We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

You can now transfer funds to Canada with $0 handling fees using Global Money+, along with UK, US, AU, NZ and 50 other designated countries and regions, funds arrive as fast as the same day.

Enjoy up to 15.8% p.a. 1-week time deposit rate for designated currencies exchange and earn stable interest return. View details

With Global Money+[1], you can send money overseas in just a few steps using Hang Seng Mobile App, all from the comfort of your home! You can enjoy $0 handling fee for transfers to designated countries and regions, ensuring hassle-free and cost-effective transactions. You can also transfer overseas via Personal e-Banking, phone banking service or by visiting any of our branches[2].

Transfer to CA, UK, US, AU, NZ and others at no cost

Hang Seng personal customers can transfer funds in local currency to over 50 designated countries or regions[3], such as Canada, the United Kingdom, the United States, Australia and New Zealand, without any handling fee.

If you need to transfer non-local currency (e.g. USD to UK) or to other non-designated countries or regions (e.g. Japan), it only costs HKD160 or equivalent regardless of the overseas banks fee[4].

Fastest same-day arrival

Transfer to applicable countries / regions and currencies will arrive within the same day at the earliest. Other transfers will generally arrive in 1 to 4 working days[5].

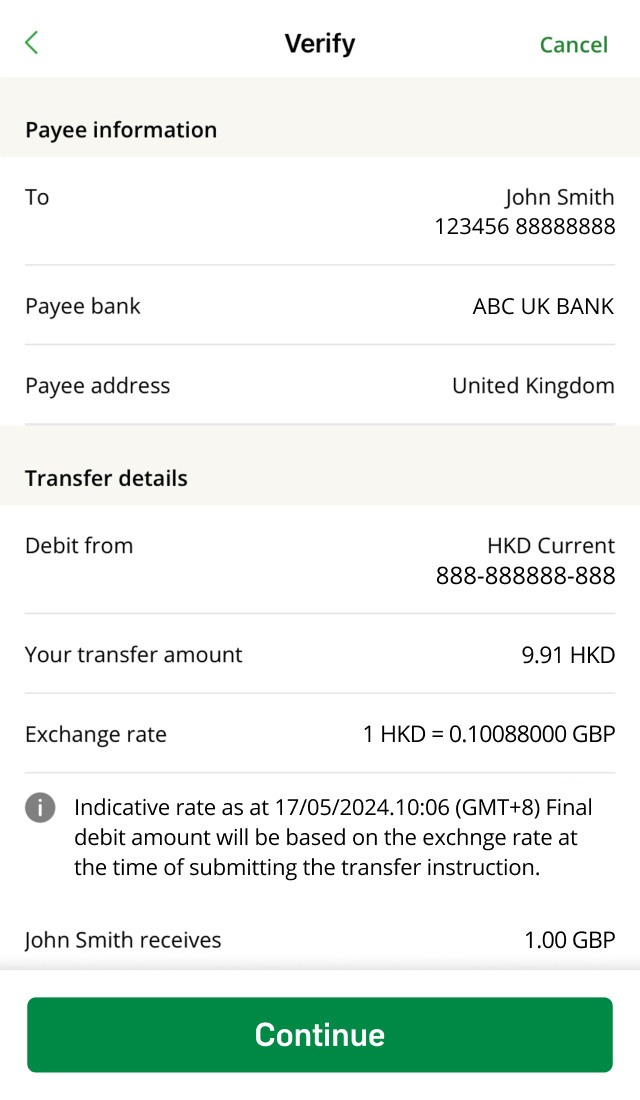

All transfer details are clear at a glance

Whether it's the exchange rate, handling fee and estimated arrival time, we'll list them clearly to make your transfer more transparent and help you budget more effectively!

Terms and conditions apply.

Fee waiver is applicable to overseas transfer in local currencies for certain designated country / region only. For overseas transfers, you'll need to provide basic payee information (e.g. payee name and address).

Make sure you provide the correct country / region bank code for successful transfers, which can be found on bank websites or bank statements. You can refer to the lists below for details:

Each country has its own applicable bank code, common examples include: the United Kingdom (Sort Code), the United States (Routing Number), Canada (Institution Number and Transit Number), Australia (BSB number) and New Zealand (National Clearing Code). You can refer to the table in the above lists (scroll to bottom) for details.

The handling fee is subject to the transfer type:

Please note, some receiving and/or correspondent banks may still charge additional fee to payee when they process the transaction.

Specific requirements may apply to waive fees for certain designated country or region transfers. For example, Australian payee account number should be 6 to 9 digits. When sending money to the US, the charges may vary based on payee details.

When making a transfer, the fee details will be shown for your reference before you confirm the transfer. For details, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

The estimated time of arrival time depends on which country or region you're sending money to. It generally takes 1 business day to transfer local currencies to designated countries or regions, while other transfers may take 1 to 4 business days.

The estimated time of arrival of your transfer will be shown for your reference before you confirm and after you submit the instruction.

You can't amend or cancel a Global Money+ transfer that has already been made.

If you'd like to recall a submitted transfer instruction due to incorrect payee information, please call us at (852) 2822 0228 (press #-1-7-4 after choosing language) for assistance. Once we receive your request, we'll request the receiving bank to recall the transfer on your behalf. The result is subject to receiving bank's decision, and we can't guarantee you'll get the money back.

If the payee hasn't received your transfer within a reasonable time, it may be because the receiving bank's local clearing process takes time. You can call us at (852) 2822 0228 (press #-1-7-4 after choosing language) and provide the below information for us to follow up:

If receiving bank rejects your transfer, the amount will be credited back to your account. The refund time is subject to receiving bank's processing time and you'll be notified when the refund's made. Please note, some receiving and/or correspondent banks may charge additional fee when they process the transaction.

You can use Global Money+ as long as you hold an Integrated Account, current or savings account and have already registered for Hang Seng Mobile App.

Over 50 designated countries or regions don't require handling fee, you can refer to the full list under "List of free-of-charge country or region" section in this page.

Depending on the country or region you're transferring to, you need to provide the below information:

You can learn more under "List of free-of-charge country or region" section in this page.

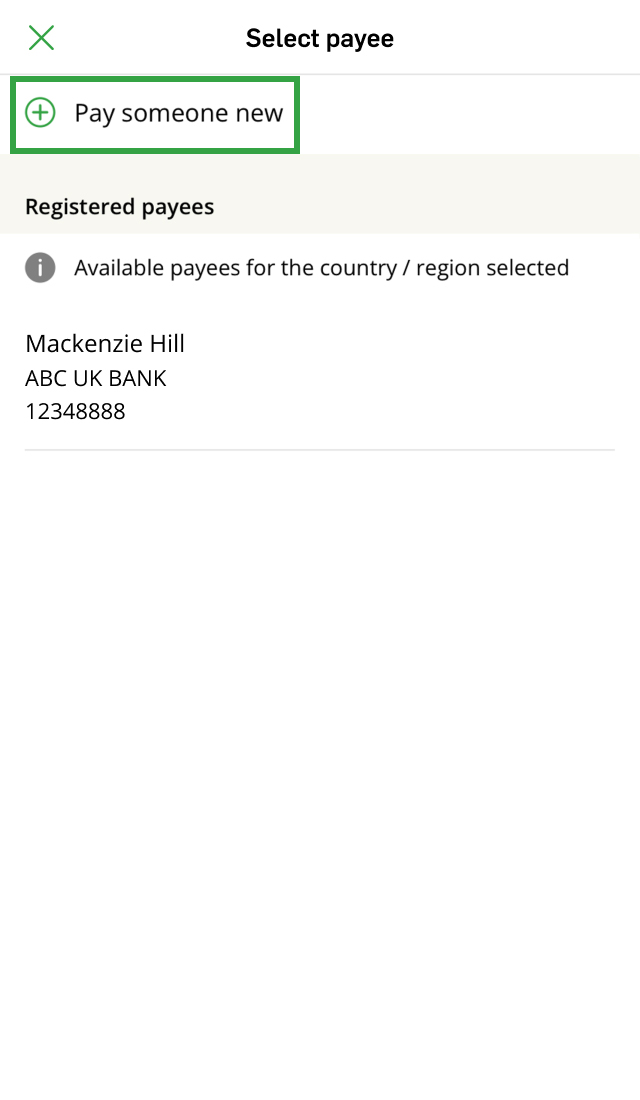

Yes. You can add a new payee during the Global Money+ transfer process. To learn how, please refer to the "Add payee for easier future transfers" tab under "How Global Money+ works" section in this page.

If the Global Money+ transfer involves foreign exchange, the page will display real-time exchange rates updated every 60 seconds (except for CNY). Before completing the transfer, we'll ask you to confirm the exchange rate and other payment details. You'll be notified if the exchange rate has been refreshed. Make sure you check the exchange rate again before confirming the transfer.

For transfers involving foreign exchange of CNY, the actual debit amount and exchange rate will be calculated based on the exchange rate on the execution time of your transfer.

We can't track the arrival time of the transfer, but you'll receive notification when the transfer amount is debited from your bank account.

The non-registered payee daily transfer limit is up to HKD400,000, which is shared by (i) cross-border transfers, (ii) transfers to non-registered third-party Hang Seng accounts, (iii) remittances and (iv) fund transfers to non-registered payee's other Hong Kong bank accounts through FPS or CHATS.

The registered payee daily transfer limit is up to HKD1,500,000, which is shared by (i) cross-border transfers, (ii) fund transfers to registered third-party Hang Seng accounts, (iii) remittances and (iv) fund transfers to registered payee's other Hong Kong bank accounts through FPS or CHATS.

The maximum mainland & overseas daily transfer limit is HKD1,500,000, and only applies to the transfer to payee outside Hong Kong. The transfer amount may also subject to registered payee daily transfer limit, non-registered payee daily transfer limit or small value daily transfer limit, whichever is lower. Mainland & overseas daily transfer limit is applicable to mainland and overseas transfer, FPS × PromptPay QR Payment.

For transferring CNY to mainland China, please refer to the questions under the part of “Mainland China transfers” below. Please note, CNY transfers to self-named account in mainland China will be subject to a daily limit of CNY80,000 based on CNY transfer regulations. For details, please refer to FAQs of Cross-Border Transfer.

You'll be notified via SMS, email and/or push notification (if enabled) when we debit funds from your account.

We currently don't provide recurring and future dated payment services for Global Money+.

Yes. If you've registered an overseas payee in Personal e-Banking, you can use the record for Global Money+. However, depending on the receiving country or region, you'll need to supplement the corresponding bank code.

We've implemented multiple authentication to protect your account security:

You can also make an overseas transfer via methods below:

16 currencies are available for overseas transfer via Hang Seng Mobile App, Personal e-Banking, our branches and Phone Banking. We may add or delete currencies from time to time. Please refer to our currency converter for the latest foreign exchange rates.

Currency |

Code |

|---|---|

Australian Dollar |

AUD |

Canadian Dollar |

CAD |

Danish Kroner |

DKK |

Euro |

EUR |

Hong Kong Dollar |

HKD |

Japanese Yen |

JPY |

New Zealand Dollar |

NZD |

Norwegian Kroner |

NOK |

Pound Sterling |

GBP |

Renminbi |

CNY |

Singapore Dollar |

SGD |

South African Rand |

ZAR |

Swedish Kroner |

SEK |

Swiss Franc |

CHF |

Thai Baht |

THB |

US Dollar |

USD |

Transfer channel |

Daily Limit |

|---|---|

| Personal e-Banking | The non-registered payee daily transfer limit is up to HKD400,000, which is shared by (i) cross-border transfers, (ii) transfers to non-registered third-party Hang Seng accounts, (iii) remittances and (iv) fund transfers to non-registered payee's other Hong Kong bank accounts through FPS or CHATS. The registered payee daily transfer limit is up to HKD1,500,000, which is shared by (i) cross-border transfers, (ii) fund transfers to registered third-party Hang Seng accounts, (iii) remittances and (iv) fund transfers to registered payee's other Hong Kong bank accounts through FPS or CHATS. The maximum mainland & overseas daily transfer limit is HKD1,500,000, and only applies to the transfer to payee outside Hong Kong. The transfer amount may also subject to registered payee daily transfer limit, non-registered payee daily transfer limit or small value daily transfer limit, whichever is lower. Mainland & overseas daily transfer limit is applicable to mainland and overseas transfer, FPS × PromptPay QR Payment. For transferring CNY to mainland China, please refer to the questions under the part of “Mainland China transfers” below. Please note, CNY transfers to self-named account in mainland China will be subject to a daily limit of CNY80,000 based on CNY transfer regulations. For details, please refer to FAQs of Cross-Border Transfer. |

| Branch | No limit |

| Phone Banking | HKD100,000 for non-registered payees |

Yes. You can set up recurring instructions to send money to designated payees regularly by debiting from your selected Hang Seng account. Handling fee for setting up each recurring instruction is HKD100 and the charge for each executed transfer is the same as the one-time instructions submitted via branches or Phone Banking.

The cut-off time is subject to different currency. We generally process the instruction on the same business day if it's submitted before cut-off time. Otherwise it'll be proceed the next business day. For details, please refer to Outward Remittance & CHATS Services Cut-off Timetable.

You can also submit overseas transfer instructions via our branches or Phone Banking during business hours on Sat and we'll process them within the same day except:

We'll debit funds from your designated account on the day we process your instruction, which is usually the submission day or next business day. For details, please refer to Outward Remittance & CHATS Services Cut-off Timetable.

The estimated time of arrival time depends on the processing time of the intermediary bank(s) / receiving bank or its branches. Funds are usually transferred within 1 to 4 business days.

However, it may take longer for transfers to countries or regions where exchange control is in place, where it's the receiving bank's requirement to release funds upon contact with the payee, or if the payment has to go through a number of banks and branches.

We usually send out the transfer instruction to the receiving bank as normal, but they won't process accordingly on local public holidays (subject to the operations and practices adopted by the receiving bank).

Transfer to |

Currency |

Charge per transaction (including handling fee and cable charge) |

|

|---|---|---|---|

Via Personal e-Banking |

Via branches, Phone Banking and recurring instruction [6] |

||

Payee's Hang Seng China or Macau account |

Any |

HKD65 |

HKD190 |

Payee's other bank accounts in mainland China, Hong Kong, Macau or Taiwan |

Any |

HKD230 |

|

Other countries or regions |

HKD / Local Currency |

HKD230 |

|

Non-local currency |

HKD270 |

||

*We charge HKD0 for transfers in CNY to mainland China via Hang Seng Personal e-Banking. Please note that corresponding bank charge isn't included. For more information, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

In general, you can choose the following remittance charge arrangement:

Each bank has its own tariff and the pricing is subject to change from time to time.

It's free of charge if the transfer instruction hasn't been sent out yet. Otherwise, you'll need to pay HKD200 handling fee, HKD100 cable charge and corresponding bank charge (if both applicable). Please note, reversing transfers involving foreign exchange may incur losses due to exchange rate changes.

Please refer to Part B: “Remittances and Foreign Exchange Service” > “Outward Remittances” of the Banking Services Fees and Charges for details.

You can call us at (852) 2123 1088 or visit any of our branches and provide the below information for us to follow up:

For each cable enquiry, we'll charge HKD100 and foreign bank charge (if both applicable), with a minimum HKD250 as handling fee per enquiry.

Once the transfer's completed and the amount's debited, you'll receive a notification via email stating the final exchange rate used.

Simply log on to Personal e-Banking and go to "Transfer & Pay" in the left menu > "Limit / Payee Settings" > "Payee Maintenance" to add or remove existing payee.

Personal customers can remit CNY through your Hang Seng personal CNY account maintained to their self-named CNY account in mainland China (not applicable to commercial customers). According to the current CNY transfer regulations, HKID Card holders must remit to their self-named account and the maximum daily CNY remittance limit per person is CNY80,000 (if the transfer is for the purchase of a residential property or mortgage repayment in the Greater Bay Area, it's not subject to this restriction).

The daily limit is CNY80,000 for a Hong Kong Identity Card holder in accordance with current CNY Transfer Regulations (If the remittance is used to pay for property purchase price/mortgage repayment of the residential property in the Greater Bay Area, it is not subject to the daily maximum remittance amount limit).

Transfer to mainland China or other places outside Hong Kong for a non-Hong Kong Identity Card holder is subject to local rules and requirements of mainland China or the relevant jurisdictions. Overseas transfer may be rejected due to local regulatory requirements and rules and subject to charges applicable to returned transfers.

Purpose of payment is required for CNY remittance to Mainland China. Please refer to Purpose of Payment Category for details.

The handling fee for transfers via different channels are:

The above handling fees don't include corresponding bank charges. To learn more about the privileges for Prestige Private or Prestige Banking customers, please refer to Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

If Hong Kong and Macau residents purchase new and second-hand residential properties in 9 Greater Bay Area cities, namely Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing, and/or pay for mortgage repayment or relevant property purchase price (e.g. deposit, security deposit, down payment, full payment, public maintenance fund, home purchase related taxes and liquidated damages, etc.), such remittance isn't subject to the limit.

This remittance service is currently only available at our branches, but you don't need to make an appointment in advance.

You should provide your receiving account information, including the account number, the account and bank name, and the related bank's SWIFT code. For transfer made to Hang Seng Bank accounts, please provide Hang Seng Bank Limited and our SWIFT code: HASEHKHH.

For US transfers, you should also provide our CHIPS number: 010522, in addition to the above information.

In general, money will be credited to your account on the same business day if we receive the transfer instruction from the transferring bank before the cut-off time (Mon to Fri: 5:30 p.m., Sat: 11:00 a.m.; excluding public holidays).

Money transferred directly from an overseas bank to us isn't subject to handling fees. Learn more via Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

If you opt in paper advices, we'll mail the advice to you on the next working day after the money is credited.

If you have Personal e-Banking and opt in e-Advices, you'll receive the Inward Remittance e-Advice instantly on the day the money is credited. The advice will be saved for 30 days and automatically deleted afterwards.

Reminder: you can also set up the e-Alert Service for receiving transfers of any amount or a specified amount. You'll receive a notification when the money is credited to your account (the credited amount is the net amount after deduction of handling fees).

The e-Alert email service is free, while the SMS service is subject to a charge. Log on to Personal e-Banking via the website > Left menu > "e-Services" > "e-Alert" for more details.

Based on exchange regulations, HKID Card holders can receive CNY transfer if they've previously transferred money from their CNY account in Hong Kong to their self-named account in mainland China. In such cases, with prior approval from the relevant financial institutions in mainland China, the amount they can transfer back shouldn't exceed the original transfer amount. Transfers from mainland China or overseas for non-HKID Card holders are subject to the regulations of the respective regions.

You can learn more about the details via smart tips for inward payments.

Ensure the payee's information you provided to sender is complete and accurate to avoid delays or rejection of the transfer.

If we're able to identify you as the payee of a transfer with incorrect details like account number or name, we may ask you to inform the sender to update the information via the correspondent bank. You can call our Remittance Hotline at (852) 2123 1088 to check your transfer status.

You can track the status of your remittance from Hang Seng to other overseas banks via Track My Remittance service (except Global Money+ and receiving transfers to Hang Seng).

Your overseas remittance instructed via various channels, including Personal e-Banking, branches and Phone Banking can be tracked using Track My Remittance service (except Global Money+). No additional service fee will be charged for Track My Remittance, except for the remittance handling fees.

Every remittance instruction has a Unique End-to-end Transaction Reference (UETR). You can use it to check your remittance status with Hang Seng or other banks.

We process CNY remittances via the Cross-border Interbank Payment System (CIPS). Based on CNY remittance regulations, we aren't able to provide detailed information about the remittance.

Yes. Track My Remittance is applicable for remittances from Hang Seng to other overseas banks, but not for remittance to Hang Seng China. |

If the receiving bank isn't registered with the SWIFT Global Payments Innovation (GPI) service, its processing status won't be displayed under Track My Remittance. |

Planning for your children's studies abroad requires thorough preparation. Studysure Protection Plan offers comprehensive protection for your children, providing 24/7 support in case of emergencies while they're overseas.

Manage your cross-border accounts easily and transfer up to 10 currencies between your self-named Hang Seng accounts in Hong Kong and mainland China anytime and anywhere.

Get 24/7 support from our Virtual Assistant.

You can find more details about applicable bank code under this list.

Country / region |

Currency |

Applicable bank code |

|---|---|---|

Canada |

CAD |

Canadian Institution Number / |

| United Kingdom | GBP / EUR | Sort Code / IBAN |

| United States | USD | Routing Number (or ABA Routing Number)

(When sending money to the US, the charges may vary based on payee details. The fee details will be shown for your reference before you confirm the transfer.) |

| Australia | AUD | Australian Bank State Branch (BSB) |

| New Zealand | NZD | National Clearing Code (NCC) |

| Singapore | SGD | SWIFT / BIC |

| Andorra | EUR | IBAN |

| Austria | EUR | IBAN |

| Belgium | EUR | IBAN |

| Bulgaria | BGN/EUR | IBAN |

| Croatia | EUR | IBAN |

| Cyprus | EUR | IBAN |

| Czech Republic | CZK/EUR | IBAN |

| Denmark | DKK/EUR | IBAN |

| Estonia | EUR | IBAN |

| Finland | EUR | IBAN |

| France | EUR | IBAN |

| French Guiana | EUR | IBAN |

| Germany | EUR | IBAN |

| Gibraltar | EUR | IBAN |

| Greece | EUR | IBAN |

| Guadeloupe | EUR | IBAN |

| Guam | USD | Routing Number (or ABA Routing Number)

(When sending money to the US, the charges may vary based on payee details. The fee details will be shown for your reference before you confirm the transfer.) |

| Guernsey | GBP/EUR | Sort Code / IBAN |

| Holy See (Vatican City State) | EUR | IBAN |

| Hungary | HUF/EUR | IBAN |

| Iceland | EUR | IBAN |

| India | INR | SWIFT / BIC |

| Ireland | EUR | IBAN |

| Isle of Man | GBP/EUR | Sort Code / IBAN |

| Italy | EUR | IBAN |

| Jersey | GBP/EUR | Sort Code / IBAN |

| Kenya | KES | IBAN |

| Latvia | EUR | IBAN |

| Liechtenstein | CHF/EUR | IBAN |

| Lithuania | EUR | IBAN |

| Luxembourg | EUR | IBAN |

| Malta | EUR | IBAN |

| Martinique | EUR | IBAN |

| Mayotte | EUR | IBAN |

| Monaco | EUR | IBAN |

| Netherlands | EUR | IBAN |

| Norway | NOK/EUR | IBAN |

| Poland | PLN/EUR | IBAN |

| Portugal | EUR | IBAN |

| Romania | RON/EUR | IBAN |

| Saint Pierre and Miquelon | EUR | IBAN |

| San Marino | EUR | IBAN |

| Saudi Arabia | SAR | IBAN |

| Slovakia | EUR | IBAN |

| Slovenia | EUR | IBAN |

| South Africa | ZAR | SWIFT / BIC |

| Spain | EUR | IBAN |

| Sweden | SEK/EUR | IBAN |

| Switzerland | CHF/EUR | IBAN |

Bank code details

Country / region |

Bank code |

Details |

|---|---|---|

Canada |

Canadian Institution Number |

A 3-digit number identifying a particular bank or financial institution in Canada. |

Canadian Transit Number |

A 5-digit number identifying a particular bank and branch in Canada. |

|

| United Kingdom | Sort Code | A 6-digit number identifying a particular bank and branch in the UK. |

| United States | Routing Number (or ABA Routing Number) | A 9-digit number used in the US to identify a particular bank for transactions. |

| Australia | Bank State Branch (BSB) code | A 6-digit number identifying a particular bank and branch in Australia. |

| New Zealand | National Clearing Code (NCC) | A 6-digit number identifying a particular bank and branch in New Zealand. |

| Others | The International Bank Account Number (IBAN) | A globally recognised code consisting of up to 34 letters and numbers. |

| SWIFT / BIC | A code with 8 to 11 characters that identifies your payee's country / region, city, bank, and branch. |

You can find more details about applicable bank code under this list.

Country / region |

Bank code |

|---|---|

| Albania | IBAN |

| Algeria | SWIFT / BIC |

| American Samoa | SWIFT / BIC |

| Anguilla | SWIFT / BIC |

| Antigua and Barbuda | SWIFT / BIC |

| Argentina | SWIFT / BIC |

| Armenia | SWIFT / BIC |

| Aruba | SWIFT / BIC |

| Azerbaijan | IBAN |

| Bahamas | SWIFT / BIC |

| Bahrain | IBAN |

| Bangladesh | SWIFT / BIC |

| Barbados | SWIFT / BIC |

| Belize | SWIFT / BIC |

| Benin | SWIFT / BIC |

| Bermuda | SWIFT / BIC |

| Bhutan | SWIFT / BIC |

| Bolivia, Plurinational State of | SWIFT / BIC |

| Bonaire, Sint Eustatius and Saba | SWIFT / BIC |

| Bosnia and Herzegovina | IBAN |

| Botswana | SWIFT / BIC |

| Brazil | SWIFT / BIC |

| Brunei Darussalam | SWIFT / BIC |

| Burkina Faso | SWIFT / BIC |

| Burundi | SWIFT / BIC |

| Cambodia | SWIFT / BIC |

| Cameroon | SWIFT / BIC |

| Cape Verde | SWIFT / BIC |

| Cayman Islands | SWIFT / BIC |

| Central African Republic | SWIFT / BIC |

| Chad | SWIFT / BIC |

| Chile | SWIFT / BIC |

| China | SWIFT / BIC |

| Colombia | SWIFT / BIC |

| Comoros | SWIFT / BIC |

| Congo | SWIFT / BIC |

| Congo, the Democratic Republic of the | SWIFT / BIC |

| Cook Islands | SWIFT / BIC |

| Costa Rica | IBAN |

| Côte D'Ivoire | SWIFT / BIC |

| Curacao | SWIFT / BIC |

| Djibouti | SWIFT / BIC |

| Dominica | SWIFT / BIC |

| Dominican Republic | IBAN |

| Ecuador | SWIFT / BIC |

| Egypt | IBAN |

| El Salvador | SWIFT / BIC |

| Equatorial Guinea | SWIFT / BIC |

| Eritrea | SWIFT / BIC |

| Eswatini (Swaziland) | SWIFT / BIC |

| Ethiopia | SWIFT / BIC |

| Falkland Islands (Malvinas) | SWIFT / BIC; or IBAN |

| Faroe Islands | IBAN |

| Fiji | SWIFT / BIC |

| French Polynesia | IBAN |

| Gabon | SWIFT / BIC |

| Gambia | SWIFT / BIC |

| Georgia | IBAN |

| Ghana | SWIFT / BIC |

| Greenland | IBAN |

| Grenada | SWIFT / BIC |

| Guatemala | SWIFT / BIC |

| Guinea | SWIFT / BIC |

| Guinea-Bissau | SWIFT / BIC |

| Guyana | SWIFT / BIC |

| Haiti | SWIFT / BIC |

| Honduras | SWIFT / BIC |

| Indonesia | SWIFT / BIC |

| Israel | IBAN |

| Jamaica | SWIFT / BIC |

| Japan | SWIFT / BIC |

| Jordan | SWIFT / BIC |

| Kazakhstan | IBAN |

| Kiribati | SWIFT / BIC |

| Korea, Republic of | SWIFT / BIC |

| Kuwait | IBAN |

| Kyrgyzstan | SWIFT / BIC |

| Lao People's Democratic Republic | SWIFT / BIC |

| Lebanon | IBAN |

| Lesotho | SWIFT / BIC |

| Liberia | SWIFT / BIC |

| Libya | SWIFT / BIC |

| Macao SAR | SWIFT / BIC |

| Madagascar | SWIFT / BIC |

| Malawi | SWIFT / BIC |

| Malaysia | SWIFT / BIC |

| Maldives | SWIFT / BIC |

| Mali | SWIFT / BIC |

| Marshall Islands | SWIFT / BIC |

| Mauritania | IBAN |

| Mauritius | IBAN |

| Mexico | SWIFT / BIC |

| Moldova, Republic of | IBAN |

| Mongolia | SWIFT / BIC |

| Montenegro | IBAN |

| Montserrat | SWIFT / BIC |

| Morocco | SWIFT / BIC |

| Mozambique | SWIFT / BIC |

| Myanmar | SWIFT / BIC |

| Namibia | SWIFT / BIC |

| Nepal | SWIFT / BIC |

| New Caledonia | IBAN |

| Nicaragua | SWIFT/BIC |

| Niger | SWIFT/BIC |

| Nigeria | SWIFT/BIC |

| Norfolk Island | SWIFT/BIC |

| North Macedonia | IBAN |

| Oman | IBAN |

| Pakistan | SWIFT / BIC |

| Palestine, State of | IBAN |

| Panama | SWIFT / BIC |

| Papua New Guinea | SWIFT / BIC |

| Paraguay | SWIFT / BIC |

| Peru | SWIFT / BIC |

| Philippines | SWIFT / BIC |

| Puerto Rico | SWIFT / BIC |

| Qatar | IBAN |

| Réunion | IBAN |

| Rwanda | SWIFT / BIC |

| Saint Helena, Ascension and Tristan Da Cunha | SWIFT / BIC |

| Saint Kitts and Nevis | SWIFT / BIC |

| Saint Lucia | SWIFT / BIC |

| Saint Vincent and the Grenadines | SWIFT / BIC |

| Samoa | SWIFT / BIC |

| Sao Tome and Principe | SWIFT / BIC |

| Senegal | SWIFT / BIC |

| Serbia | IBAN |

| Seychelles | IBAN |

| Sierra Leone | IBAN |

| Sint Maarten (Dutch part) | IBAN |

| Solomon Islands | SWIFT / BIC |

| Somalia | SWIFT / BIC |

| South Sudan | SWIFT / BIC |

| Sri Lanka | SWIFT / BIC |

| Suriname | SWIFT / BIC |

| Taiwan | SWIFT / BIC |

| Tajikistan | SWIFT / BIC |

| Tanzania, United Republic of | SWIFT / BIC |

| Thailand | SWIFT / BIC |

| Timor-Leste | SWIFT / BIC |

| Togo | SWIFT / BIC |

| Tonga | SWIFT / BIC |

| Trinidad and Tobago | SWIFT / BIC |

| Tunisia | IBAN |

| Turkey | IBAN |

| Turkmenistan | SWIFT / BIC |

| Turks and Caicos Islands | SWIFT / BIC |

| Tuvalu | SWIFT / BIC |

| Uganda | SWIFT / BIC |

| Ukraine | IBAN |

| United Arab Emirates | IBAN |

| Uruguay | SWIFT / BIC |

| Uzbekistan | SWIFT / BIC |

| Vanuatu | SWIFT / BIC |

| Venezuela (Bolivarian Republic of) | SWIFT / BIC |

| Vietnam | SWIFT / BIC |

| Virgin Islands, British | SWIFT / BIC |

| Virgin Islands, U.S. | SWIFT / BIC |

| Wallis and Futuna | IBAN |

| Yemen | SWIFT / BIC |

| Zambia | SWIFT / BIC |

Bank code details

Country / region |

Bank code |

Details |

|---|---|---|

| Other countries / regions | IBAN | The International Bank Account Number (IBAN) is a globally recognised code consisting of up to 34 letters and numbers. |

| SWIFT / BIC | A code with 8 to 11 characters that identifies your payee's country / region, city, bank, and branch. |