000 x 21/31 x 5% =779.033 |

Not applicable4 |

| 2015/06/01 to 2015/06/30 |

2015/06/01 to 2015/06/30 |

23,000 | 23,000 x 5% =1,150 |

Not applicable4 | ||

| 2015/07/01 to 2015/07/31 |

2015/07/01 to 2015/07/31 |

23,000 | 23,000 x 5% =1,150 |

23,000 x 5% =1,150 |

||

| Employee who reaches the age of 65 on | 2015/05/21 | 2015/05/01 to 2015/05/31 |

2015/05/01 to 2015/05/20 |

23,0002 | 23,000 x 20/31 x 5% =741.943 |

23,000 x 20/31 x 5% =741.943 |

1 If the original period of an employee’s employment visa for permission to work in Hong Kong is not more than 13 months, but the visa is renewed and brings the employee’s total continuous period of permission for employment in Hong Kong to over 13 months, that employee would cease to be exempt from the first day after the 13-month period. Please note that no exemption would be given to an employee who has been granted an employment visa for permission to work in Hong Kong for a period of more than 13 months.

2The relevant income reported on the remittance statement should be the full relevant income for the payroll period from 1 May 2015 to 31 May 2015 but not the prorated relevant income for mandatory contribution purposes for the contribution period.

3The mandatory contributions reported on the remittance statement should be the actual mandatory contributions amount paid by the employer and/or employees for the contribution period. It is calculated using the prorated relevant income for the contribution period.

4The first 30 days of employment and any incomplete contribution period or calendar month (depending on the remuneration cycle (for example, weekly, monthly, quarterly) of the non-casual employee concerned) that immediately follows the 30-day period, during which the non-casual employees are not required to make mandatory contributions.

In the circumstance that the mandatory contributions of a previous contribution period of your employees having been fully settled on or before the relevant contribution day according to the relevant income stated in the remittance statement at that time, but if there is a subsequent change of the employee's relevant income which resulted an increase of the mandatory contributions for such contribution period, as the increased part of mandatory contributions cannot be settled on or before the relevant contribution day of the previous contribution period, it will be considered as a default contributions. Trustee will have to report the default contributions to the MPFA.

Retroactive salary adjustment is a common practice in many industries. To avoid default contributions due to improper reporting of salary adjustment, you should report relevant income and make mandatory contributions properly when making a back payment of salary to your employee.

Proper reporting of the relevant income and contributions

Back payments (eg payments relating to an earlier period perhaps arising from a salary adjustment or a time lag between the ascertainment and payment of commissions, tips or bonuses) to a relevant employee are not relevant income, in general, until the contribution period in which the back payment is ascertained and paid.

For example, an employer decides to increase salary to a relevant employee in September in a particular year, the relevant salary adjustments can be traced back to 1 April of the year, the amount of the increased salary of April, May, June, July and August of that year should be included in the relevant income of September as and when the back payment are ascertained and paid. If the employer adjusted the relevant income and mandatory contributions of each contribution period from April to August, despite the increased part of mandatory contributions were immediately paid, the increased part of contributions will still be regarded as not been paid on or before the contribution day of the relevant contribution period. As employers are required to settle the mandatory contributions in full on or before the contribution day of the relevant contribution period, MPFA may impose a surcharge and/or financial penalty of these late contributions on the relevant employers.

Please refer to below examples:

Example 1:

In September 2015, an employer adjusts the monthly salary of an employee from HKD10,000 to HKD12,000 and this salary adjustment will take retroactive effect from April of that year.

| Contribution periods | ||||||

| April | May | June | July | August | September | |

| Proper reporting of relevant income and contributions | No adjustment of the relevant income and employer’s and employee’s mandatory contributions for each contribution period | Report and settle the following mandatory contributions: Relevant income: HKD22,000 (include the salary of HKD12,000 for September 2015 and increased part of salary HKD2,000 each month, totalling HKD10,000 from April to August) Employer's mandatory contributions: HKD1,100 Employee's mandatory contributions: HKD1,100 |

||||

| Improper reporting of relevant income and contributions (Additional mandatory contributions may subject to surcharge and/or financial penalty imposed by MPFA) | Adjust the relevant income for each contribution period: HKD10,000 to HKD12,000 Adjust both employer’s and employee’s mandatory contributions for each contribution period: HKD500 to HKD600 Pay the total additional employer’s and employee’s mandatory contributions amount: HKD1,000 |

Report and settle the following mandatory contributions: Relevant income: HKD12,000 Employer's mandatory contributions: HKD600 Employee's mandatory contributions: HKD600 |

||||

Example 2:

In September 2015, an employer adjusts the monthly salary of an employee from HKD20,000 to HKD22,000 and this salary adjustment will take retroactive effect from April of that year.

| Contribution periods | ||||||

| April | May | June | July | August | September | |

| Proper reporting of relevant income and contributions | No adjustment of the relevant income and employer’s and employee’s mandatory contributions for each contribution period | Relevant income: HKD32,000 (include the salary of HKD22,000 for September 2015 and increased part of salary HKD2,000 each month, totalling HKD10,000 from April to August) Employer’s mandatory contributions: HKD1,500^ Employee’s mandatory contributions: HKD1,500^ |

||||

| Improper reporting of relevant income and contributions (Additional mandatory contributions may subject to surcharge and/or financial penalty imposed by MPFA) | Adjust the relevant income for each contribution period: HKD20,000 to HKD22,000 Adjust both employer's and employee's mandatory contributions for each contribution period: HKD1,000 to HKD1,100 Pay the total additional employer's and employee’s mandatory contributions amount: HKD1,000 |

Report and settle the following mandatory contributions: Relevant income: HKD22,000 Employer’s mandatory contributions: HKD1,100 Employee’s mandatory contributions: HKD1,100 |

||||

^ Subject to the maximum level of relevant income for MPF contributions. Example 2 is illustrated using the maximum mandatory contributions amount of HKD1,500 per month.

![]() Fail to report the contribution details and make the payment of MPF contributions in full on or before the

Fail to report the contribution details and make the payment of MPF contributions in full on or before the

![]() Report termination details for your employees timely

Report termination details for your employees timely

Whenever an employee ceases their employment with your company, employer should report the termination details to us and pay the last contributions timely. For non-casual employees, the deadline for reporting termination details and paying last contributions is on or before the 10th day of the calendar month following the employee’s last day of employment. For example, if the last employment date of an employee is 20 January, the reporting of termination details and payment of the last contributions for that particular employee for the period from 1-20 January should be completed on or before 10th of February.

![]() Settle the last contributions in full and timely?

Settle the last contributions in full and timely?

Similar to the calculation of regular contributions for your existing employees, the last contributions for an employee who ceased employment is 5% of the employee’s relevant income paid within that payroll cycle.

3.2.1 Paper-based remittance statement

Termination details of existing employees should be reported in 'Termination Details' under Section A ‘Existing Employees Section’ of the pre-printed Remittance Statement. The ‘Termination Details’ including (1) last employment date, (2) termination code, (3) indication of long service payment/ severance payment (if applicable).

If the records of the employees concerned are not yet shown in the pre-printed remittance statement, you can notify us about the employee’s termination of employment through completion of the relevant information under Section B ‘New Employees Section’.

3.2.2 Electronic remittance statement through Hang Seng Business e-Banking (BIB) MPF and Payroll Services

You can also report termination of employee through Hang Seng BIB MPF and Payroll Services. Under the page of ‘Prepare MPF Remittance Statement and Payroll Transaction – Add/ Amend Termination’, you can simply provide the termination details including the last employment date, termination reason and long service payment or severance payment paid to employee.

If the records of the employees concerned are not yet shown in the electronic remittance statement, you can also notify us about the employee’s termination of employment through the page of ‘Prepare MPF Remittance Statement and Payroll Transaction – Add/ Amend Termination’.

To understand more about how can Hang Seng BIB MPF and Payroll Services help you, you may refer to Hang Seng Business e-Banking MPF and Payroll Services User Guide.

The MPF legislation allows employers to offset long service payment or severance payment paid to your employee with the relevant MPF accrued benefits derived from employer contributions.

3.3.1 Offset sequence of long service payment and severance payment

The member's vested accrued benefits derived from the employer's contributions will be used for the offsetting according to the following sequence:

1. Employer voluntary contributions (if applicable)

2. Employer's ORSO transfers (if applicable)

3. Employer special contributions (if applicable)

4. Employer mandatory contributions

3.3.2 Ways to apply for the refund of long service payment and severance payment

You must provide the following supporting documents in order to request for a refund of accrued benefits attributable to employer’s contributions, for the purpose of offsetting long service payment and severance payment which you have already paid to employee:

1. A completed termination notice signed by an authorised person of the company.

2. A completed ‘Payment Proof for Long Service Payment/Severance Payment (HALS)’signed by an authorised person of the company and the departed employee.

Signatures of the authorised persons of the company and the departed employee on the above documents must match with our records.

Employers should also note that, for long service payment and severance payment offsetting, it is essential to submit Payment Proof for Long Service Payment/Severance Payment (HALS) promptly. If your departed employee’s accrued benefits have been transferred to another MPF scheme or are paid out at the employee’s request before we receive the HALS form from you, we will not be able to arrange any refund. Even if such benefits are transferred to another MPF account of the employee under Hang Seng Mandatory Provident Fund ― SuperTrust Plus, a consent from your departed employee may be required for us to process the refund.

An employee may be transferred between companies (employers) due to a change in business ownership, or transferred between associated companies (the ‘Transfer between companies’). In these circumstances, employment with the ‘Existing Employer’ can be recognized by the ‘New Employer’ as continuous service in determining Severance or Long Service Payments under the Employment Ordinance.

To arrange the transfer of MPF accrued benefits for employees due to the Transfer between companies, employers must complete and submit the "Employer’s Request for Fund Transfer Form (HAPE)", "Member Transfer Form (HAET)" and such other relevant MPF forms subject to the types of transfers. Please refer to below table for the details of the required forms:

| Type | Member Transfer Form (HAET) | Employer’s Request for Fund Transfer Form (HAPE) | Employee Application Form | Remittance Statement |

| Type 1 Member transfers within Hang Seng Mandatory Provident Fund - SuperTrust Plus |

✔ | ✔ | ✔ | |

| Type 2 Transfer from another service provider’s MPF scheme to Hang Seng Mandatory Provident Fund ― SuperTrust Plus |

✔ | ✔ | ✔ | |

| Type 3 Transfer from Hang Seng Mandatory Provident Fund ― SuperTrust Plus to another service provider’s MPF scheme |

✔ | ✔ | ✔ | |

| Remarks |

The Member Transfer Form must be completed and signed by employee, the authorised persons of existing and new employers. | The Employer’s Request for Fund Transfer Form must be completed and signed by the authorised person of the new employers. | The Employee Application Form must be completed and signed by employee and the authorised persons of new employers. | The Remittance Statement must be completed and signed by the authorised persons of existing and new employers. |

‘Existing Employer’, ‘New Employer’ and employees concerned are all required to complete and sign the above documents, in order to complete the transfer of MPF accrued benefits due to the Transfer between companies. Employers and employees concerned should pay attention to the following:

‘Existing Employer’

‘Existing Employer’ is required to report to Hang Seng MPF regarding the termination details and pay the last contributions for the employee concerned. You may report the contributions and termination details for the employee concerned via paper or electronic remittance statement. You need to fill in ‘GO’ under the column of termination code as a representation of the Transfer between companies for the employee concerned.

In general, the deadline for ‘Existing Employer’ to report the termination details and pay the last contributions for the employee concerned is on or before the 10th day of the calendar month following the employee's last day of previous employment (ie Contribution day). If the contribution day falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the contribution day will be postponed to the following working day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day. Failure to pay the contributions in full and on time incurs a 5% surcharge on the outstanding mandatory contributions and the transfer of MPF accrued benefits due to the Transfer between companies may not be allowed to proceed as well.

‘New Employer’

‘New Employer’ should submit the ‘Member Transfer Form’ and ‘Employer’s Request for Fund Transfer Form’ to the transferee trustee (ie the trustee of the New Employer's scheme) arranging the transfer within the permitted period, enrol the employee concerned in the new MPF scheme and make contributions.

‘New Employer’ is required to make the MPF contributions for the employee concerned on time. In general, the ‘30 days contribution holiday’ is not applicable to the employees for the Transfer between companies. That means both the contributions for ‘New Employer’ and employee will be calculated immediately starting from the effective date of the transfer.

If the employee concerned submits the ‘Employee Application Form’ in order to enrol into the new MPF scheme, ‘New Employer’ is required to choose ‘Member transfer’ and provide the ‘First date joined employer group’ under item 7 of Part II – Employer Section on the Employee Application Form. The years of service for the calculation of the member’s vesting entitlement on the voluntary contributions (if any) will be counted from this date. Please refer to the ‘Ways to enrol an employee’ section for other points to note on enrolment for employees.

‘New Employer’ needs to provide a list of employee names together with their HKID/Passport numbers, and the effective date of transfer when filling in the ‘Employer’s Request for Fund Transfer Form’. In completing the ‘Member Transfer Form’, the ‘Date joined existing employer group’ must be filled in order to transfer the years of service from ‘Existing Employer’ to ‘New Employer’.

‘Existing Employer’, ‘New Employer’ and employee concerned should read the completed MPF forms carefully, sign and stamp the company chop (applicable to employers) on the form to confirm the correctness of the information.

Under the MPF system, apart from making mandatory contributions, employers can also arrange additional voluntary contributions (‘AVCs’) to your employees as part of the employee benefits programme. Same as the mandatory contributions, the AVCs made by employers are also profit tax deductible. For further details of the tax issues, please refer to the latest announcements by the Inland Revenue Department of the government of the HKSAR.

For the employer’s AVCs, Hang Seng MPF offers the below contribution scales for employers’ selection and they are:

1. Fixed amount

2. Percentage of the relevant income

(i) Designated contribution formula

(ii) Designated contribution percentage

3. Lump sum contributions

To set up AVCs for employees and the corresponding vesting arrangement, just complete the ‘Additional Voluntary Contribution Application Form’(HA12) and submit it together with your Employer Application Form for your MPF scheme.

If employers plan to set up AVCs to your employees after enrolling Hang Seng Mandatory Provident Fund ― SuperTrust Plus, you may also submit the ‘Additional Voluntary Contribution Application Form’. Please allow at least one month advance notice when specifying the effective date of AVCs for us to process your application.

When employers set up AVCs at Hang Seng MPF, they are required to select the contribution scale of the voluntary contributions arrangement.

5.3.1 Fixed amount

Voluntary contribution amounts paid in each contribution period are in fixed amounts and such amounts can be a specified lump sum amount or formulated by years of services.

5.3.2 Percentage of income

Voluntary contribution amounts paid in each contribution period are calculated according to a specific contribution formula or percentage.

(i) Designated contribution formula

Voluntary contribution amounts are calculated by a specific contribution formula which are:

Basic salary x contribution percentage

Relevant income x contribution percentage

Basic salary x contribution percentage – mandatory contribution

Relevant income x contribution percentage – mandatory contribution

(ii) Designated contribution percentage

Voluntary contribution amounts are calculated by a specific percentage. Either a flat contribution percentage or percentages set by years of services can be chosen.

5.3.3 Lump sum contributions

Voluntary contributions are set according to the report from employers which has no fixed formula.

Once you have selected either one of the AVCs arrangements, you should also set up different voluntary contribution scales for different classes of employees. The contribution percentage or fixed amount for the employer and employee is not necessary to be the same. You can also allocate the voluntary contribution scale according to years of services and please be reminded that to pick a calculation method of years of services on the application form.

The vesting scale specifics the percentage of employer’s balance derived from employer’s voluntary contributions and/or employer’s ORSO transfer which your employees are entitled to when they cease employment. Employers can set a vesting scale for the AVCs. The vesting scale is normally determined by an employee’s length of service and the reason for termination of employment which the years of services of employees can be counted from the date of employment or the date joined the scheme. Employers can either use the standard vesting scale or customise a new one which fits their needs.

Once the AVCs arrangement is effective, employers are required to report and submit the AVCs for their employees according to corresponding arrangements. For more information about reporting and submitting contributions, please refer to ‘Ways to report contributions’ and ‘Payment methods’ sections for details.

Any benefits which your employees are not entitled upon cessation of employment will be treated as unvested benefits. The arrangements of the unvested benefits are (i) refund to employer by cheque, (ii) transferred to the reserve account or (iii) transferred to the reserve account and allocated to existing members once a year. If method (i) is chosen that is refunding to employer by cheque, we will mail a cheque to the employer once the employees cease employment. If employers choose either method (ii) or (iii), please indicate the investment instructions under ‘investment instruction for reserve account’ section on the application form and we will make relevant investments according to your instructions. Please note: employers need to submit a written request to us if they would like to return the unvested benefits in the future. For the change from method (iii) to (i), the consent from your employees and/or other applicable administration procedure or review may be required.

Before the implementation of the MPF system in 2000, some employers set up Occupational Retirement Schemes, also known as ORSO schemes, to provide retirement benefits for their employers. After the commencement of the MPF system, if the employers opt to terminate ORSO schemes and set up MPF schemes, the contributions made by employers under ORSO schemes will be transferred to MPF schemes, which named as ORSO transfer and regarded as voluntary contributions. Employers can set the vesting scale for the relevant amounts of ORSO transfer by providing details of existing ORSO scheme (including both name of scheme service provider and ORSO registration number) and fill in the relevant vesting scale when filling in the ‘Additional Voluntary Contribution Application Form'.

According to regulations, employers should pay the mandatory contributions in full to the trustee on or before the contribution day. For non-casual employees, no matter how often do they get paid, whether on a weekly, monthly or quarterly basis, employers should fully pay the mandatory contributions and remit all necessary contribution information, including (i) the relevant income in respect of the contribution period, (ii) the contribution amount of both the employers and employees, and (iii) the voluntary contribution amount of both the employers and employees (if any), by the contribution day, this is the 10th day of the month following the calendar month when the last day of the contribution period falls.

Since trustee processes the mandatory contributions of their employees according to the contribution information provided by the employers, therefore, while employers are making contribution payments, they should at the same time, remit the relevant contribution information to the trustee by the deadline. Hang Seng MPF provides employers with a range of methods for remitting contribution information and making contribution payments. No matter which method they take, they should send the complete contribution information with cheque (if applicable) to the administrator through authorised channels on or before the contribution day. More information on the authorised channels and other important points to note, please go to the section of ‘General Support’.

Payment Methods

Cheque (together with contribution details sent by post to designated mailing address or place into the Hang Seng MPF Drop-In Box)

Direct Debit

Ways to remit contribution details for employees

Remittance statement in paper form

Hang Seng Business e-Banking MPF and Payroll Services

Other electronic means

As stated above, according to regulations, employers should pay the mandatory contributions in full and send the relevant contribution information to the trustee on or before the contribution day. Otherwise, trustee must have to report to the Mandatory Provident Fund Schemes Authority (‘MPFA’) about the default mandatory contributions within 10 days after the contribution day. There are four circumstances, in which trustee will report the employers’ default contributions to MPFA:

Employers who successful pay the contributions will receive a ‘Confirmation of MPF Contribution’ issued by the administrator (Employers who submit contribution information via Hang Seng Business e-Banking MPF and Payroll Services will receive an electronic ‘Fund purchase confirmation’). Under circumstances of default payment, either under-payment or non-paid, we will send the following mails to the employers by post, which include ‘Mandatory Contribution Reminder’ for employers who have not paid the contributions, and ‘Mandatory Contribution Discrepancy Bill’ for employers who have a payment shortfall. These mails serve as a reminder of the outstanding contributions, and employers are required to settle them as soon as possible. No matter it is a non-paid, late payment or shortfall of payment, they are classified as default contribution. Trustees are obliged to report the cases to the MPFA in accordance to MPF legislations.

*We will not process the information of employment cessation written on the inappropriate areas or on blank papers.

MPFA will issue a surcharge notice to the relevant employers according to the default contribution details reported by the trustee. The surcharge is equal to 5% of the outstanding payment. Employers should check with your trustee directly to see if the default contribution records are correct or not, or if there are sufficient reasons to impose a surcharge.

6.3.1 Pay the outstanding contributions and surcharge

If employers do not object the surcharge imposed, they should confirm with the trustee the amount of outstanding contributions and the administration procedures to remit the surcharge. Employers should pay the outstanding mandatory contributions with all surcharges to the trustee by the deadline stated in the surcharge notices. In addition, employers must submit a separate remittance statement to the trustee, with the name of the affected employees, the amounts of default contributions and surcharge due to them provided. Trustee will process the outstanding contributions and surcharge for the relevant affected employees according to the information from the remittance statements. If employers do not pay the outstanding contributions in due time, it may result in a financial penalty and imprisonment. For more details about offences and penalties, please visit the MPFA website: www.mpfa.org.hk

6.3.2 Mechanism of filing an objection to surcharge

If employer does not agree with the imposition of surcharge, and believe that there is no default contribution, which can be supported by, for example, a proven record of full payment by due date, and/or a record showing a completed remittance statement had been submitted with all information provided correctly. Under these circumstances, you can file an objection with MPFA.

Objection must be filed within 14 days from the date of the payment notice, and you have to return a completed ‘Contribution Surcharge Objection Form’ and the relevant payment records to MPFA. ‘Contribution Surcharge Objection Form’ can be downloaded from ‘Filing an objection to contribution surcharge’ section under the page of ‘For Employer’ on the MPFA website.

MPFA will pass the case to the trustee for investigation upon receipt of your objection. If result concludes that there is no default contribution, MPFA will withdraw the surcharge. Otherwise, objection will be rejected, and employer must remit the surcharge immediately.

6.4.1 Avoid administrative errors

Employers should avoid administrative errors and get the surcharge prevented when managing mandatory contribution payment. There are some points to be aware of regarding different ways of payment, to ensure the payment can reach the trustee successfully before the deadline:

| Payment Methods | Points to note |

| Cheque by post | Make sure there are sufficient amount in your bank account to cover the cheque written and reserve enough time for delivery |

| Place the cheque into the Hang Seng MPF drop-in box at designated Hang Seng Bank branches | Make sure there are sufficient amount in your bank account to cover the cheque and place the cheque in Hang Seng MPF Drop-In Box |

| Direct debit | Make sure there are sufficient amount in your bank account for debiting |

6.4.2 Remit the first-time contributions for new employees on time

You have to fill in the information of the new employee under the ‘New Employees Section (for employees who make 1st contribution)’ on the remittance statement, otherwise, late contribution will be resulted and employers are required to pay a surcharge. Please do not wait until the new employee’s record being reflected on the remittance statement to make the first-time contributions. For details on how to calculate the first-time contributions of the employees, please refer to the ‘First Contributions’ section.

6.4.3 Correctly fill out the remittance statement

As an employer, it is your obligation to ensure information provided on the remittance statement is complete and correct, especially on below items:

The Hang Seng Mandatory Provident Fund – SuperTrust Plus is a master trust scheme. The content on enrolment to MPF schemes, making contributions and reporting termination and paying last contributions for casual employees is explained in the context for the arrangement under master trust schemes. For the enrolment to industry schemes and its related arrangement for casual employees, please refer to Mandatory Provident Fund Schemes Authority’s website at www.mpfa.org.hk

Casual employees are:

Employers are required to enrol your casual employees into an MPF scheme within the 10-day permitted period (first 10 days of employment).

If the last day of the 10-day permitted period falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the deadline for enrolment will be extended to the next following day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day.

Failing to enrol employees into an MPF scheme, the employer is liable to a financial penalty and even imprisonment. Please visit MPFA's website at www.mpfa.org.hk for further details.

Employers have to submit the contribution details and make the contribution payment for casual employees once every payroll cycle (also known as contribution period) in full on or before the relevant contribution day. If casual employees cease employment within 10 days, employers still need to arrange to make contributions for the days worked.

In general, for casual employees who are employed on a day-to-day basis or for a fixed period of less than 60 days, the contributions are to be paid by the employer on or before the 10th day after each contribution period; (or the 10th day after the last day of contribution period in which the 10th day of employment falls if this is a later date).

If the contribution day falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the contribution day will be postponed to the next following working day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day.

Employers please also be cautious that for the purpose of determining the contribution day of the first contributions for new casual employee, the permitted period end date would not be extended even if the last day of the permitted period is a Saturday, a public holiday, a gale warning day or a black rainstorm warning day.

In calculating the mandatory contributions for casual employees, please take special note that the amount of mandatory contributions is subject to the minimum and maximum relevant income levels. MPFA reviews the minimum and maximum relevant income levels regularly and please always refers to the latest minimum and maximum relevant income levels published at MPFA's website at www.mpfa.org.hk.

Unlike non-casual employees, the contribution holiday is not applicable to casual employees. Both the employer’s mandatory contributions and the employee’s mandatory contributions shall be payable from the first day of employment. If an employee is working in the same employment for not less than 10 days, the first mandatory contribution should be made on or before the 10th day after the last day of the contribution period in which the permitted period ends.

If the employees cease employment within the first 10 days, employer still needs to arrange the enrolment and make contributions for the days worked. The contribution must be made on or before the 10th day after the last day of the first contribution period.

Failure to pay mandatory contributions in full and on time to a MPF service provider incurs a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment. You may refer to the MPFA's website at www.mpfa.org.hk for further details.

Whenever an employee ceases their employment with your company, employer should report the termination details to trustee and pay the last contributions timely. For casual employees, employer should notify the trustee within 30 days after the employee’s termination.

Besides reporting the termination, employer should make the last mandatory contributions timely. Employers and employees are required to make the mandatory contributions even if the casual employee ceased employment within the ‘permitted period’. The contribution day by the employers for casual employees who ceased employment within or after ‘permitted period’ may vary. Please refer below table for the explanation.

| Scenario | Contribution day (applicable to making the last contributions for casual employees) |

| Casual employees who ceased employment within the permitted period | the 10th day after the end of the relevant contribution period |

| Casual employees who ceased employment after the permitted period | (1) for all contribution periods ending on or before the permitted period (enrolment deadline), the 10th day after the end of the contribution period in which the enrolment deadline falls |

| (2) for all contribution periods ending after the permitted period (enrolment deadline), the 10th day after the end of the relevant contribution period |

At Hang Seng MPF, we are dedicated to provide quality and comprehensive MPF services to our customers.

Got a question?

You can simply visit our Employer FAQ section, where you may find the answers for the most frequently asked questions.

Want to submit us the MPF documents?

Please send your MPF documents, including remittance statement or other instructions through the designated channels (‘authorised channels’) to the administrator for processing. Authorised channels include mailing to:

The Hongkong and Shanghai Banking Corporation Limited

PO Box 73770 Kowloon Central Post Office

Alternatively, you can place the whole set of MPF documents into the 'Hang Seng MPF Drop-in Boxes' in our designated Hang Seng Bank branches.

'Hang Seng MPF Drop-In Box' has been set up at designated Hang Seng Bank branches for collection of MPF documents submitted by customers, such as paper remittance statement and cheque payment (if any). Submission of the MPF documents via ‘Hang Seng MPF Drop-In Box’ will be forwarded to the administrator for processing directly.

Please note that channels other than the authorised channels specified above are regarded as unauthorised channels. Submission of the MPF documents to the unauthorised channels include but not limited to:

(1) the staff at service counters at the branches,

(2) the branches without ‘Hang Seng MPF Drop-In Box’, or

(3) other collection boxes in the branches (for examples, the collection boxes for cheque payment).

CAUTIONS

Please be aware that employers and/or self-employed persons should NOT hand in any MPF documents (in particular for those paper remittance statement and cheque payment (if any) which must be submitted on time according to the MPF legislation) to unauthorised channels.

Any submission of the MPF documents to unauthorised channels will not be forwarded to the administrator for processing directly and it may take a longer time for the documents to be transferred to the administrator. While the receipt date by the administrator will be stamped only when the documents reached the administrator, employers and/or self-employed persons please be cautious that this will result in delay in receiving and processing the paper remittance statement or other instructions by the administrator. Any failure to pay mandatory contributions in full and on time to a trustee incurs a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment by the MPFA. You may refer to the MPFA's website www.mpfa.org.hk for further details of offences and penalties.

Prefer to speak to us?

Please feel free to call our Hang Seng MPF Employer Direct on (852) 2288 6822 during operating hours from 8:30am to 7:30pm on Monday to Friday and 8:30am to 1pm on Saturday (except public holiday).

You can also meet with our MPF Specialists at designated Hang Seng branches from Monday to Friday during business hours for MPF services and enquiries.

Issued by Hang Seng Bank Limited

Contact Us |

|

Hang Seng MPF Hotline

Hang Seng MPF Hotline

|

Make an e-Appointment

Make an e-Appointment

|

| Existing MPF Customers | Make a reservation online and meet with our MPF Specialists at designated branches |

| - Employers: 2288 6822 | |

| - Members / Self-employed persons: 2213 2213 | |

| - HKSARG Employees: 2269 2269 | |

| Non-existing MPF Customers | |

| - Enquiries / Apply for Hang Seng MPF: 2997 2838 |