We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Please read the Important Risk Warnings for Structured Notes before making investment decisions.

Eligible customers who successfully subscribe Structured Notes (Capital Protected) /or other Designated Investment Products online can enjoy extra up to 5% p.a. interest rate for the first month. Start investing from HKD100,000.

Structured note is a structured investment product issued by financial institutions and includes derivatives with different payoff structures linked to various underlying asset types, e.g. foreign exchange rate or upon early redemption. It provides investors opportunities to gain higher potential return. You can start your investment online with HKD100,000.

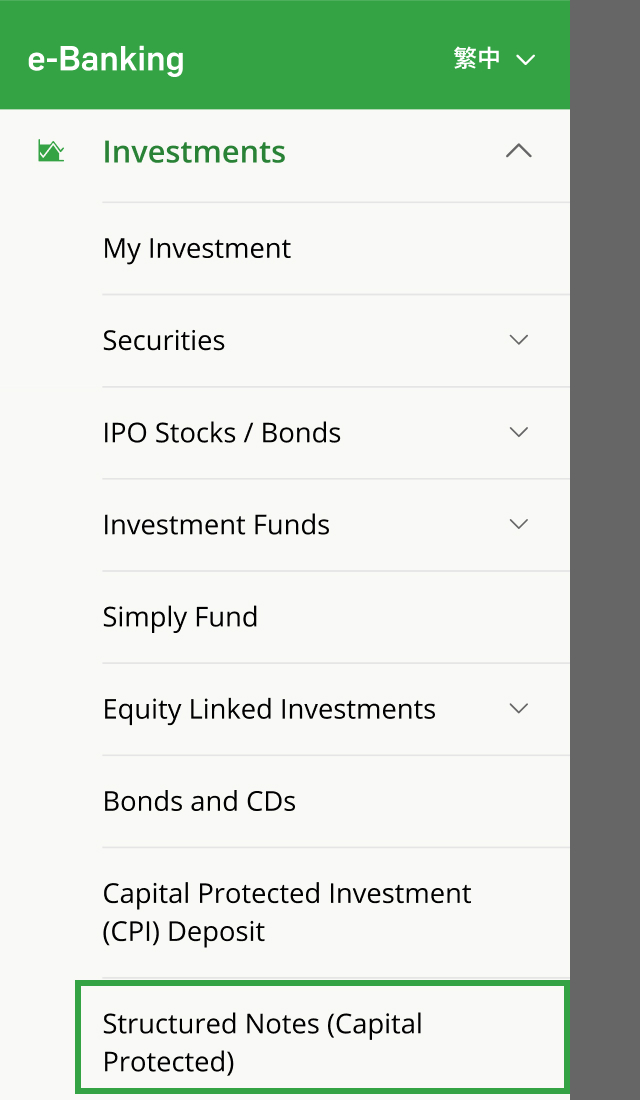

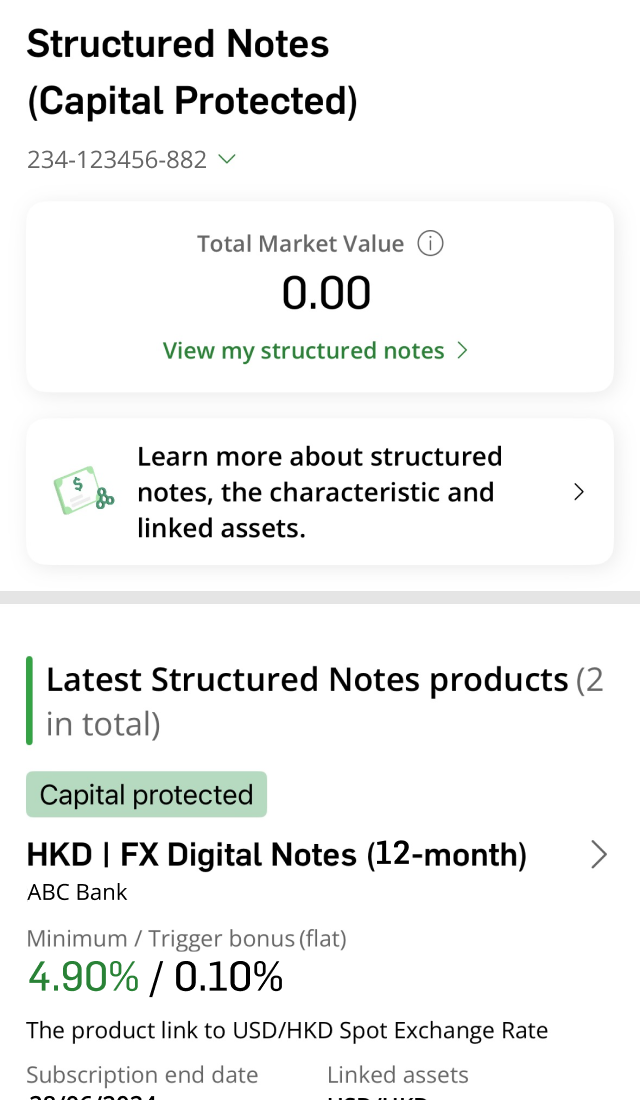

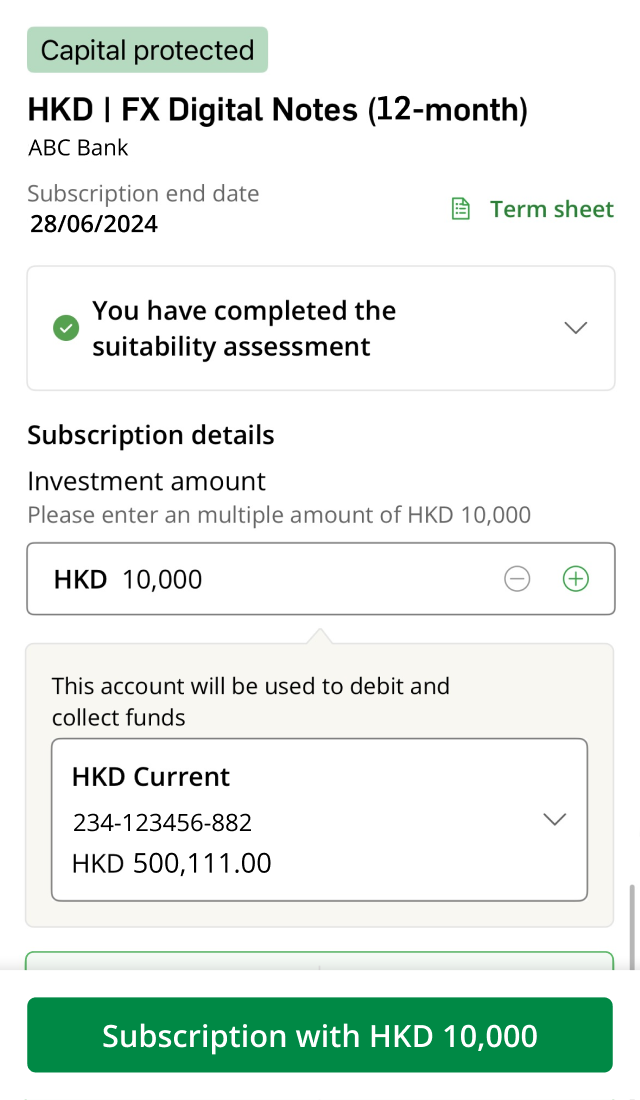

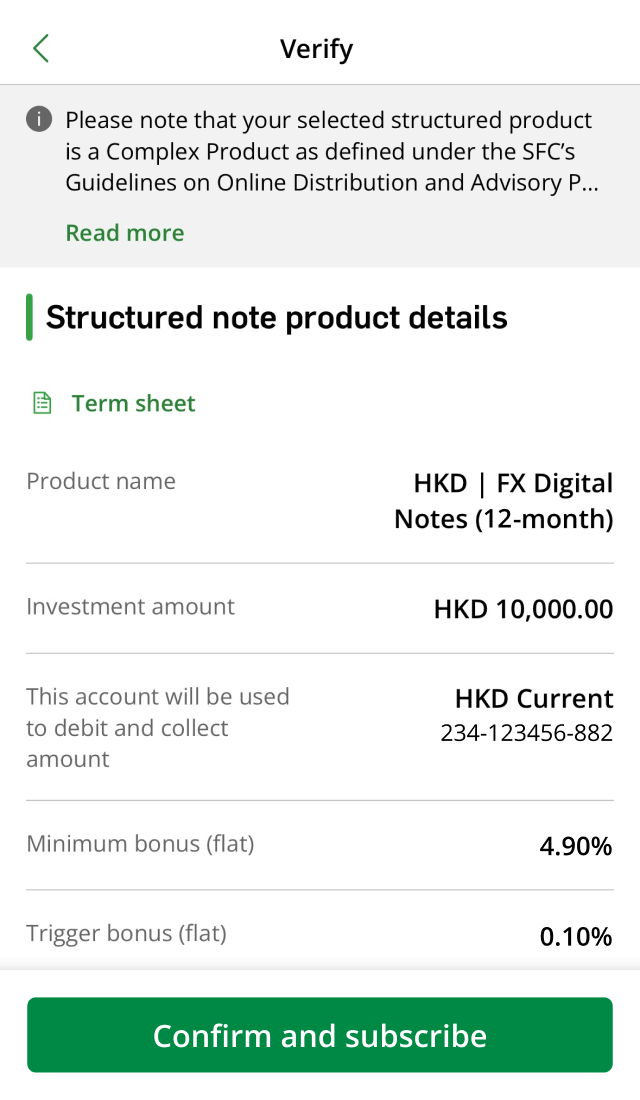

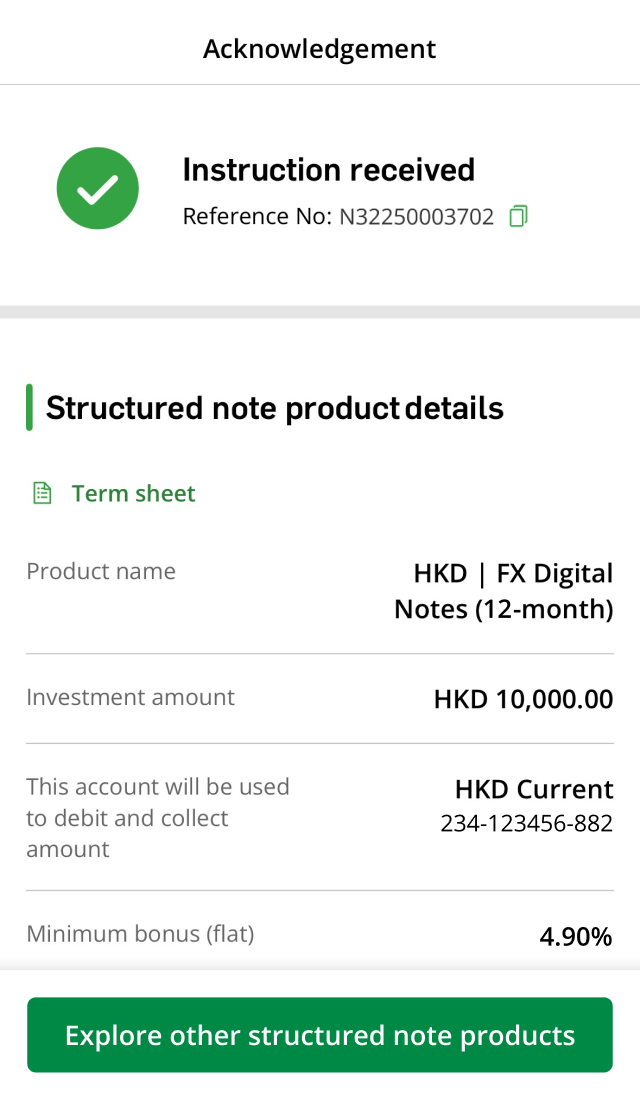

You can log on to Hang Seng Mobile App to subscribe structured notes with ease.

This investment product helps to reduce capital loss risk amid market fluctuations.

Structured notes (capital protected) are 100% capital protection only when it is held to maturity. The amount received by you upon early withdrawal/ termination may be less than the amount initially invested by you. Please refer to Risk Factors detailed in the Issuer’s term sheet, Important Facts and the offering documents.

In addition to the minimum return at maturity or upon Issuer early redemption (if any), you can receive the potential return if the conditions (i.e. the performance of the linked asset, specific market events or other specified criteria) is/ are satisfied. You may go to the "Products overview and example" section to learn more about different return scenarios at maturity/ upon Issuer early redemption of various note products.

For details, please refer to the product’s additional terms and conditions in product subscription.

Different investment tenors available and major currencies are acceptable as investment currency, providing greater flexibility to achieve your investment goal.

You can subscribe for structured notes via Hang Seng Mobile App with simple steps or any of our branches.

Whether you are an investment beginner or experienced investor, you can subscribe for structured notes easily with an investment amount as low as HKD100,000.

Digital Coupon Notes on USD / HKD is a structured product linked to the performance of USD against HKD foreign exchange rate. It offers 100% capital protection and minimum return at maturity. If the trigger event occurs on valuation date, you can receive additional trigger bonus at maturity.

Subscription channel: Branch, Mobile

Subscription details

Investment amount

HKD100,000

Investment tenor

1 year

Linked assets

USD/HKD spot exchange rate

Trigger event

USD / HKD spot exchange rate is at or above limit (i.e. 7.80) on valuation date

Minimum bonus

3.00% flat rate

Trigger bonus

0.10% flat rate

When you subscribe

You invest HKD 100,000

At maturity

You receive 100% of your principal and both minimum and trigger bonus, a total of HKD103,100

Your return

HKD100,000 ✕ (3.00% + 0.10%) = HKD3,100

When you subscribe

You invest HKD100,000

At maturity

You receive 100% of your principal and minimum bonus, a total of HKD103,000

Your returns

HKD100,000 ✕ 3.00% = HKD3,000

Callable Linear Bonus Coupon Note is a structured product linked to interest rate, it offers 100% capital protection and coupon payment at maturity or upon issuer’s early redemption. A one-off bonus coupon will be paid if certain conditions is fulfilled.

Subscription channel: Branch, Mobile

Subscription details

Investment amount

USD20,000

Investment tenor

5 years

Linked assets

Secured Overnight Financing Rate (SOFR)

Linear coupon

3.80% per annum without compounding

Linear coupon payment date

Upon issuer's optional redemption or at maturity

Bonus coupon payment date

One year after issue date

Issuer’s Optional Redemption

Issuer has the right to redeem the note one year after issue date, and on the same date in the 2nd, 3rd and 4th year

At maturity

You receive 100% of your principal and accrued linear coupon (3.80% ✕ 5 years), a total of USD23,800

Your return

USD20,000 ✕ (3.80% ✕ 5 years) = USD3,800

Total receivable (principal and gain)

You receive 100% of your principal and maximum potential gain (including max bonus coupon), a total of USD23,900

Your total return

USD100 + 3,800 = USD3,900

Upon early redemption

You receive 100% of your principal and accrued linear coupon (3.80% ✕ 1 year), a total of USD20,760

Your return

USD20,000 ✕ (3.80% ✕ 1 year) = USD760

Total receivable (principal and gain)

You receive 100% of your principal and minimum gain, a total of USD20,760

Your total return

USD760

Relevant Rate: Daily Compounded SOFR

Upper barrier: 4.50%

Lower barrier: 4.00%

Scenarios

Condition

Calculation formula

Case 1: Receiving max bonus coupon

Relevant rate is above upper barrier on bonus coupon determination date

Investment amount ✕ (upper barrier - lower barrier)

USD20,000 ✕ (4.50% - 4.00%) = USD100

Case 2: Receiving bonus coupon

Relevant Rate is at or below upper barrier and above lower barrier

Investment amount ✕ (Relevant Rate - lower barrier)

USD20,000 ✕ (4.30% - 4.00%) = USD60

Case 3: No bonus coupon

Relevant Rate is at or below lower barrier on bonus coupon determination date

Relevant Rate: USD SOFR CMS 1 year

Limit: 3.00%

Bonus coupon: 0.50%

Scenarios

Condition

Calculation formula

Case 1: Receiving bonus coupon

Relevant Rate is at or above limit (3.00%) on bonus coupon determination date

Investment amount ✕ predetermined bonus coupon

USD20,000 ✕ 0.50% = USD100

Case 2: No bonus coupon

Relevant Rate is below limit (3.00%) on bonus coupon determination date

Floating Rate Coupon Note is a structured product linked to the performance of interest rate, the product offers 100% capital protection at maturity, coupon are distributed every quarter in general. It also offers minimum gain and opportunities to enjoy higher potential gain, up to a cap.

Subscription channel: Branch

Subscription details

Investment amount

USD20,000

Investment tenor

1 years

Linked assets

USD SOFR CMS 1 year

Cap

3.50% p.a.

Floor

2.50% p.a.

Coupon frequency

Every 3 months

Day count factor

30/360

Total receivable (principal and gain) at maturity

When you subscribe

You invest USD20,000

On a coupon payment date

Your coupon will be calculated based on capped coupon, i.e. USD175

Your coupon amount

USD20,000 x 3.5% x 30/360 ✕ 3 months = USD175

When you subscribe

You invest USD20,000

On a coupon payment date

Your coupon will be calculated based on coupon rate equal to linked interest rate, i.e. USD165

Your coupon amount

USD20,000 x 3.3% x 30/360 ✕ 3 months = USD165

When you subscribe

You invest USD20,000

On a coupon payment date

Your coupon will be calculated based on floored coupon, i.e. USD125

Your coupon amount

USD20,000 ✕ 2.5% ✕ 30/360 ✕ 3 months = USD125

When you subscribe

You invest USD20,000

Total coupon payment

You receive max floating coupon on each coupon payment date, total coupon amount USD700

Your coupon amount

USD20,000 ✕ [(3.5% ✕ 30/360 ✕ 3 months) ✕ 4 coupon periods] = USD700

Total receivable (principal and gain)

You receive 100% of your principal and USD700 total coupon amount, a total of USD20,700

When linked interest rate is below 3.5% but above 2.5% on each floating coupon determination date, you will receive floating coupon with coupon rate equal to linked interest rate on each coupon payment date.

For example, assuming linked interest rate = 3.30%, your coupon will be calculated based on coupon rate equal to linked interest rate.

Please refer to offering documents for details.

When you subscribe

You invest USD20,000

Total coupon payment

You receive min floating coupon on each coupon payment date, total coupon amount USD500

Your coupon amount

USD20,000 x [(2.5% ✕ 30/360 ✕ 3 months) ✕ 4 coupon periods ] = USD500

Total receivable (principal and gain)

You receive 100% of your principal and USD500 total coupon amount, a total of USD20,500

Inverse Floater Note is a structured product linked to the performance of interest rate. Coupon are distributed every quarter in general. Offer minimum gain and opportunities to enjoy higher potential gain which is inversely related to the performance of the linked assets, subject to a cap. Offer 100% capital protection at maturity.

Subscription channel: Branch

Subscription details

Investment amount

USD20,000

Investment tenor

2 years

Linked assets

USD SOFR CMS 1 year

Fixed coupon

4.00% p.a.

Cap

6.00% p.a.

Floor

2.00% p.a.

Coupon frequency

Every 3 months

Day count factor

30/360

Total receivable (principal and gain) at maturity

When you subscribe

You invest USD20,000

On a coupon payment date

You receive fixed coupon regardless of the performance of the linked assets, being USD200

Your coupon amount

USD20,000 ✕ (4.00% ✕ 30/360 ✕ 3 months) = USD200

When you subscribe

You invest USD20,000

On a coupon payment date

Your coupon will be calculated based on capped coupon, i.e. USD300

Your coupon amount

USD20,000 ✕ (6.00% ✕ 30/360 ✕ 3 months) = USD300

When you subscribe

You invest USD20,000

On a coupon payment date

Your coupon will be calculated based on cap (6.00%) minus linked interest rate (2.00%), i.e. USD200

Your coupon amount

USD20,000 x [(6%-2%) x 30/360 ✕ 3 months] = USD200

When you subscribe

You invest USD20,000

On a coupon payment date

Your coupon will be calculated based on floored coupon, i.e. USD100

Your coupon amount

USD20,000 ✕ (2.00% ✕ 30/360 ✕ 3 months) = USD100

When you subscribe

You invest USD20,000

In the 1st year

You receive fixed coupon regardless of the performance of the linked assets, total coupon amount USD800

Your coupon amount

USD20,000 ✕ [(4.00% ✕ 30/360 ✕ 3 months) ✕ 4 coupon periods]= USD800

In the 2nd year

You receive max floating coupon on the respective coupon payment dates, total coupon amount USD1,200

Your coupon amount

USD20,000 ✕ [(6% ✕ 30/360 ✕ 3 months) ✕ 4 coupon periods] = USD1,200

Total receivable (principal and gain)

You receive 100% of your principal, USD800 and USD1,200 total coupon amount, a total of USD22,000

Your total gain

USD800 + USD1,200 = USD2,000

When linked interest rate is above 0.00% but below 4.00% on each floating coupon determination date during the investment tenor, you receive mid floating coupon on each coupon payment date.

For example, assuming linked interest rate = 2.00%, your coupon will be calculated based on cap (6.00%) minus linked interest rate (2.00%).

Please refer to offering documents for details.

When you subscribe

You invest USD20,000

In the 1st year

You receive fixed coupon regardless of the performance of the linked assets, total coupon amount USD800

Your coupon amount

USD20,000 ✕ [(4.00% ✕ 30/360 ✕ 3months) ✕ 4 coupon periods]= USD800

In the 2nd year

You receive min floating coupon on the respective coupon payment dates, total coupon amount USD400

Your coupon amount

USD20,000 ✕ [(2.00% ✕ 30/360 ✕ 3months) ✕ 4 coupon periods] = USD400

Total receivable (principal and gain)

You receive 100% of your principal, USD800 and USD400 total coupon amount, a total of USD21,200

Your total gain

USD800 + USD400 = USD1,200

Subscribe Structured Notes via Hang Seng Mobile App (Cantonese version)

Invest in Capital protected products and enjoy higher potential returns while managing risk

Open an integrated account and activate your investment account via Hang Seng Mobile App with ease[2]

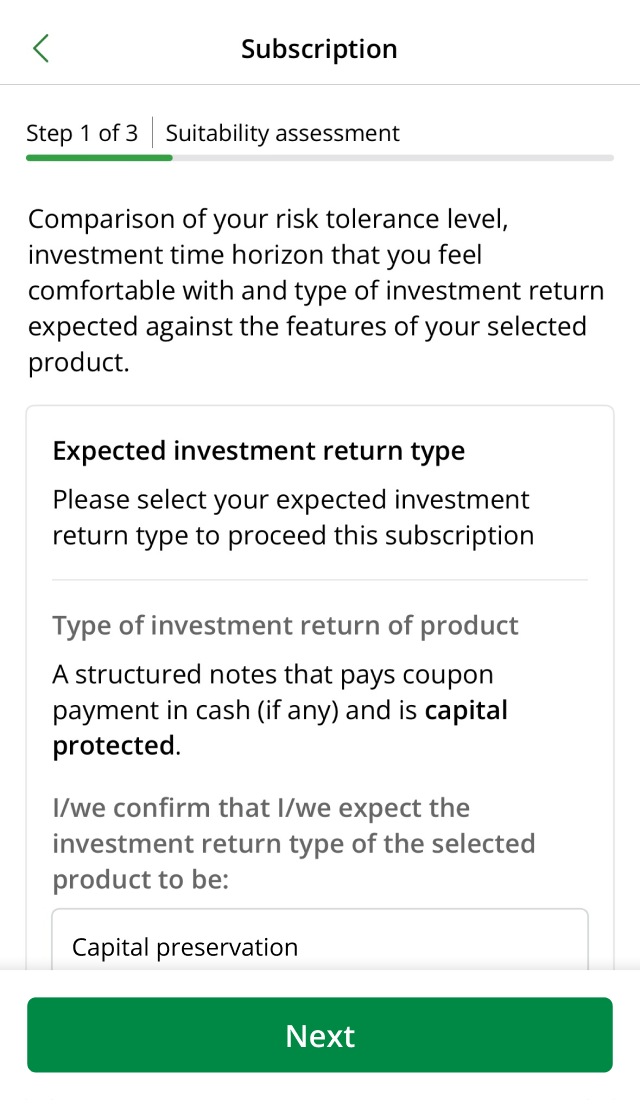

Comprehensive Structured Notes (Capital Protected) experience is just a few steps away[3]

9:00 a.m. to 5:30 p.m. from Mon to Fri (excluding Hong Kong public holidays, half-day trading or market disruption days), however, the subscription time for individual products could be different.

You can refer to the risk factors listed in the relevant offering documents for the structured notes.

The relevant offering documents (including Term Sheet and Important Notes to Customers) are provided during the structured notes’ subscription process . After you have subscribed a note, you may also find it from "My Structured Notes" page in Hang Seng Mobile App. Alternatively, printed copies of the offering documents can be obtained free of charge during normal business hours on any business days at our branches. Please call us at 28220228 for details of the addresses our branches.

The issue date is the date on which structured notes are issued. The issue date is a day falling from 5 to 10 business days (subject to the specified structured notes) after the subscription date.

Yes, simply log on to Hang Seng Mobile App and tap "Structured Notes (Capital Protected)” to visit My Structured Notes page, you can view your subscription status and holding details.

According to LERS, when the demand for Hong Kong dollars is greater than the supply and the market exchange rate strengthens to the strong-side CU of HKD7.75 to USD1, the Hong Kong Monetary Authority (HKMA) stands ready to sell Hong Kong dollars to banks for US dollars. The aggregate balance (a component of the monetary base) will then expand to push down Hong Kong dollar interest rates, creating monetary conditions that move the Hong Kong dollars away from the strong-side limit to within the convertibility zone of 7.75 to 7.85.

If the supply of Hong Kong dollars is greater than demand and the market exchange rate weakens to the weak-side CU of HKD7.85 to USD1 the HKMA stands ready to buy Hong Kong dollars from banks. The aggregate balance (a component of the monetary base) will then contract to drive Hong Kong dollar interest rates up, pushing the Hong Kong dollars away from the weak-side limit to stay within the convertibility zone. For details, please refer to https://www.hkma.gov.hk/eng/key-functions/money/linked-exchange-rate-system/how-does-the-lers-work/

Only applicable for specific notes product.

Subject to the terms in the product's term sheet, you can redeem your investment in structured notes before maturity. The early redemption amount may be affected by the prevailing market conditions and may result in loss of the principal.

No. Please visit any of our branches if you want to redeem your structured notes.

There is no handling fee for subscribing structured notes. For details, please refer to offering documents.

SOFR is a broad indicator used to calculate the cost of borrowing overnight in the repo market collateralised by US Treasury securities. It is essentially the benchmark interest rate for USD denominated derivatives and loans.

Federal Reserve's Alternative Reference Rates Committee announced its preferred alternative reference rate to the USD LIBOR rate: Secured Overnight Financing Rate (SOFR).

For details, you may refer to https://www.hkma.gov.hk/media/eng/doc/key-functions/banking-stability/banking-policy-and-supervision/LIBOR_transtion_corporates_Q&As_revised.pdf and https://www.cmegroup.com/education/courses/introduction-to-sofr/what-is-sofr.html

Since SOFR is an overnight interest rate, several calculation methods based on SOFR have been developed to provide various interest rate options for different products. CME Term SOFR Reference Rates benchmark (Term SOFR) which is a set of forward-looking interest rate estimates, calculated and published daily for 1-, 3-, 6- and 12-month tenors. USD SOFR CMS 1 year is a forward-looking interest rate estimates for 12-month tenors.

For details, you may refer to https://www.cmegroup.com/articles/faqs/cme-term-sofr-reference-rates.html