We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

Currently extended-hours subscription session (Mon to Fri: 5:00 p.m. - 6:00 a.m. the next day; Sat to Sun & Hong Kong public holiday: 10:00 a.m. - 6:00 a.m. the next day). Instructions submitted will be regarded as pending instructions and processed in the Offer Period stated in the relevant Term Sheet.

CPI Deposit is available for subscription from Mon to Sun 10:00 a.m. - 6:00 a.m. the next day (subject to our discretion, market disruption events etc.), please try again during subscription hours. Product information displayed outside subscription hours is for reference only.

We care about your Foreign Exchange need. 24/7 Online Foreign Exchange, Instant FX trading anytime, anywhere. You can also set target exchange rates via ‘FX Order Watch’, helping you capture your desired rates and meet your FX needs.

The currency in which you pay for the deposit amount and receive for settlement.

The performance of the underlying currency pair within the observation period will be evaluated to determine the amount of potential / minimum return at maturity.

You anticipate the linked currency with bullish view will appreciate.

You anticipate the linked currency with bearish view will depreciate.

You anticipate the exchange rate of the underlying currency pair will move within the trading range.

At the same time, your investment will have 2 ways of observing exchange rate movements and determining final return:

Evaluate underlying currency pair performance during whole investment period.

Evaluate underlying currency pair performance on the final exchange rate determination date or on each coupon determination date.

Historical data for reference only. It may not be indicative of future data. Investment involves risks. Prices of foreign exchange may go up or down.

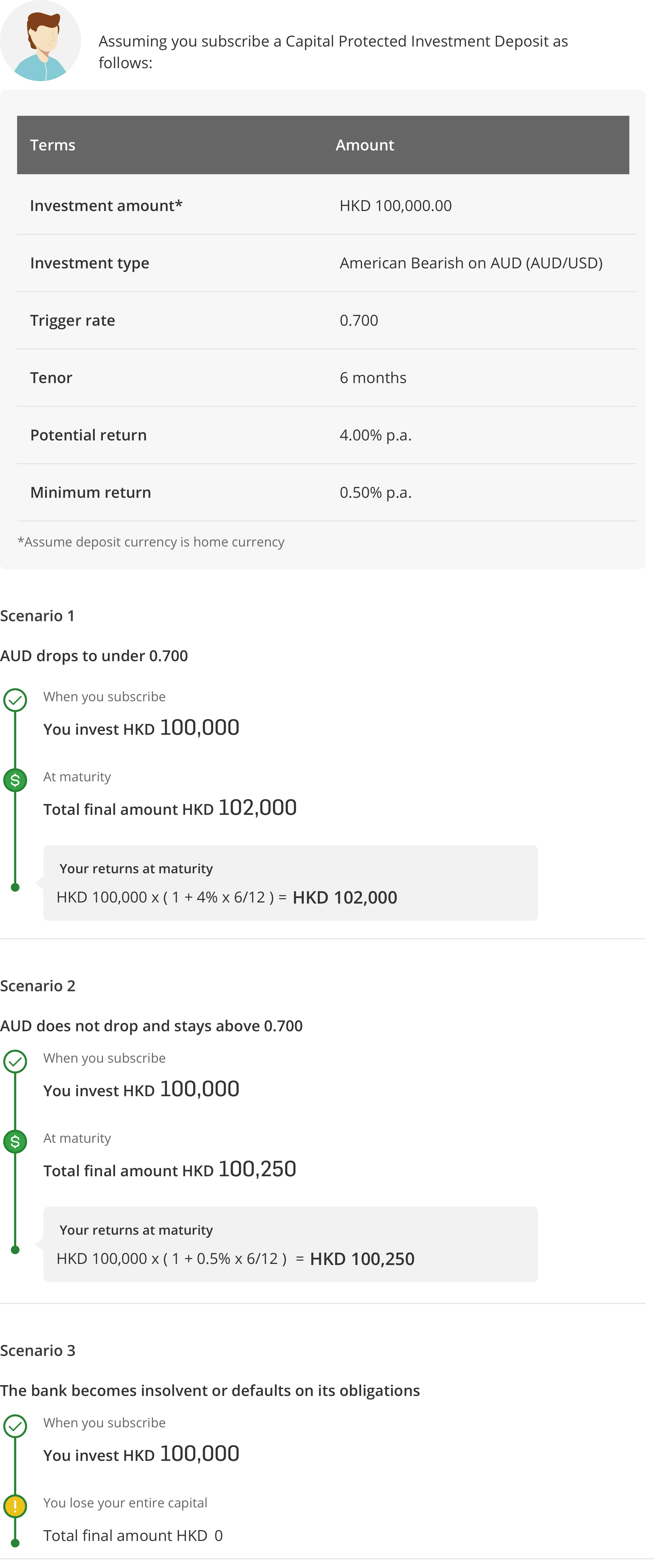

Capital Protected Investment Deposit is a currency-linked structured product with 100% capital protection at maturity.

To subscribe for Capital Protected Investment Deposit through Business e-Banking, advance enrollment for online "Investment Services" is required. Simply complete and return the application form (for non-existing customer of Business e-Banking / existing customer of Business e-Banking) to any of our branches. For enquiry, please contact (852) 2998 9788.

Not a time deposit: Currency-Linked Capital Protected Investment Deposit is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

Derivatives risk: Currency-Linked Capital Protected Investment Deposit is embedded with FX options. Option transactions involve risks, even when buying an option. The option’s value might become worthless if the market moves against your expectation.

Limited potential gain: The maximum potential gain is limited to the pre-agreed Return/Coupon calculated at the Potential Return/Coupon Rate.

Not the same as buying the Underlying Currency Pair: Investing in Currency-Linked Capital Protected Investment Deposit is not the same as buying the Underlying Currency Pair directly.

Market risk: The investment return of Currency-Linked Capital Protected Investment Deposit is linked to the exchange rate of the Underlying Currency Pair. Movements in exchange rates can be unpredictable, sudden and drastic, and affected by complex political and economic factors.

Liquidity risk: Currency-Linked Capital Protected Investment Deposit is designed to be held till maturity. The Bank may at its absolute discretion refuse to consent to any withdrawal/termination request before maturity.

Credit risk of the Bank: Currency-Linked Capital Protected Investment Deposit is not secured by any collateral. When you invest in Currency-Linked Capital Protected Investment Deposit, you will be relying on the Bank’s creditworthiness. If the Bank becomes insolvent or defaults on its obligations under a Currency-Linked Capital Protected Investment Deposit, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your investment amount.

Currency risk: Exchange rate fluctuates and sometimes drastically. If the Deposit Currency used for investment is not the home currency customarily used by you and thus conversion is required, you should note that you may make a gain or suffer a loss due to exchange rate fluctuations. When the Deposit Currency depreciates, the loss from depreciation may set-off or even exceed the Return/Coupon (if any) that you may receive from investing in the Currency-Linked Capital Protected Investment Deposit.

Risk of adjustments or early termination by the Bank: Certain terms and conditions (including some of the key dates) of Currency-Linked Capital Protected Investment Deposit can be adjusted by the Bank, this might have a negative impact on the Return/Coupon (if any) of the Currency-Linked Capital Protected Investment Deposit.

Concentration Risks: You should avoid excessive investment (in terms of its proportion of the overall portfolio) in any single type of investment, so as to avoid the investment portfolio being over-exposed to any particular investment risk.

Return/Coupon of Currency-Linked Capital Protected Investment Deposit: In order to provide capital protection, the investment strategy adopted for Currency-Linked Capital Protected Investment Deposit may lead to a dilution of performance when compared to non-capital protected products investing in similar markets. You should be prepared to take the risks of earning a lower Return/Coupon (if any) on the capital invested and losing the interest that might otherwise earned on money invested by way of deposits. For Currency-Linked Capital Protected Investment Deposit (with potential multi-coupon), periodic Coupon may be payable to you. For other types of Currency-Linked Capital Protected Investment Deposit, no periodic Return/Coupon will be payable to you prior to maturity.

Principal protection at maturity only: You should understand that the Principal of the Currency-Linked Capital Protected Investment Deposit is capital-protected only when it is held to maturity. If the Bank allows you to early withdraw/terminate the Currency-Linked Capital Protected Investment Deposit with written consent, the amount received by you upon early withdrawal/termination may be less than the amount initially invested by you.

Market Risks associated with Potential Return/Coupon: Apart from the Return/Coupon calculated at the Minimum Return/Coupon Rate (which may be set at zero), there is no guarantee of any Return/Coupon calculated at the Potential Return/Coupon Rate. For Currency-Linked Capital Protected Investment Deposit (with potential multi-coupon), Coupon (if any) is payable only if the Currency-Linked Capital Protected Investment Deposit is held till the relevant Coupon Distribution Dates. Return/Coupon (if any) of Currency-Linked Capital Protected Investment Deposit depends on the market conditions at the time of the relevant determination. Investment return on foreign exchange-linked products are dependent on the prices of inter-banks’ transactions on the linked exchange rate in the foreign exchange markets. You should be fully aware of the risks relating to fluctuations in the linked exchange rates. Factors affecting the performance of foreign exchange markets are numerous, including but are not limited to changes in global and local investment sentiments, interest rate policies, fund flows, political environment, economic environment, business and social conditions in the local marketplace. If the market trend is different from the view taken by you, there is an inherent risk that the total investment return that you may receive from Currency-Linked Capital Protected Investment Deposit will be less than the interest that would have been payable on a time deposit for the same tenor. There is also an inherent risk that no Return/Coupon calculated at the Potential Return/Coupon Rate will be payable to you in respect of the Currency-Linked Capital Protected Investment Deposit.

Early Withdrawal/Termination Risks: Early withdrawal/termination by you is not allowed for Currency-Linked Capital Protected Investment Deposit and the capital of you will be invested in the Currency-Linked Capital Protected Investment Deposit for the entire investment period. The Bank may at its absolute discretion refuse to give consent to any early withdrawal/termination request. If the Bank allows you to early withdraw/terminate the Currency-Linked Capital Protected Investment Deposit with written consent, the Bank shall be entitled to deduct from the Principal of the relevant Currency-Linked Capital Protected Investment Deposit and/or any other amount which may have accrued to you any expenses, costs or damages to the Bank. Damages may include any costs, expenses, liability or losses to the Bank as a result of the early withdrawal/termination by you. Therefore, there is no guarantee that you will be able to receive the Principal and the amount payable to you at early withdrawal/termination may be less than the Principal initially invested. Besides, if the Currency-Linked Capital Protected Investment Deposit is early withdrawn/terminated, you will no longer be entitled to any Return/Coupon of the Currency-Linked Capital Protected Investment Deposit.

Risks associated with unsuccessful subscriptions of Currency-Linked Capital Protected Investment Deposit: The Bank reserves the absolute right to approve any application and to decline any application received (whether in whole or any part thereof) before the Deposit Start Date. In the event of non-acceptance, a notification will be sent by the Bank and any subscription funds received will be returned to you after the Deposit Start Date or as soon as practicable.

Risks relating to Renminbi: If Currency-Linked Capital Protected Investment Deposit involves CNY, the relevant exchange rate(s) or level(s) of the relevant currency pair will be quoted in offshore Renminbi against alternate currency. While both onshore Renminbi and offshore Renminbi are the same currency, they are traded in different and separate markets operating under different regulations and independent liquidity pool. Onshore Renminbi and offshore Renminbi are currently quoted in different markets with different exchange rates, whereby their exchange rate movements may not be in the same direction or magnitude. The offshore Renminbi exchange rate may deviate significantly from the onshore Renminbi exchange rate. You should also note that Renminbi is currently not freely convertible, the value of Renminbi against other foreign currencies fluctuates and will be affected by, amongst other things, the PRC government’s control (for example, the PRC government regulates conversion between Renminbi and foreign currencies), which may adversely affect your investment return under the Currency-Linked Capital Protected Investment Deposit when you convert CNY into your home currency. Renminbi is subject to foreign exchange control by the PRC government and thus investors investing in Currency-Linked Investment Deposit involving Renminbi are subject to the currency risk of Renminbi.