We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

View the relevant Key Facts Statement.

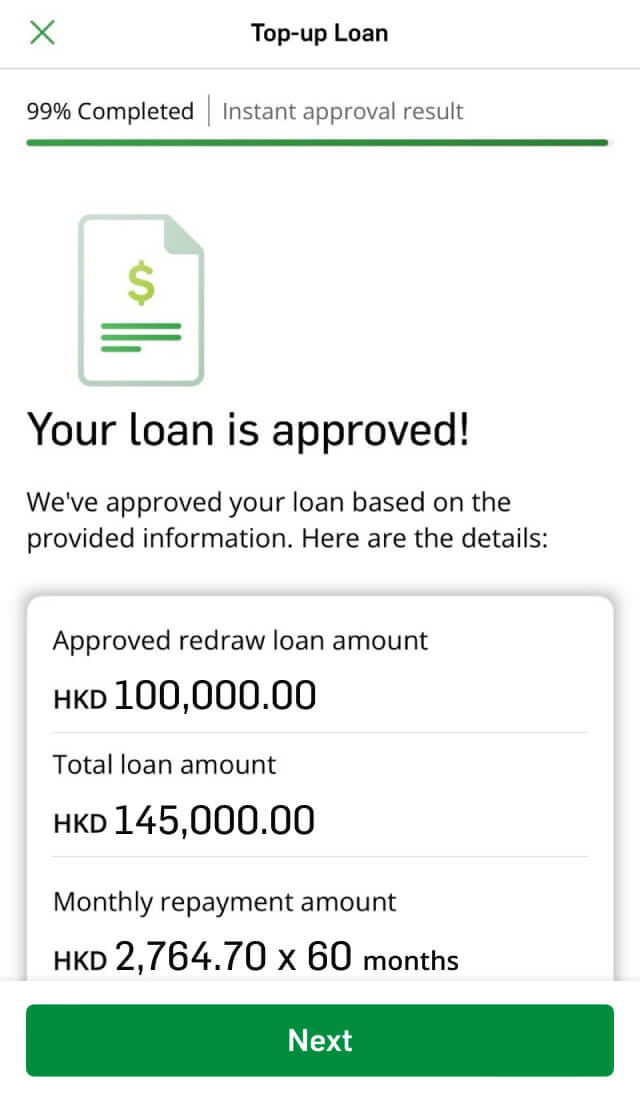

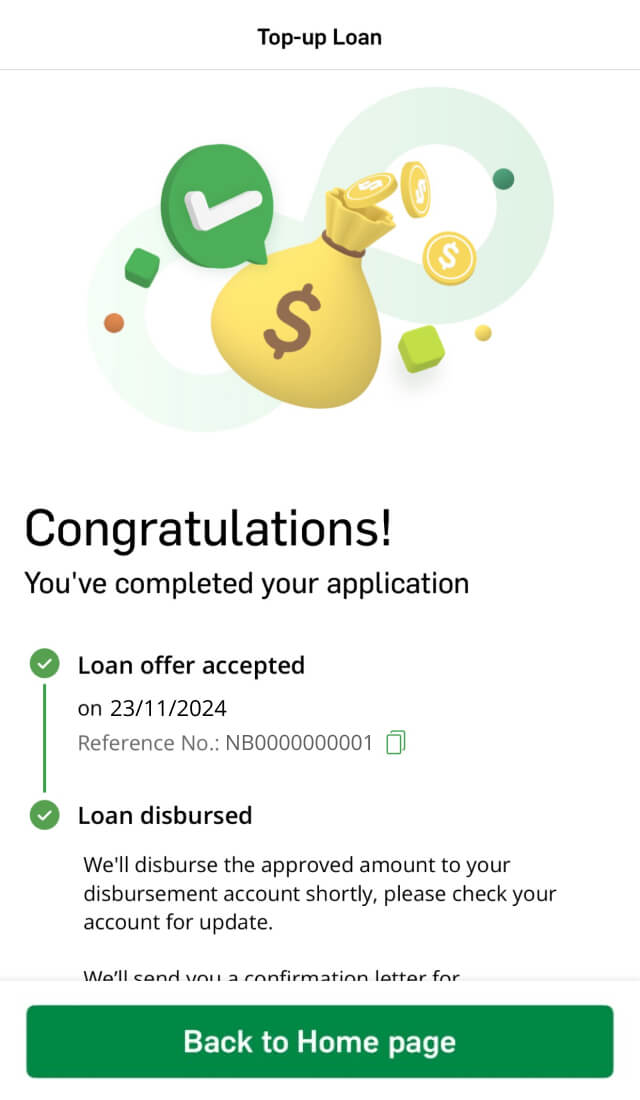

Experience a brand new, simpler process and easier approval for top-up loan application. Simply apply online to enjoy instant approval and cash disbursement[1]!

No further documentation is needed, giving you more flexibility.

Please read the Privacy Notice, Terms and Conditions for Hang Seng Personal Instalment Loan and Hang Seng Personal Revolving Loan and the Declaration.

If you understand and agree to be bound by them, please call (852) 3146 9987.

Please read the Privacy Notice, Terms and Conditions for Hang Seng Personal Instalment Loan and Hang Seng Personal Revolving Loan and the Declaration.

If you understand and agree to be bound by them, please call (852) 3146 9987.

Exclusive for existing personal instalment loan customers

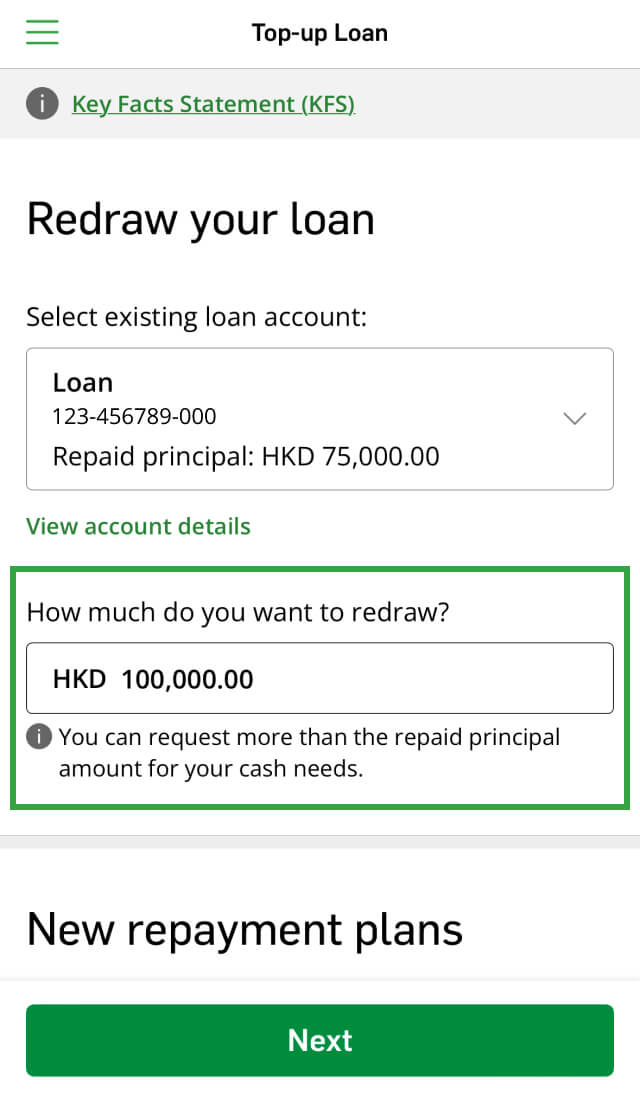

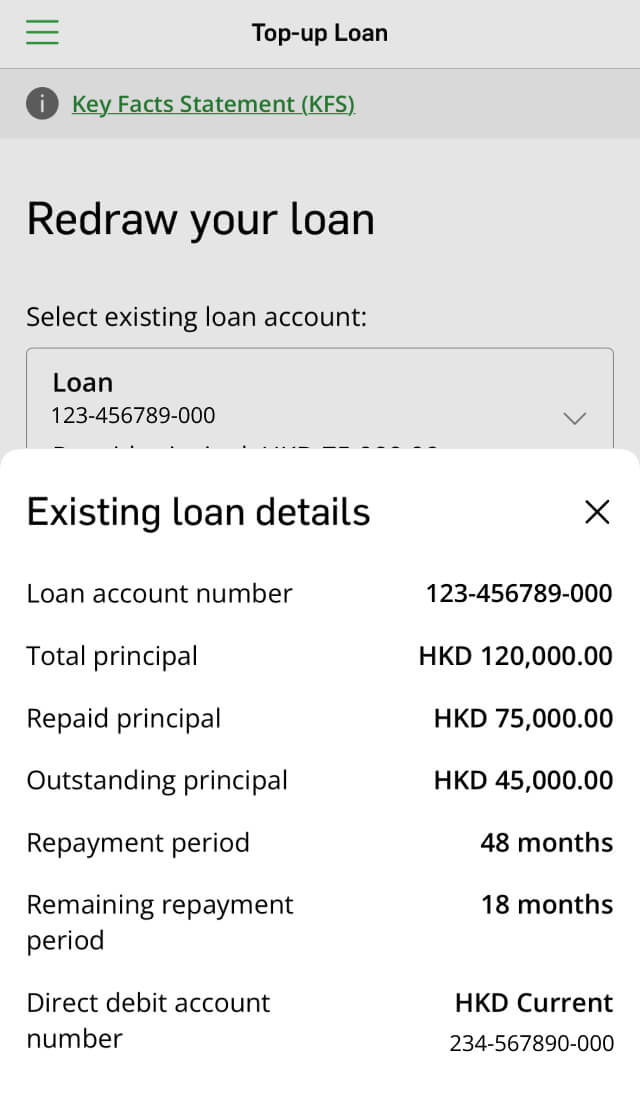

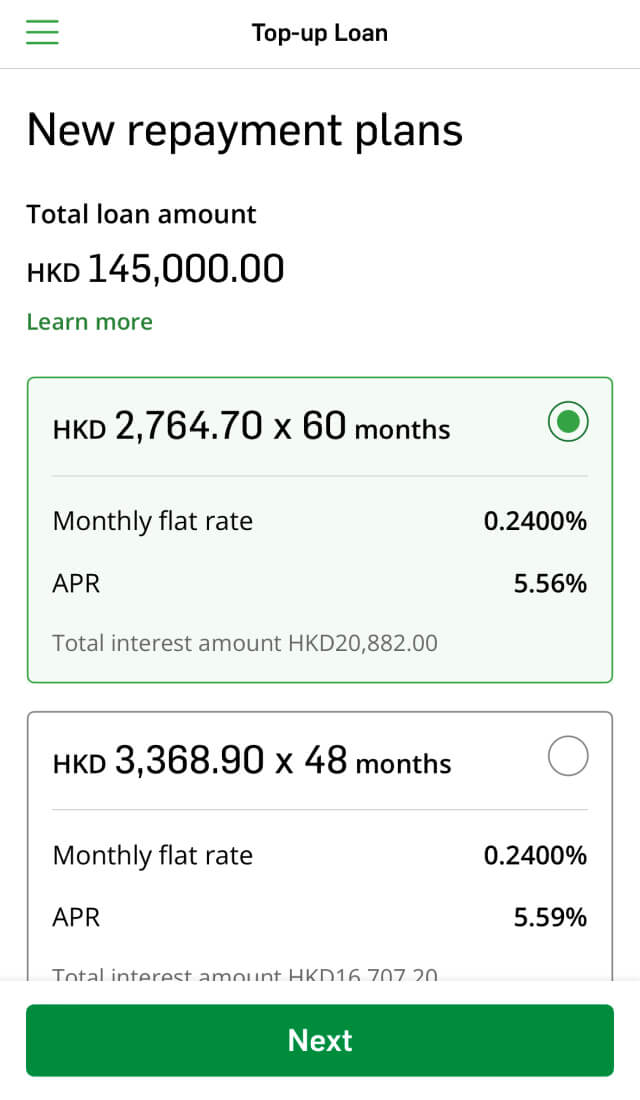

Re-borrow repaid loan principal or more[2] with the existing or longer loan tenor[3]

Enjoy the prevailing interest rate[4] on your existing loan

0% redraw handling charge

Get Instant Loan Approval[1] as well as up to HKD2,000 cash rebate[5]

Answer simple questions below and get your loan plan

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment |

|---|

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment | |

|---|---|---|

| Monthly repayment amount | HKD - | Minimum Payment |

| Total interest amount | HKD - (Save HKD -) |

HKD - |

| Repayment period | 72 month(s) (Shortened by - month(s)) |

- month(s) |

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|---|---|

| Only the minimum repayment | - month(s) | - |

| - | 36 month(s) | - |

To borrow or not to borrow? Borrow only if you can repay!