We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

View the relevant Key Facts Statement

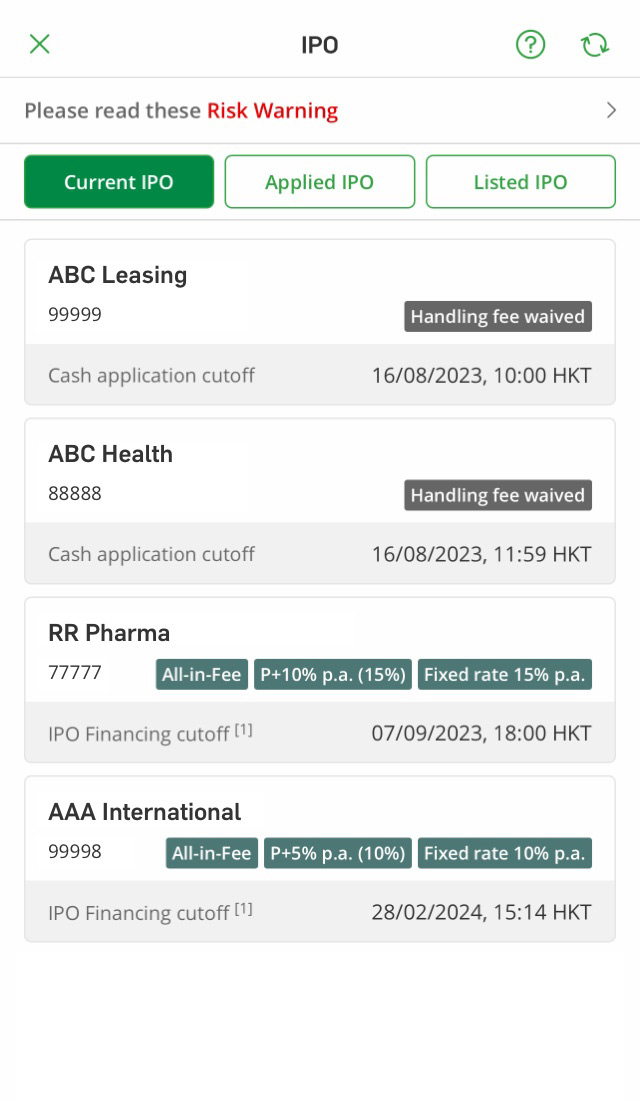

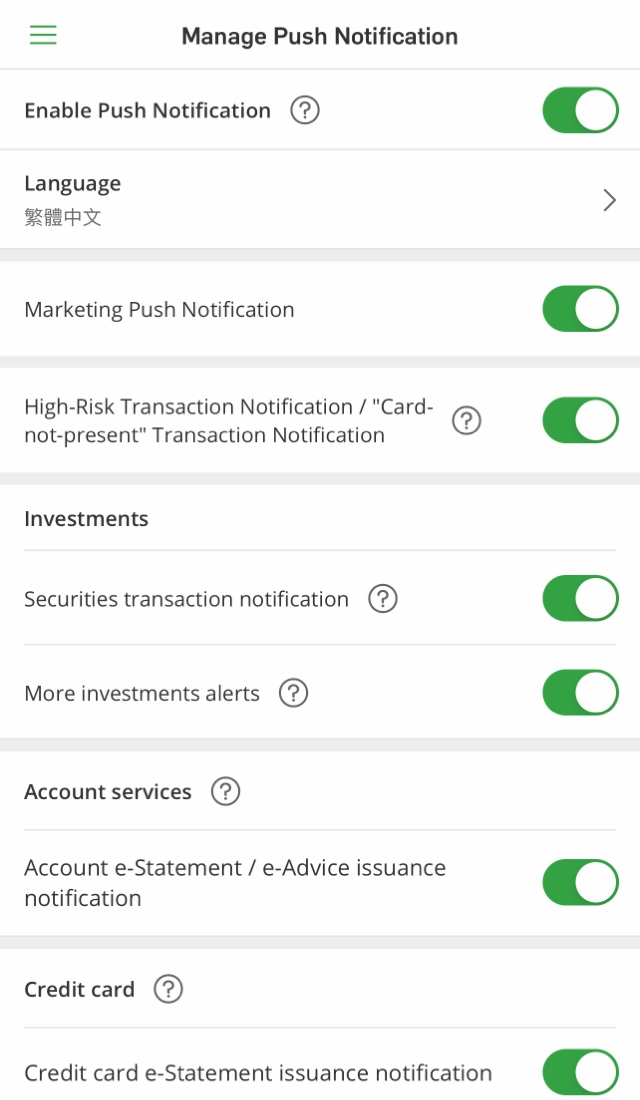

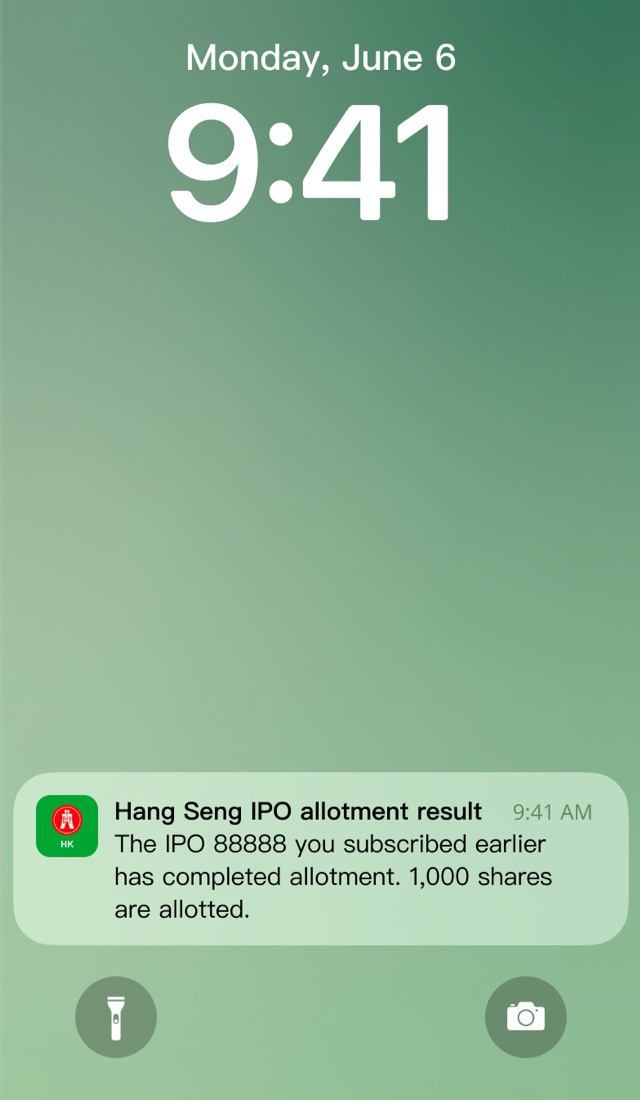

Enjoy a handling fee waiver for all IPOs of HK stocks when you subscribe through Hang Seng Invest Express or Personal e-Banking. You'll receive your IPO allotment result before listing through push notification if enabled or SMS.

Initial Public Offering (IPO) subscription service refers to the first time a company issues shares to public investors and will be listed on the stock exchange for trading. Apart from applying through the bank's designated branches or Phone Banking Services, you can also use Hang Seng Personal e-Banking (desktop version) or Hang Seng Invest Express to subscribe at ease.

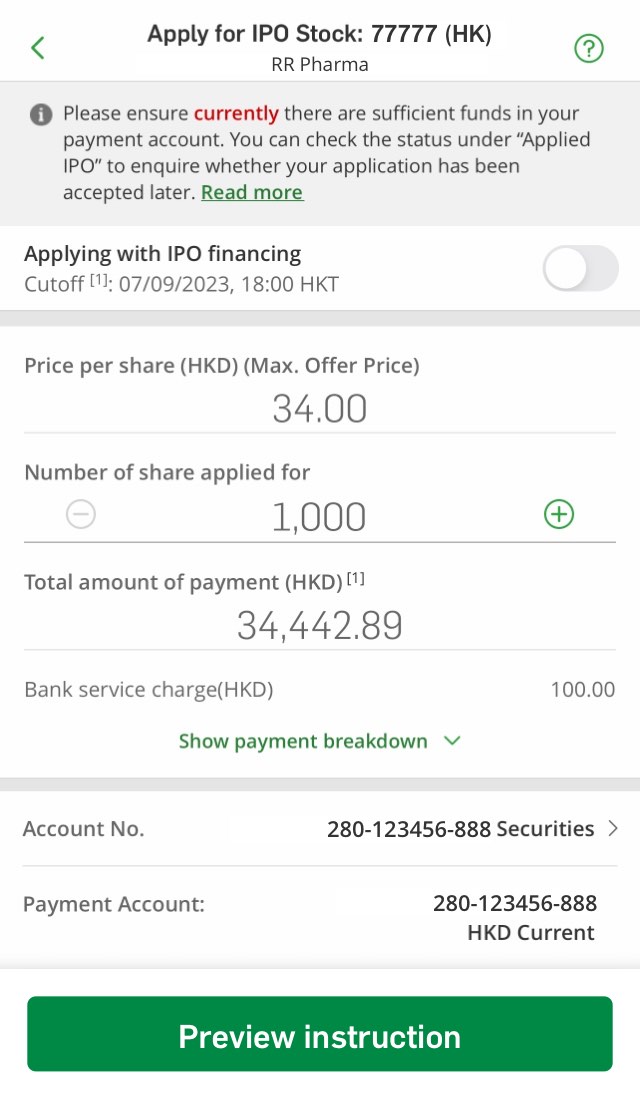

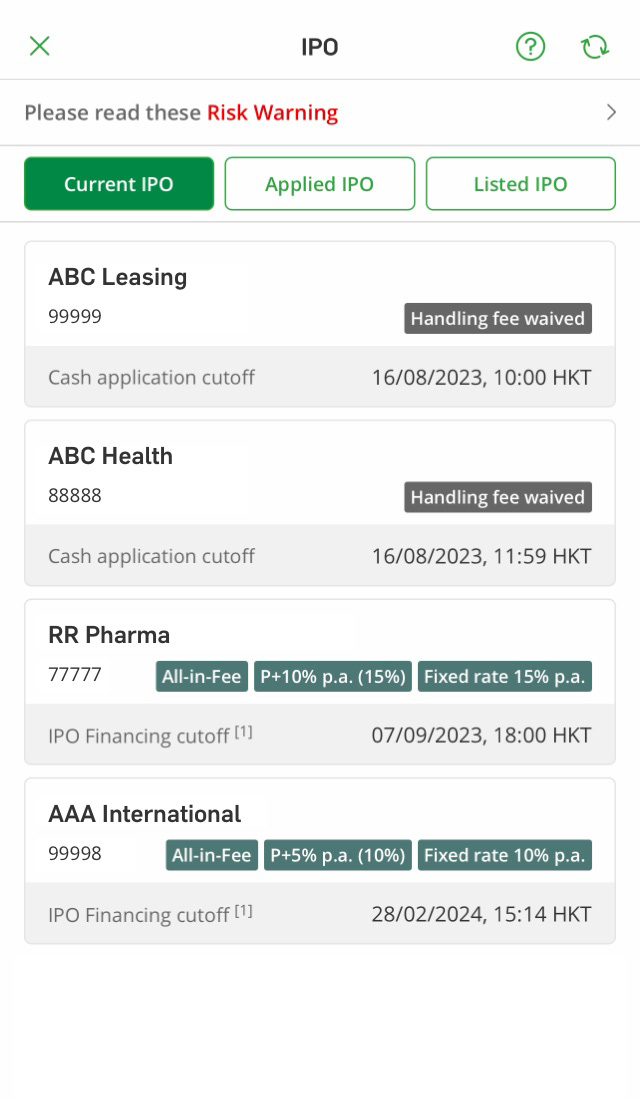

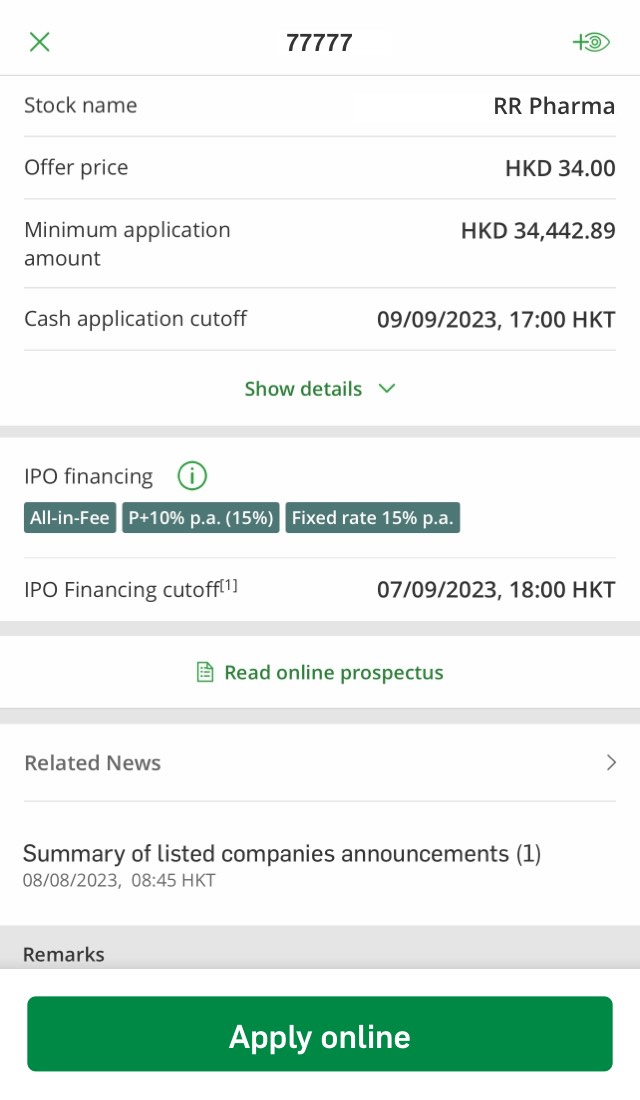

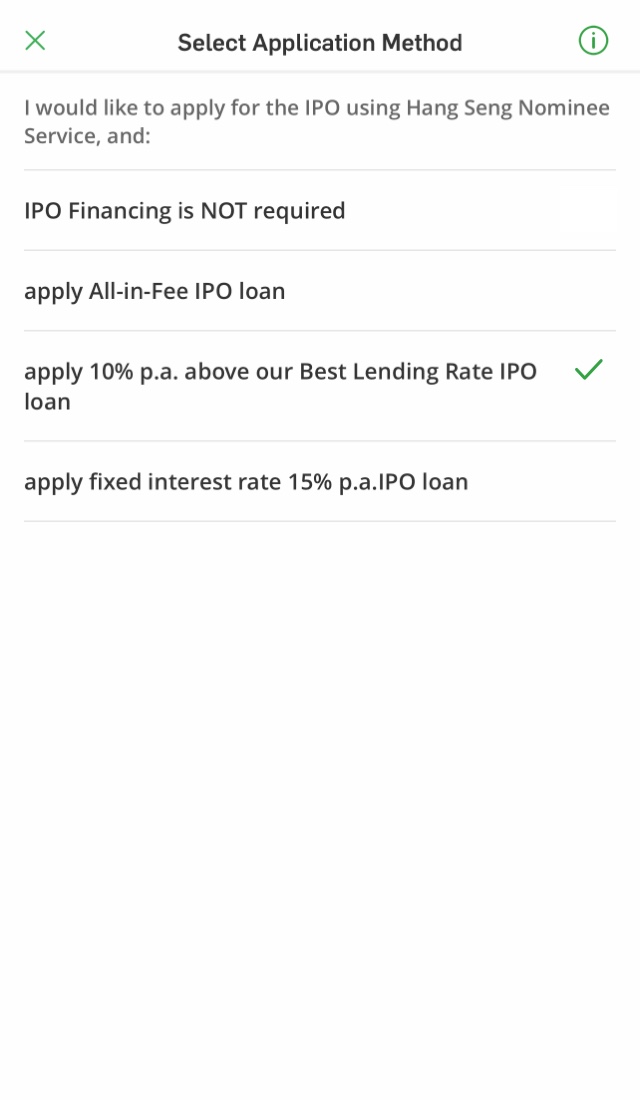

You can also apply IPO financing to increase the subscription amount of IPO with a view to increase the chances of shares allotment.

You can apply for IPO financing services to cater various investment needs.

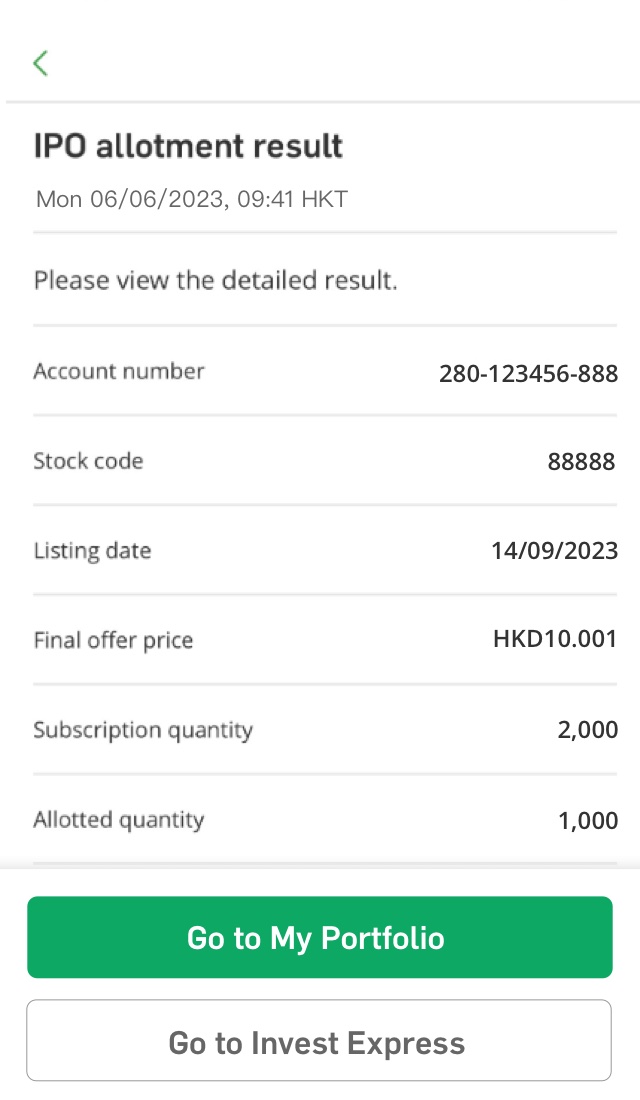

You'll receive your IPO allotment result one day before listing through push notification if enabled or SMS.

You can use the same Hang Seng securities account to manage stock trading and subscribe any IPO listed on The Stock Exchange of Hong Kong.

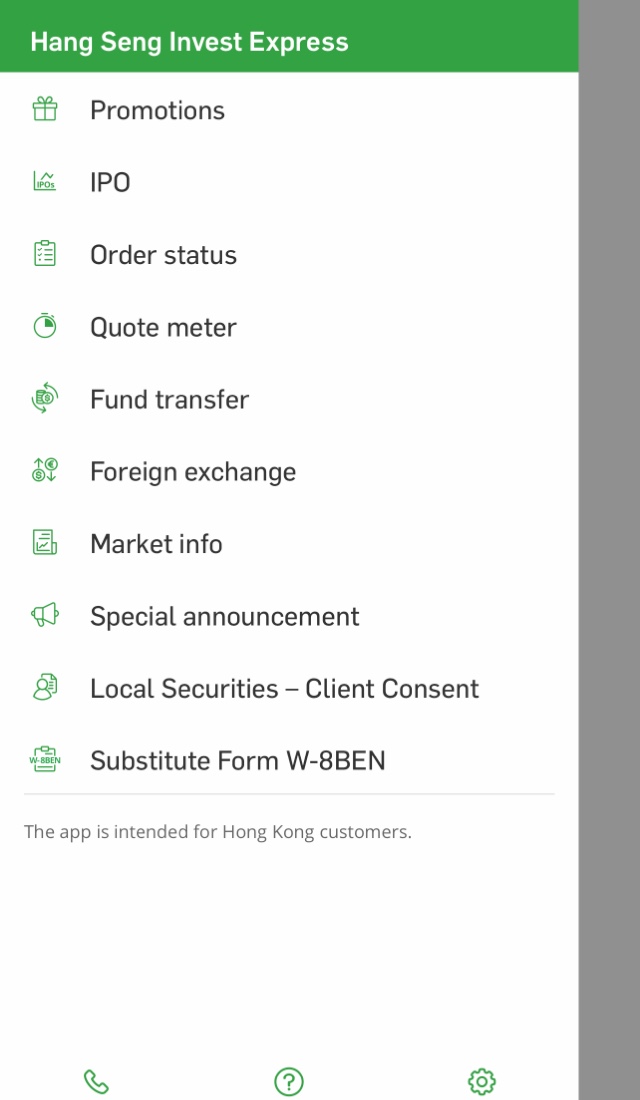

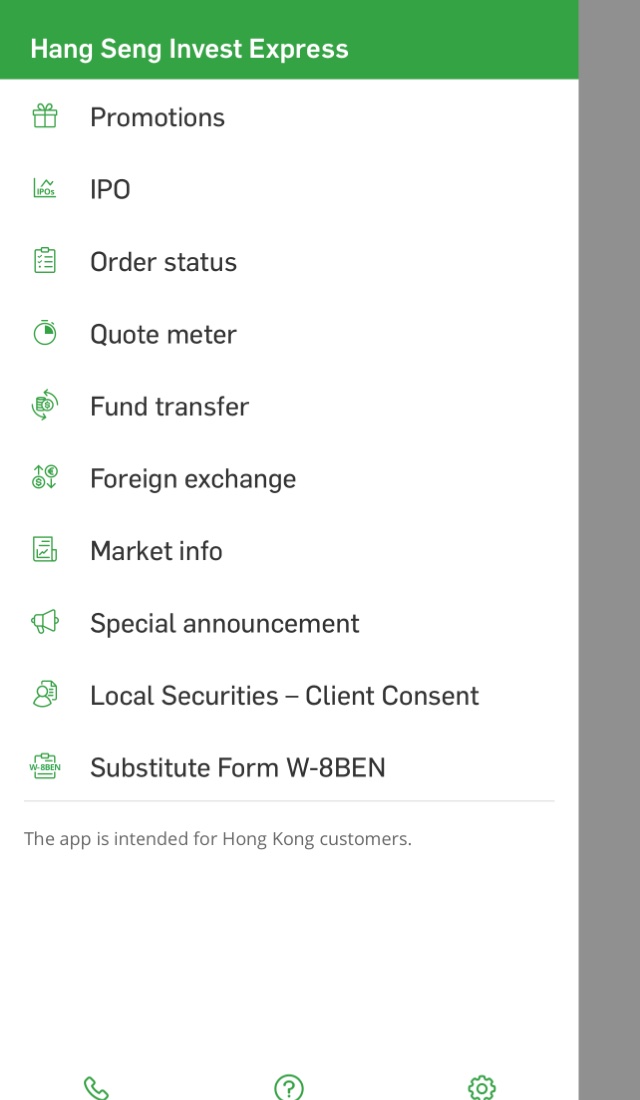

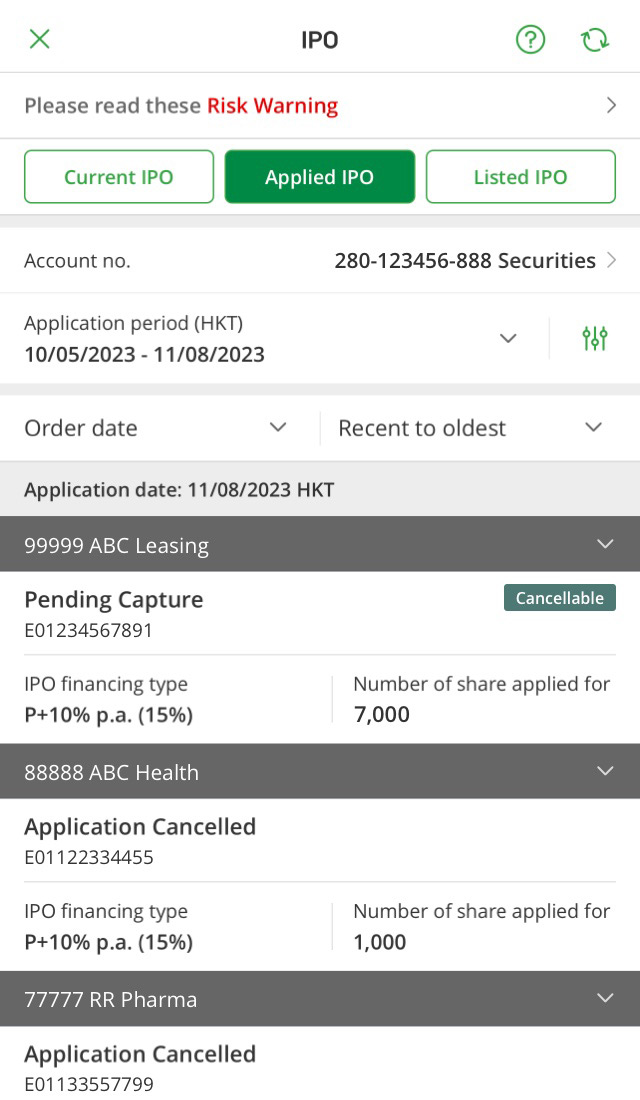

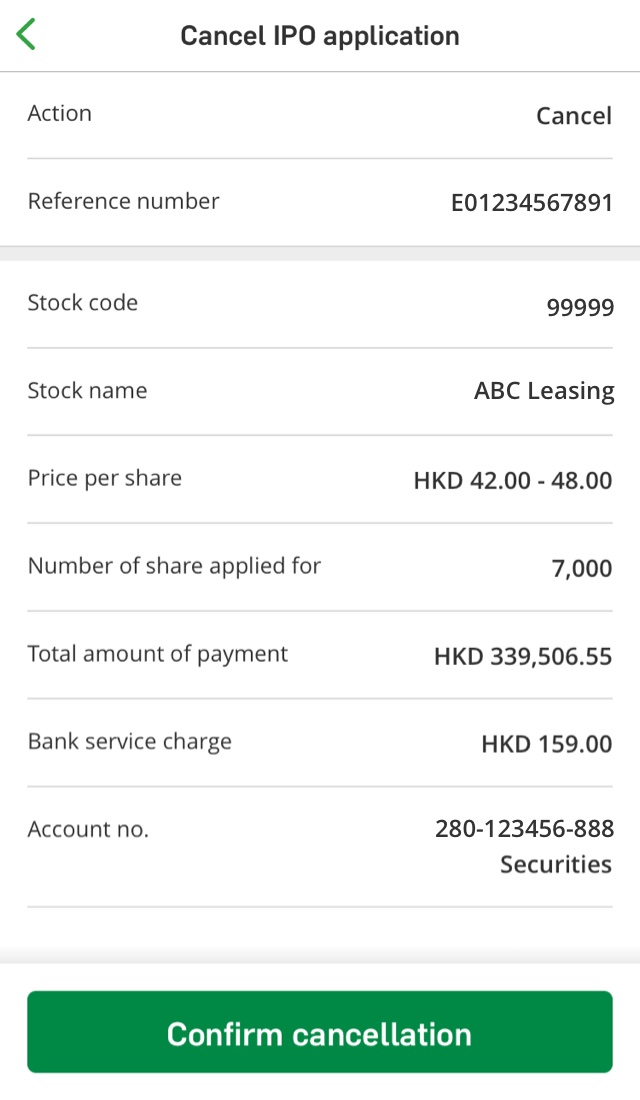

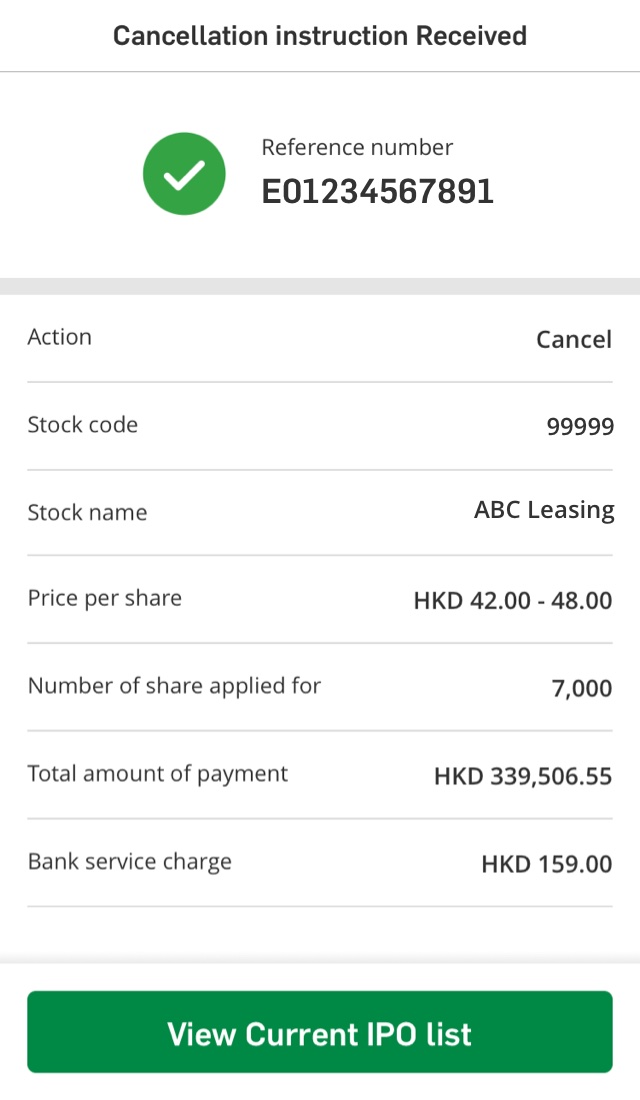

You can use Hang Seng Invest Express or Personal e-Banking to check the status of IPO subscription and cancel IPO subscription online. A comprehensive IPO services is provided in one app.

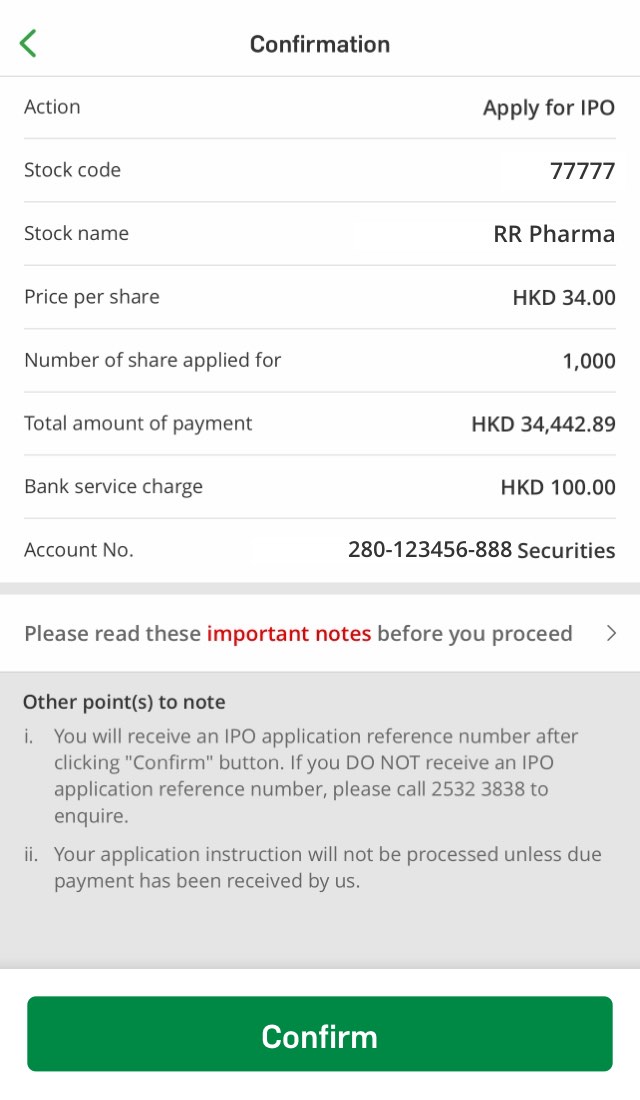

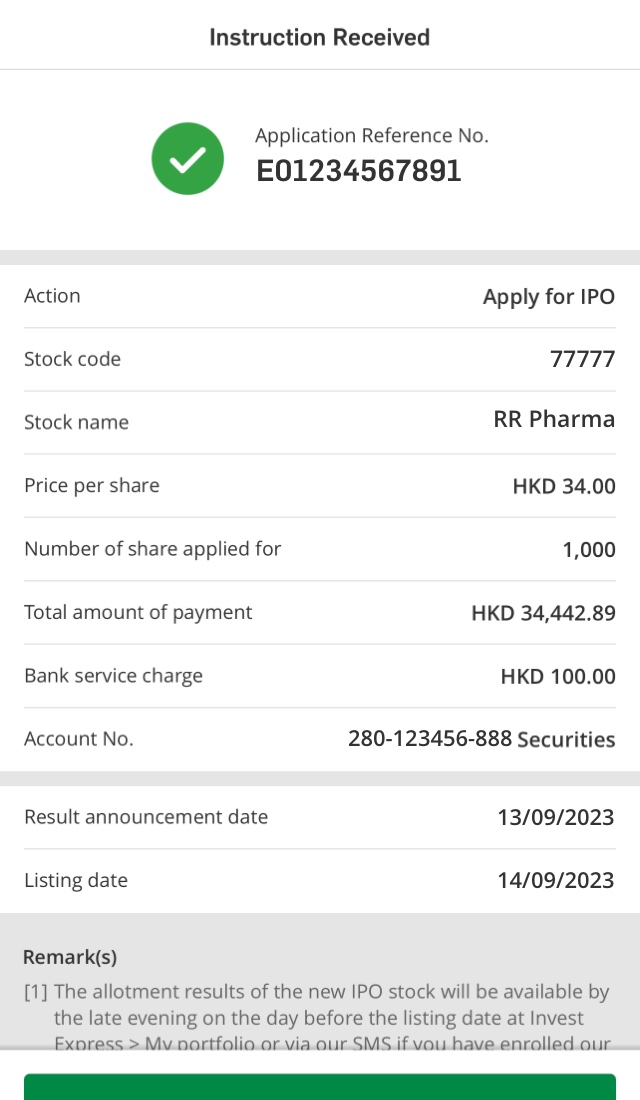

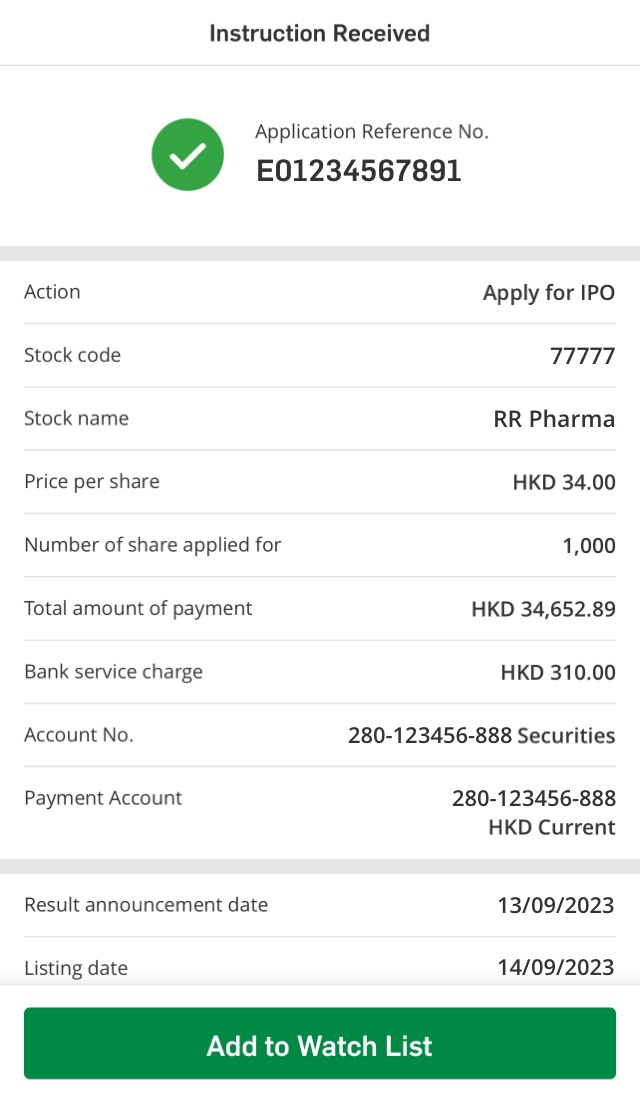

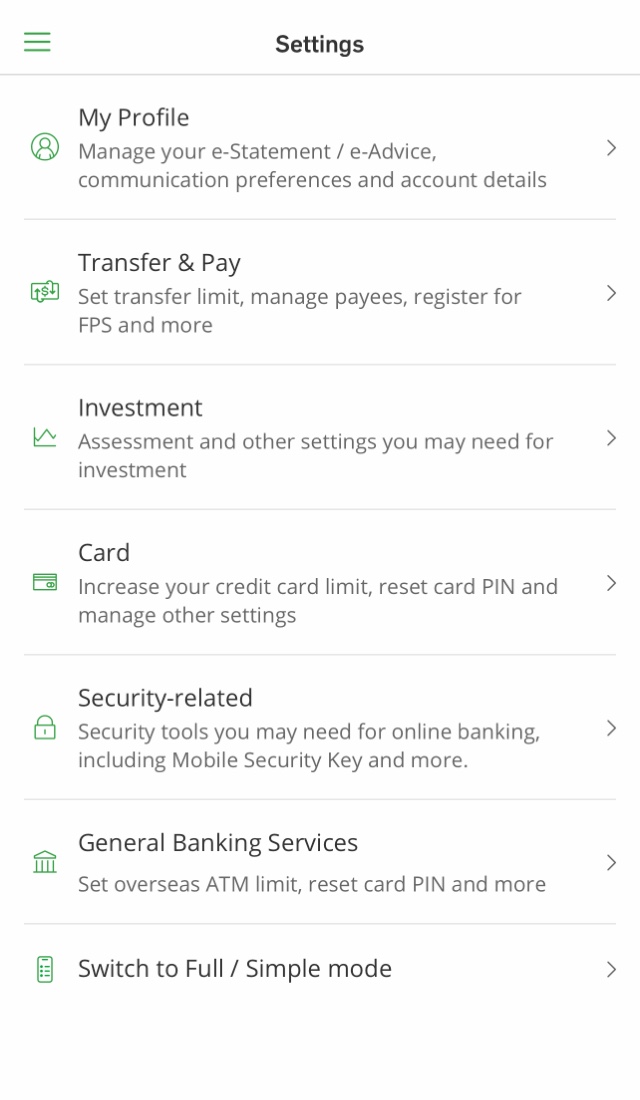

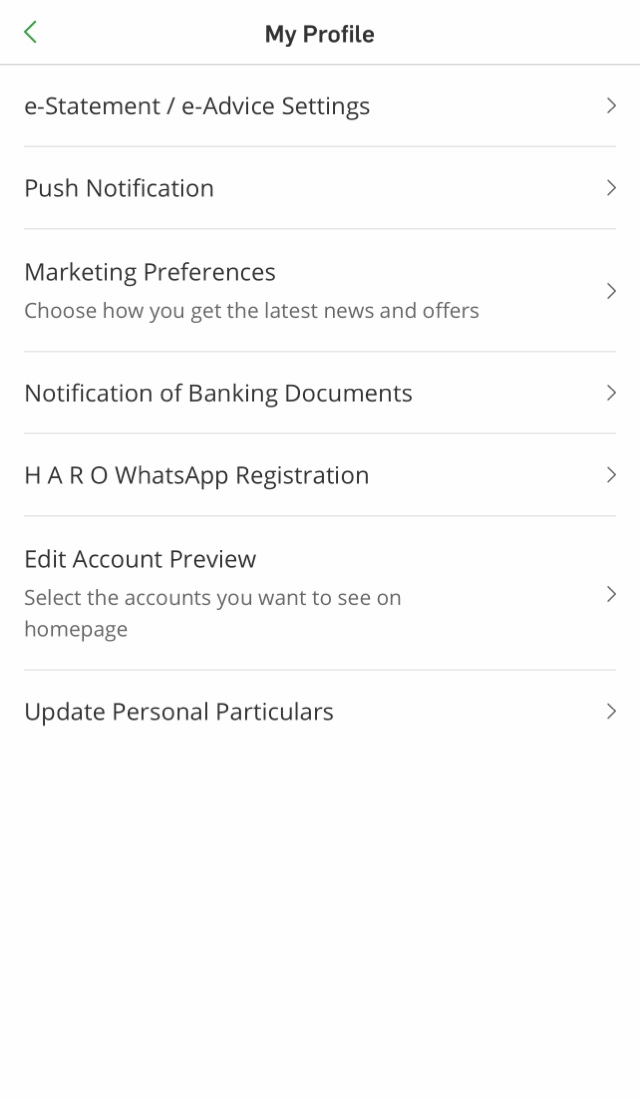

You can now subscribe IPO, view the status and cancel the IPO application through Hang Seng Invest Express or Hang Seng Personal e-Banking (desktop version). The following will demonstrate how it works through Hang Seng Invest Express.

Comprehensive securities experience is just a few steps away[1]

Open an Integrated Account and activate your securities account and other investment accounts via Hang Seng Mobile App with ease

You must open a securities account for the application of IPO. For further information, you‘re welcome to call our Customer Service Hotline at (852) 2822 0228 or visit our branches.

Each IPO has a different subscription period. Please refer to IPO details.

The IPO subscription results will be announced the day before the IPO listed date. Please refer to the IPO details.

IPO subscription service is only available in the Hong Kong market.

Yes. You need to provide consent for Hong Kong Investor Identification Regime (HKIDR) before subscribing to IPOs.

Application amount includes 1% brokerage, 0.0027% SFC transaction levy, 0.00015% AFRC transaction levy and 0.00565% Hong Kong Stock Exchange trading fee. Customers who apply for the IPO through Hang Seng should pay the handling fee (HKD IPO: HKD100; RMB IPO: RMB85) per application for the IPO stock subscription. And such a charge will not be refunded irrespective of the allotment result or whether the company is successfully listed or not.

You need to open an integrated account with Hang Seng for the application of IPO financing. For further information, you're welcome to call our Customer Service Hotline at (852) 2822 0228 or visit our branches.

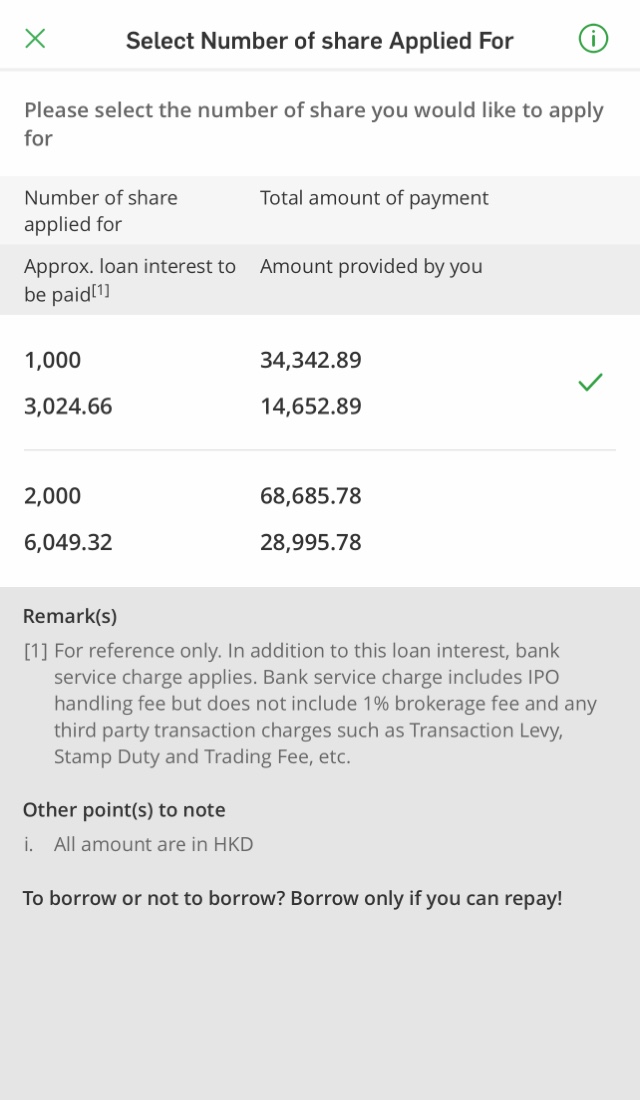

The general terms of financing: The financing amount can be 90% of your subscription amount or below (varies among IPO stocks). You need to pay the remaining subscription amount (i.e. "deposit amount") and relevant bank service charges. The interest rate on financing will be subject to the current market environment and varies among IPO stocks.

Interest from the day of advance up to the refund day (excluding the refund day). You need to pay the interest incurred separately starting from the refund day until full repayment of the loan amount (excluding the repayment day) if you fail to repay the full loan amount on the refund day. A handling fee of HKD100 for IPO stock subscription. 1% brokerage, 0.0027% SFC transaction levy, 0.00015% AFRC transaction levy and 0.00565% Hong Kong Stock Exchange trading fee.

Please provide the following information to calculate the interest to be paid:

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment |

|---|

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment | |

|---|---|---|

| Monthly repayment amount | HKD - | Minimum Payment |

| Total interest amount | HKD - (Save HKD -) |

HKD - |

| Repayment period | 72 month(s) (Shortened by - month(s)) |

- month(s) |

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|---|---|

| Only the minimum repayment | - month(s) | - |

| - | 36 month(s) | - |

The result of the interest calculator is for reference only. The actual repayment liability depends on the actual terms of each borrowing arrangement.

Investors should note that all investment involves risks. Prices of securities may go up or down and may even become valueless. Investors should read the relevant prospectus for detailed information about the proposed offer and seriously consider if investment in the relevant shares is suitable for his/her investment needs by reference to his/her financial situation, investment experience, investment objectives and other conditions and needs before deciding whether to invest in the relevant shares. If required, investors should obtain independent legal, financial and other professional investment or other advice before making any investment decision.

To borrow or not to borrow? Borrow only if you can repay!