We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Set up in just 3 quick steps

Please read the Important Risk Warnings for securities investment before making any investment decisions.

Investors should note that investment involves risks. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Investors should note that ETF is different from a typical unit trust and many factors will affect its performance. In general, the market price per ETF unit may be significantly higher or lower than its net asset value per unit due to market demand and supply, liquidity, and scale of trading spread in the secondary market and will fluctuate during the trading day. ETF is different from stocks, investors should read the offering documents of the relevant ETF and understand the features and risks of ETF etc.

Investors should not only base on this webpage alone to make any investment decision, but should read in detail the relevant risk disclosure statements.

![]()

Invest in securities with a monthly-contribution as low as HKD1,000.

![]()

We have over 100 listed local stocks and ETFs for your choice.

![]()

Invest in securities through monthly investment plan helps smooth out the effects of short-term market fluctuations on your investment.

With dollar cost averaging, you can buy more shares or units when the prices fall and fewer shares or units when the prices rise with a fixed monthly investment amount, allowing you to capitalise on the potential medium to long-term stock market returns (if any) without concern for short-term price fluctuations.

Tom wants to invest HKD6,000 in stocks but he lacks the funds to buy his interested stock in full lots.

With Monthly Investment Plan, Tom can start investing in stocks with as low as HKD1,000 each month, making it easier to allocate his finances.

Let's see how Tom's investment strategies differ with and without Monthly Investment Plan:

Total investment amount:

HKD5,666

Monthly investment amount:

HKD1,000

Total number of shares/units bought:

530

With Monthly Investment Plan, Tom invested a total of HKD5,666 over 6 months, buying 530 shares at an average cost of HKD10.69 per share. Compared to buying all shares at once at HKD11.20 per share in the 1st month, he saved HKD370 on investment costs (HKD6,036 - HKD5,666).[1]

Total Investment Amount:

HKD6,036

Total number of shares/ units bought:

530

With Monthly Investment Plan, Tom invested a total of HKD5,666 over 6 months, buying 530 shares at an average cost of HKD10.69 per share. Compared to buying all shares at once at HKD11.20 per share in the 1st month, he saved HKD370 on investment costs (HKD6,036 - HKD5,666).[1]

The monthly investment amount after deduction of the handling fee (0.25% of the monthly investment amount or HKD50 per security, whichever higher) will be used to buy stocks.

| Monthly investment amount (HKD) | Amount available for buying stocks (HKD)(a) | Buy Price (HKD)(b) | Number of shares / units bought (c) | Actual investment amount (HKD) (b) × (c) |

Refund amount (HKD)(a) - [(b) × (c)] | |

|---|---|---|---|---|---|---|

1stmonth |

1,000 |

950 |

11.20 |

84 |

940.80 |

9.20 |

| 2ndmonth | 1,000 | 950 | 10.00 | 95 | 950.00 | 0.00 |

| 3rdmonth | 1,000 | 950 | 10.30 | 92 | 947.60 | 2.40 |

| 4thmonth | 1,000 | 950 | 10.50 | 90 | 945.00 | 5.00 |

| 5thmonth | 1,000 | 950 | 10.80 | 87 | 939.60 | 10.40 |

| 6thmonth | 1,000 | 950 | 11.50 | 82 | 943.00 | 7.00 |

| Total | 6,000 | 5,700 | - | 530 | 5,666.00 | 34.00 |

Notes: Amount available for buying stocks = monthly investment amount - handling fee

The investment amount, after deducting the brokerage fee (0.25% of the transaction amount or HKD100 min. charge, whichever higher), will be used to buy stocks.

| Buy price (HKD)(a) | Number of shares / units bought (b) | Actual investment amount (HKD)(a) × (b) | Total investment amount (HKD) |

|---|---|---|---|

| 11.20 | 530 | 5,936 | 6,036 |

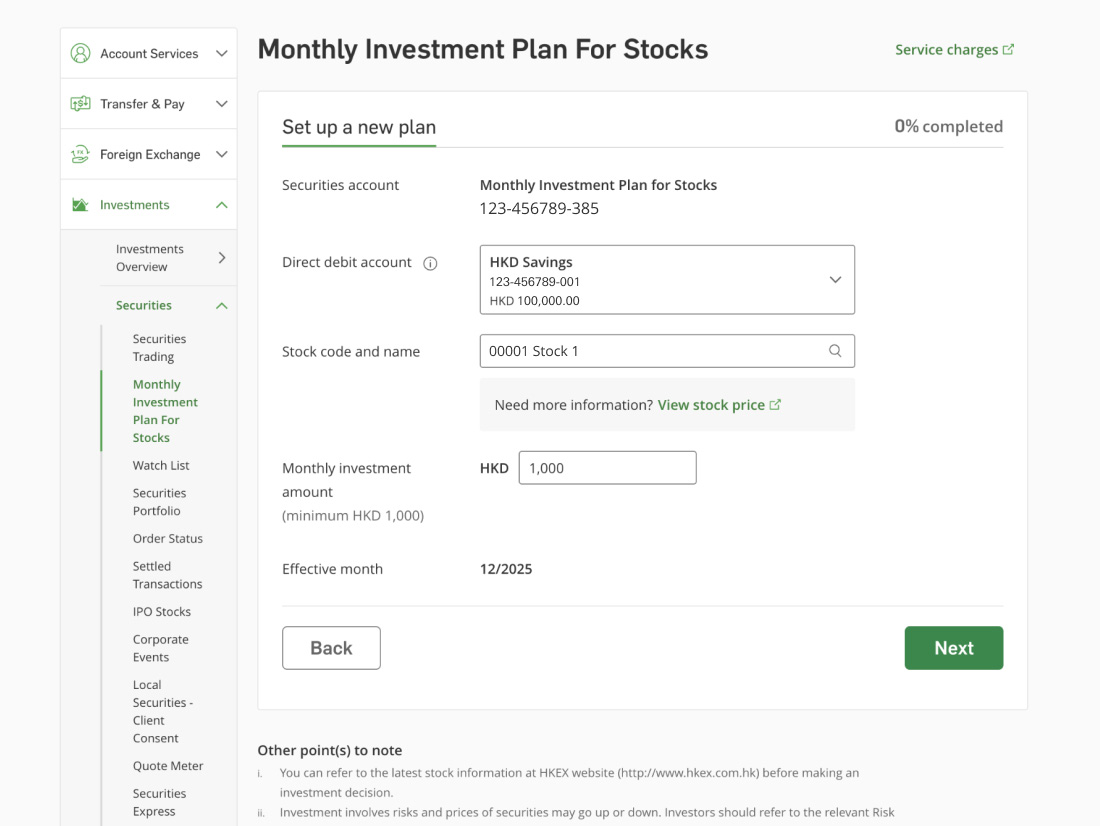

HKD1,000 per security

Hang Seng Bank HKD account

Set up direct debit authorisation to automatically deduct your monthly investment amount[2]

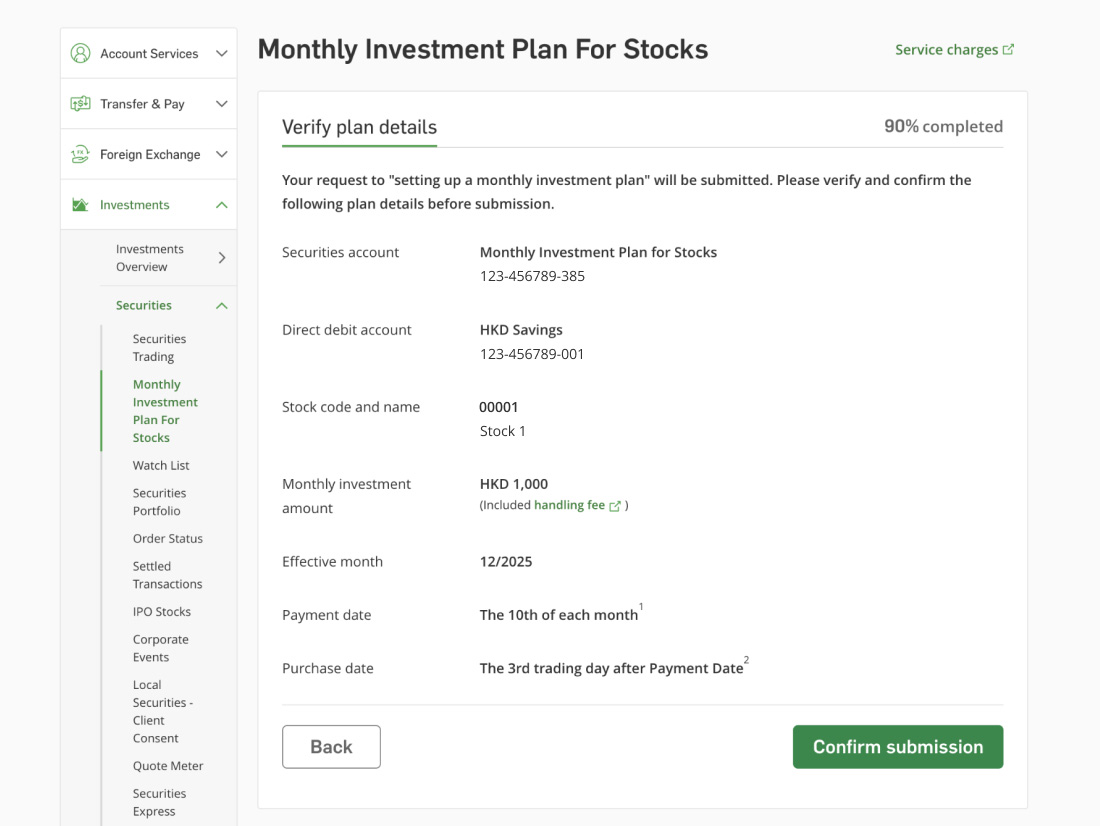

10th of each month

3rd trading day after payment date

Effective from the next calendar month after receiving following the month of receipt of customer's notice.

Effective from the next calendar month after receiving following the month of receipt of customer's notice.

Effective from the next calendar month after receiving following the month of receipt of customer's notice.

You can seize the opportunities to sell all or part of your securities in the plan anytime through Personal e-Banking, Hang Seng Invest Express mobile app, our manned securities trading hotline at (852) 2532 3838 or at our designated branches

0.25% of the monthly investment amount per security or HKD50 (whichever is higher), which includes brokerage fee, stamp duty, HKEX trading fee, SFC transaction levy, AFRC transaction levy, safe custody fee, securities deposit charge for purchase order and nominee services fees

Nil

Nil

MIP stocks with the most subscriptions

These are the most subscribed MIP stocks[6] in Dec 2025 and are for reference only. View detailed quotes for more stock information.

02800 - TRACKER FUND OF HONG KONG |

00066 - MTR CORP LTD |

00005 - HSBC HOLDINGS |

00939 - CCB |

00002 - CLP HOLDINGS LTD |

00823 - LINK REIT |

00388 - HKEX |

00003 - HK & CHINA GAS |

00941 - CHINA MOBILE |

00700 - TENCENT |

Want to see full eligible stocks list?

| Eligible Stocks[7] | |

| CKH HOLDINGS (Stock Code: 00001) | GANFENGLITHIUM (Stock Code: 01772) |

| CLP HOLDINGS (Stock Code: 00002) | GUOTAI JUNAN I (Stock Code: 01788) |

| HK & CHINA GAS (Stock Code: 00003) | CHINA COMM CONS (Stock Code: 01800) |

| HSBC HOLDINGS (Stock Code: 00005) | INNOVENT BIO (Stock Code: 01801) |

| POWER ASSETS (Stock Code: 00006) | XIAOMI-W (Stock Code: 01810) |

| PCCW (Stock Code: 00008) | BUD APAC (Stock Code: 01876) |

| HENDERSON LAND (Stock Code: 00012) | KB LAMINATES (Stock Code: 01888) |

| SHK PPT (Stock Code: 00016) | SUNAC (Stock Code: 01918) |

| NEW WORLD DEV (Stock Code: 00017) | COSCO SHIP HOLD (Stock Code: 01919) |

| SENSETIME-W (Stock Code: 00020) | SANDS CHINA LTD (Stock Code: 01928) |

| GALAXY ENT (Stock Code: 00027) | CHOW TAI FOOK (Stock Code: 01929) |

| MTR CORPORATION (Stock Code: 00066) | WHARF REIC (Stock Code: 01997) |

| HANG LUNG PPT (Stock Code: 00101) | WEIMOB INC (Stock Code: 02013) |

| YUEXIU PROPERTY (Stock Code: 00123) | LI AUTO-W (Stock Code: 02015) |

| GEELY AUTO (Stock Code: 00175) | AAC TECH (Stock Code: 02018) |

| ALI HEALTH (Stock Code: 00241) | ANTA SPORTS (Stock Code: 02020) |

| CITIC (Stock Code: 00267) | ZTO EXPRESS-W (Stock Code: 02057) |

| KINGDEE INT'L (Stock Code: 00268) | XTALPI (Stock Code: 02228) |

| GUANGDONG INV (Stock Code: 00270) | WUXI BIO (Stock Code: 02269) |

| BYD ELECTRONIC (Stock Code: 00285) | SHENZHOU INTL (Stock Code: 02313) |

| WH GROUP (Stock Code: 00288) | PING AN (Stock Code: 02318) |

| CHINA RES BEER (Stock Code: 00291) | MENGNIU DAIRY (Stock Code: 02319) |

| CATHAY PAC AIR (Stock Code: 00293) | LI NING (Stock Code: 02331) |

| MIDEA GROUP (Stock Code: 00300) | WUXI APPTEC (Stock Code: 02359) |

| OOIL (Stock Code: 00316) | SUNNY OPTICAL (Stock Code: 02382) |

| TINGYI (Stock Code: 00322) | BOC HONG KONG (Stock Code: 02388) |

| JIANGXI COPPER (Stock Code: 00358) | DOBOT (Stock Code: 02432) |

| YUNFENG FIN (Stock Code: 00376) | ROBOSENSE (Stock Code: 02498) |

| SINOPEC CORP (Stock Code: 00386) | CHALCO (Stock Code: 02600) |

| HKEX (Stock Code: 00388) | JD LOGISTICS (Stock Code: 02618) |

| CHINA RAILWAY (Stock Code: 00390) | CHINA LIFE (Stock Code: 02628) |

| TECHTRONIC IND (Stock Code: 00669) | HKELECTRIC-SS (Stock Code: 02638) |

| CHINA OVERSEAS (Stock Code: 00688) | ENN ENERGY (Stock Code: 02688) |

| TENCENT (Stock Code: 00700) | TRACKER FUND (Stock Code: 02800) |

| CHINA TELECOM (Stock Code: 00728) | CSOP A50 ETF (Stock Code: 02822) |

| CHINA UNICOM (Stock Code: 00762) | ISHARES A50 (Stock Code: 02823) |

| ZTE (Stock Code: 00763) | HSCEI ETF (Stock Code: 02828) |

| CHINA TOWER (Stock Code: 00788) | STANCHART (Stock Code: 02888) |

| LINK REIT (Stock Code: 00823) | ZIJIN MINING (Stock Code: 02899) |

| CHINA RES POWER (Stock Code: 00836) | CSOP HS TECH (Stock Code: 03033) |

| PETROCHINA (Stock Code: 00857) | BANKCOMM (Stock Code: 03328) |

| XINYI GLASS (Stock Code: 00868) | MEITUAN-W (Stock Code: 03690) |

| ZHONGSHENG HLDG (Stock Code: 00881) | HANSOH PHARMA (Stock Code: 03692) |

| CNOOC (Stock Code: 00883) | CATL (Stock Code: 03750) |

| CHINA LONGYUAN (Stock Code: 00916) | GCL TECH (Stock Code: 03800) |

| CCB (Stock Code: 00939) | KINGSOFT (Stock Code: 03888) |

| CHINA MOBILE (Stock Code: 00941) | KINGSOFT CLOUD (Stock Code: 03896) |

| LONGFOR GROUP (Stock Code: 00960) | CM BANK (Stock Code: 03968) |

| XINYI SOLAR (Stock Code: 00968) | BANK OF CHINA (Stock Code: 03988) |

| SMIC (Stock Code: 00981) | CMOC (Stock Code: 03993) |

| LENOVO GROUP (Stock Code: 00992) | CITIC SEC (Stock Code: 06030) |

| KUAISHOU-W (Stock Code: 01024) | ZA ONLINE (Stock Code: 06060) |

| CKI HOLDINGS (Stock Code: 01038) | LAOPU GOLD (Stock Code: 06181) |

| HENGAN INT'L (Stock Code: 01044) | JD HEALTH (Stock Code: 06618) |

| CHINA SHENHUA (Stock Code: 01088) | HAIER SMARTHOME (Stock Code: 06690) |

| CSPC PHARMA (Stock Code: 01093) | HKT-SS (Stock Code: 06823) |

| SINOPHARM (Stock Code: 01099) | HAIDILAO (Stock Code: 06862) |

| CHINA RES LAND (Stock Code: 01109) | YOFC (Stock Code: 06869) |

| CK ASSET (Stock Code: 01113) | JD-SW (Stock Code: 09618) |

| BRILLIANCE CHI (Stock Code: 01114) | BILIBILI-W (Stock Code: 09626) |

| YANKUANG ENERGY (Stock Code: 01171) | NONGFU SPRING (Stock Code: 09633) |

| SINO BIOPHARM (Stock Code: 01177) | HORIZONROBOT-W (Stock Code: 09660) |

| CHINA RES MIXC (Stock Code: 01209) | GDS-SW (Stock Code: 09698) |

| BYD COMPANY (Stock Code: 01211) | XPENG-W (Stock Code: 09868) |

| ABC (Stock Code: 01288) | UBTECH ROBOTICS (Stock Code: 09880) |

| AIA (Stock Code: 01299) | BIDU-SW (Stock Code: 09888) |

| NCI (Stock Code: 01336) | NEW ORIENTAL-S (Stock Code: 09901) |

| HUA HONG SEMI (Stock Code: 01347) | AKESO (Stock Code: 09926) |

| MEITU (Stock Code: 01357) | TRIP.COM-S (Stock Code: 09961) |

| CHINAHONGQIAO (Stock Code: 01378) | BABA-W (Stock Code: 09988) |

| ICBC (Stock Code: 01398) | POP MART (Stock Code: 09992) |

| 3SBIO (Stock Code: 01530) | NTES-S (Stock Code: 09999) |

Hang Seng Invest will tell you!

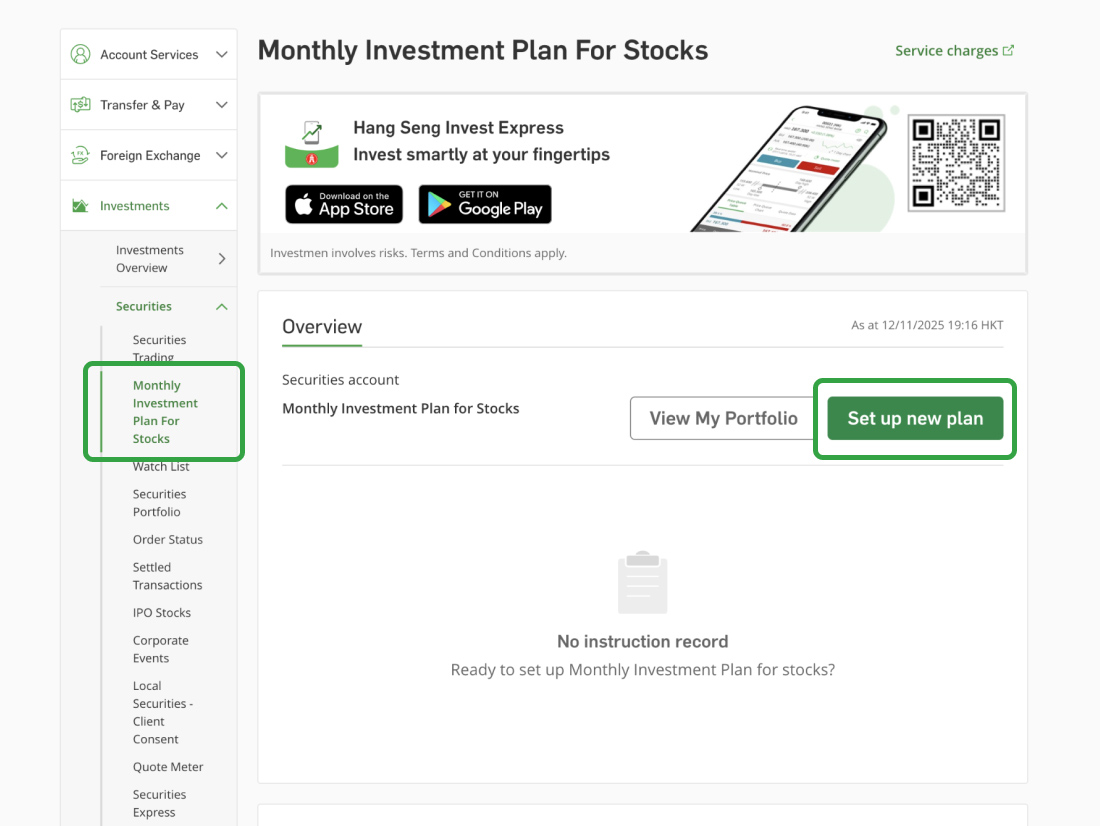

Sole-named Integrated Account holders can open an account for Monthly Investment Plan for Stocks and set up a new plan via Personal e-Banking. The new plan will be effective from the next calendar month following the month you set up the new plan, with the 1st payment date scheduled for the 10th of such following calendar month. If the 10th falls on a Saturday, Sunday or public holiday, the payment will occur on the next trading day.

Joint-named Integrated Account holders need to open a securities account for Monthly Investment Plan at our branches before setting up a new plan via Personal e-Banking. The new plan will be effective from the next calendar month following the month you set up the new plan, with the 1st payment date scheduled for the 10th of such following calendar month. If the 10th falls on a Saturday, Sunday or public holiday, the payment will occur on the next trading day.

Under normal situations, we'll start buying selected security for you on the 3rd trading day after the payment date, around 15 minutes after the market opens. If trading of the selected security is suspended or can't be executed due to market conditions, we'll try to buy the security on the next trading day. If we can't buy the security due to trading suspension or market conditions for 3 consecutive trading days, we'll refund the full investment amount paid for that month (including handling fee) to customers' payment account in the same month.

You can manage or terminate your Monthly Investment Plan(s) without any charges under "Monthly Investment Plan" in Personal e-Banking. All instructions will take effect in the next calendar month following the month of receipt of your notice.

The buy price of a security is the average price of the security purchased by us on behalf of customers after consolidating their investment amounts. These prices may include both board lot and odd lot prices. For example, if we purchase 1,000 shares of Stock A at HKD18 and another 1,000 shares at HKD20, the average price would be HKD19. The shares will be allocated to customers proportionally to their monthly investment amount.

The net amount, after deducting the handling fee from the monthly investment amount will be invested in the relevant security selected by you. The number of shares/units of the securities will be rounded down to the nearest whole number of shares/units. Any residual investment amount will be refunded to your payment accounts in the same month.

You can check your account balances and current plan(s) details via "Current Holdings" and "Current Plan" under "Monthly Investment Plan" in Personal e-Banking. After each purchase transaction, you'll receive a contract note with details of the subscription price and quantity. You'll also receive monthly securities account statements that list out the quantities of securities held and market value.

No. You can only sell the securities in your Monthly Investment Plan account with limit orders, market orders, at-auction orders and at-action limit orders.

You can choose to continue investing in the removed security, modify or terminate your existing Monthly Investment Plan. However we won't accept applications to set up new plans for the removed security. The securities available for selection will be updated according to the changes on Hang Seng Index constituent stocks.

No. You can't set up a new Monthly Investment Plan with the same security that is selected for your existing plan, a pending application or modification instruction.

Yes. Monthly Investment Plan holders enjoy the same rights as normal shareholders, including dividend payments, and bonus shares, etc.

Yes. Securities bought through the Monthly Investment Plan can be sold as normal securities, with board lots sold at board lot prices and odd lots at odd lot market prices. When selling securities through your Monthly Investment Plan account, we'll impose brokerage fee, stamp duty, SFC transaction levy, AFRC transaction levy, trading fee and other relevant charges. You can sell your securities in the plan through Personal e-Banking, Hang Seng Invest Express mobile app, our manned securities trading hotline at (852) 2532 3838 or at our designated branches.

You can sell the securities in your Monthly Investment Plan account with limit orders (for pure odd lot, you must place sell instructions with market orders), market orders and at-auction orders and at-auction limit orders (odd lot won't be accepted during auction trading session).

If you submit a sell instruction via Personal e-Banking, we'll send the execution result of your sell instruction to your "Inbox" of Personal e-Banking. If you've registered for Securities Instant Order Confirmation Service for your Monthly Investment Plan account, you'll receive SMS notification with your order execution results through your mobile phone. You can also check the execution details via "Order Status" on Personal e-Banking.

You can check pending instruction details via Personal e-Banking "Monthly Investment Plan" > "Pending Instruction", where you can also amend or cancel pending instructions. Amendments will take effect in the next calendar month while cancellation will be effective immediately.

All Monthly Investment Plans will be terminated automatically if we can't debit the monthly investment amount from your designated account for 2 consecutive months. Any amendment and/or termination instructions made on those plans will also be cancelled automatically. However instructions made to set up new plans during this period won't be affected.

You can choose to sell or keep the securities after terminating your Monthly Investment Plan(s). If you sell them, we'll impose brokerage fee, stamp duty, SFC transaction levy, AFRC transaction levy, trading fee and other relevant charges. If you choose to keep the securities, we'll impose normal securities services charges, including safe custody fee, nominee services fee and other relevant charges.

Comprehensive securities experience is just a few steps away [10]

Open an Integrated Account and activate your securities account and other investment accounts via Hang Seng Mobile App with ease