We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Eligible customers who successfully subscribe MaxiInterest Investment Deposit and/or other Designated Investment Products online with as low as HKD5,000 can enjoy extra up to 5% p.a. interest rate for the first month.

There are many occasions that we need to exchange currencies nowadays – prepare for travelling, pay school fees for children studying abroad, and planning for emigration, etc. Many of us find it difficult to keep track with the ever-changing rates and suffer additional loss. MaxiInterest Investment Deposit is an alternative way for you to trade and earn higher potential interest in the FX market.

Have you ever missed the chance to exchange at the best rate due to your hesitation? With currency-linked deposit, you can earn a high potential interest return by choosing the currency pair that you preferred. Just sit back and earn more across different currencies.

In case of travel, it’s so common that we exchange several thousands of our saving into a foreign currency – MaxiInterest Investment Deposit is just as casual, with a minimum investment as low as HKD5,000. Select HKD or other currency as Deposit Currency, and set the Initial Exchange Rate and deposit period. After the period, you can compare the actual rate with Initial Rate you set. If the actual rate is higher, you earn the interest in your Deposit Currency; otherwise, you will receive your principal amount plus interest by exchanging into the Linked Currency using Initial Rate.

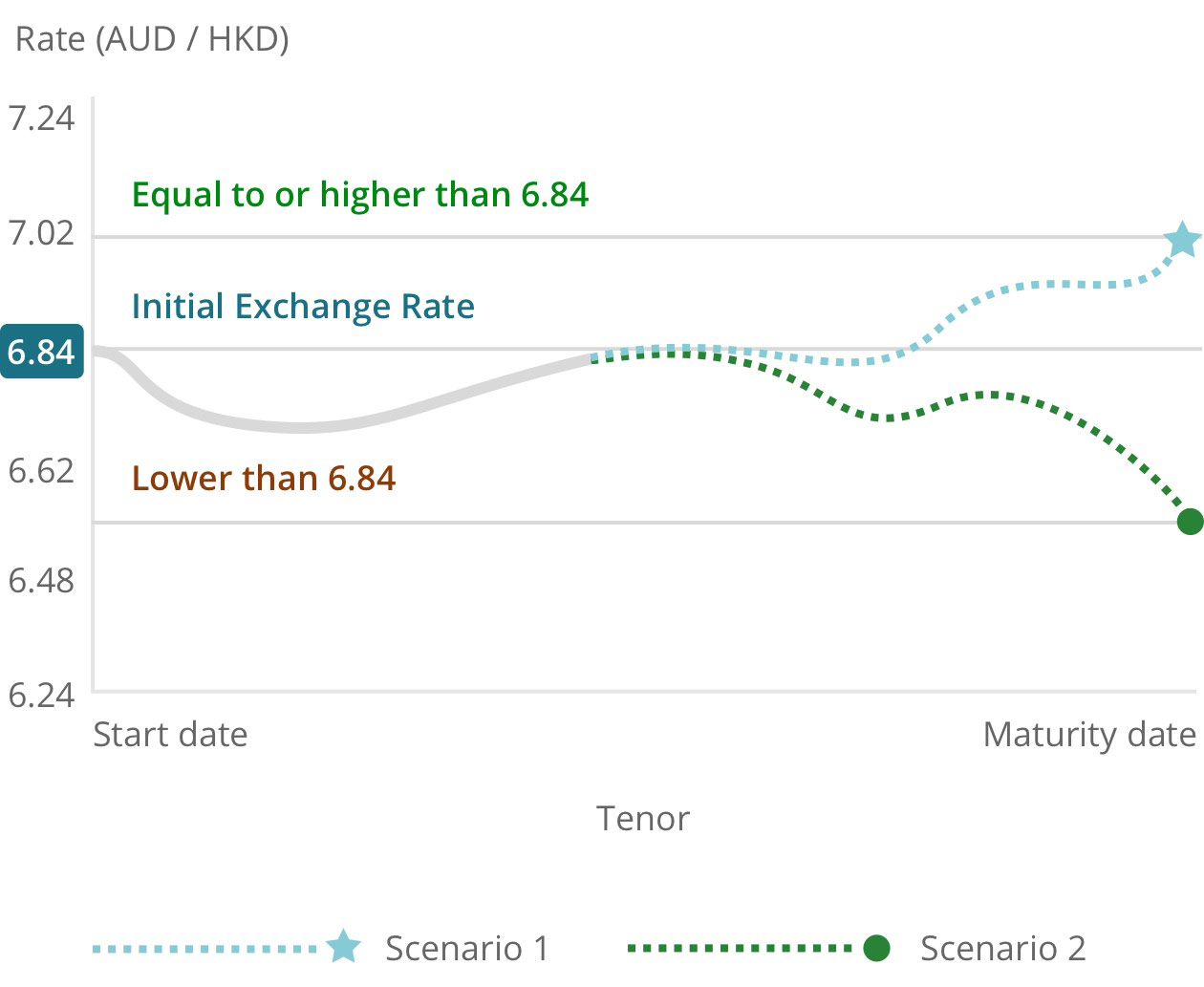

Let’s assume the deposit currency of Hong Kong Dollar is your home currency and you take a bullish view on Australian Dollar, expecting the exchange rate of AUD / HKD to increase (AUD appreciates relative to HKD). You set up a MaxiInterest Investment Deposit with HKD100,000 as principal amount for one month, taking AUD as the linked currency.

Assuming the exchange rate of AUD / HKD is 6.8400 at the start of the investment:

Items

Units

Deposit currency

HKD (Home currency)

Linked currency

AUD

Principal amount

HKD100,000

Deposit period

1 month (30 days)

Initial exchange rate (AUD / HKD)

6.8400

Annual interest rate

4.000%

Final exchange eate: 6.9000

When you subscribe

On maturity date

Received currency and amount upon maturity date HKD100,328.77

Your gain upon maturity date

(HKD100,000 x 1 + 4.000% (Annual interest rate) x 30/365) - HKD100,000 = HKD328.77

Final exchange rate: 6.8000

When you subscribe

On maturity date

Received currency and amount upon maturity date AUD14,667.95

(principal plus interest paid in AUD by exchange rate of 6.84)

Your loss upon maturity date

{[(HKD100,000 x 1 + 4.000% (annual interest rate) x 30/365) / 6.8400] x 6.8} - HKD100,000 = HKD257.95

Foreign exchange is not just a one-way game of “buy low and sell high” anymore, it can also be served as a trading tool with potential to earn higher interest return. Whether you are in need of foreign currency or aiming to grow your wealth, MaxiInterest Investment Deposit merges the concept of FX and interest earning to open up a new investment trend of low minimum amount and high flexibility. For more examples on how it works, please visit MaxiInterest Investment Deposit.

Subscribe in just 4 simple steps

Open a bank account with Hang Seng Personal Banking mobile app[1]

Subscribe in just 4 simple steps with existing account[2]

Let’s get to know some plans to help you when foreign exchange market doesn’t go along with your expectations.

Invest in products with dividends to earn income and capital gains in a volatile market.

Learn how to trade with leverage to magnify your investment power

Get 24/7 support from our Virtual Assistant.

FX hotline:

(852) 2822 8233

Personal customer:

(852) 2822 0228

Commercial customer:

(852) 2198 8000