We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions, Privacy Policy, Cookies Policy and Personal Information Collection Statement.

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit "Security Information Centre" for more security tips.

View the relevant Important Risk Warning and Key Facts Statement.

Normal switching is now available for Investment Financing Service, allowing you to switch eligible funds in one step. Managing your portfolio has never been easier.

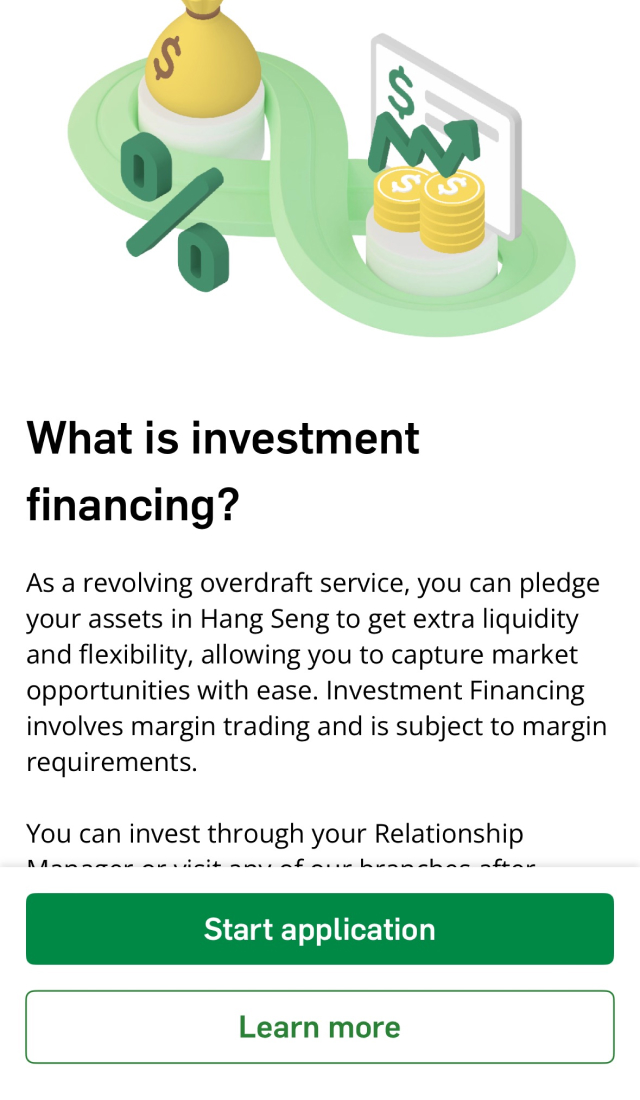

Investment Financing is a revolving overdraft facility which allows you to fund your investments in a wide range of Eligible Securities[1], providing extra liquidity and flexibility.

It also helps you capture more market opportunities by pledging your assets held at the Bank [2],[3].

Gain extra liquidity and purchasing power using leverage[3].

Provide diversified choices including investment funds, check out the eligible investment fund list and Loan Ratio for details.

To achieve higher potential return by expanding your investment portfolio[2], allowing you to further diversify your assets.

Mr. Chan has HKD50,000 cash in his Prestige Banking account and he wants to purchase an investment fund.

If he doesn't apply for Investment Financing Service, he can only use his own cash to purchase the investment fund.

If he applies for Investment Financing Service:

Assume he wants to subscribe an eligible investment fund with a Loan Ratio[4] of 50%

The maximum amount of eligible investment fund to be subscribed: HKD50,000 ÷ (1-50%) = HKD100,000

The loan amount in this transaction: HKD100,000 – HKD50,000 = HKD50,000

The example above is for reference only and shows only the major amounts and information in the calculation. For example, subscription fees and charges are not reflected in the example. The Bank may agree or refuse drawing under Investment Financing at its discretion on a case-by-case basis.

Please refer to Investment Financing Service Factsheet for detailed illustration and relevant terminology.

Assume Mr. Chan purchases an eligible investment fund with a Loan Ratio[4] of 50% and the Investment Financing interest rate is 4.125% p.a. After holding the eligible investment fund for 1 year, his investment return would be as shown below:

| Terms | Amount |

|---|---|

| Initial own capital | HKD50,000 |

| Loan ratio | 50% |

| Loan amount | HKD50,000 |

| Investment amount | HKD100,000 |

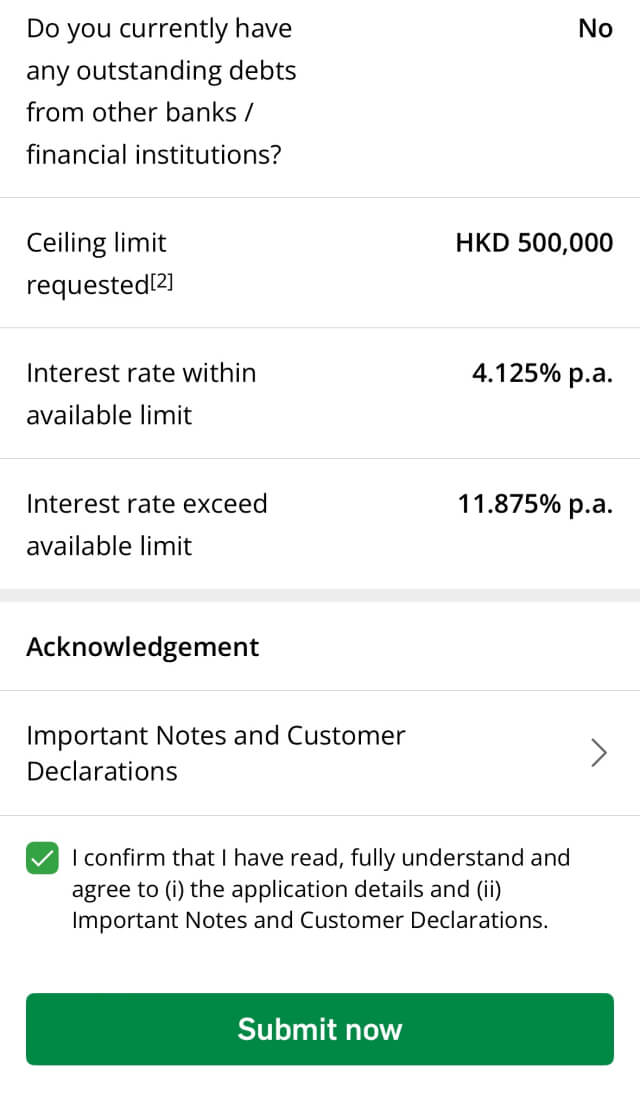

| Investment Financing interest rate[8] | P - 1.75% = 4.125% |

| Interest cost during the period | HKD50,000 x 4.125% = HKD2,062.5 |

If the market value of the investment fund increases by 20% during the 1-year holding period

Mr. Chan invests HKD100,000 for subscription

He receives HKD120,000 upon redemption of the investment fund

His investment gain amount upon redemption:

HKD120,000 – HKD100,000 – HKD2,062.5 = HKD17,937.5

Profit/initial own capital (%) = HKD17,937.5/HKD50,000 = 35.875%

If the market value of the investment fund drops by 50%[9] during the 1-year holding period

Mr. Chan invests HKD100,000 for subscription

He receives HKD50,000 upon redemption of the investment fund

His investment loss amount upon redemption:

HKD50,000 - HKD100,000 - HKD2,062.5 = -HKD52,062.5

Loss/initial own capital (%) = -HKD52,062.5/HKD50,000 = -104.125%

If the market value of the investment fund drops by 50%, Mr. Chan will lose HKD50,000 together with the interest expense of HKD2,062.5.

The above illustrations are examples for reference only. For details, please refer to Investment Financing Service Factsheet.

Please provide the following information to calculate the interest:[5]

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment |

|---|

| Debt Consolidation Instalment Loan | Credit Card Minimum Payment | |

|---|---|---|

| Monthly repayment amount | HKD - | Minimum Payment |

| Total interest amount | HKD - (Save HKD -) |

HKD - |

| Repayment period | 72 month(s) (Shortened by - month(s)) |

- month(s) |

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|

| Each month you pay (HKD) | Repayment period | Estimated total payment amount (HKD) |

|---|---|---|

| Only the minimum repayment | - month(s) | - |

| - | 36 month(s) | - |

Popular questions

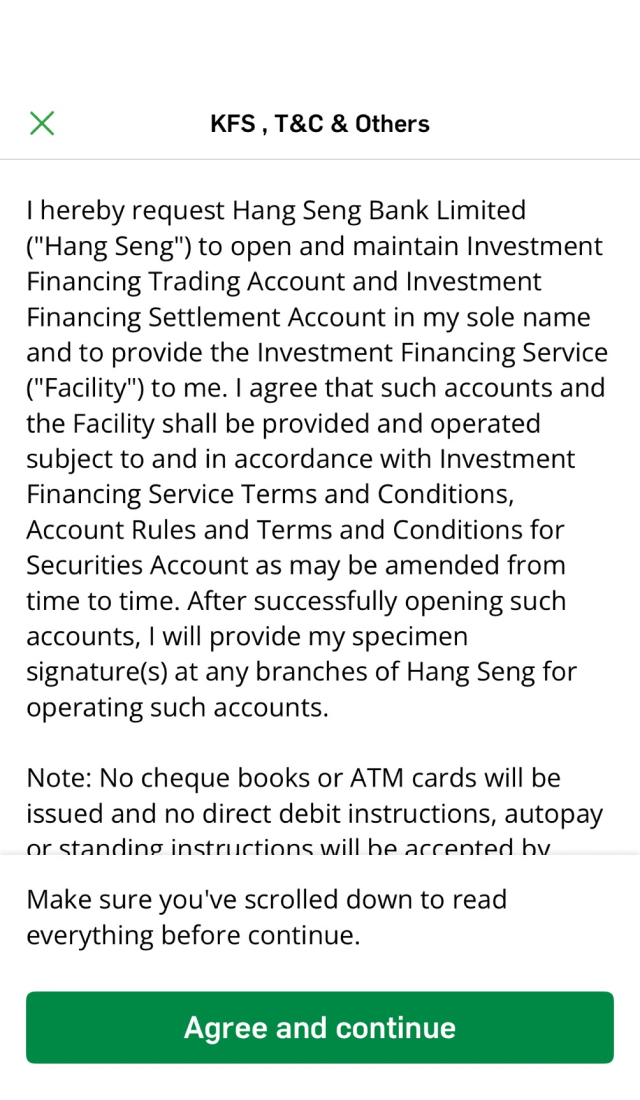

Investment Financing is a revolving overdraft facility which allows you to fund your investments in a wide range of Eligible Securities[1].

For customers without Hang Seng bank account, please open an account online or at our branch. The account status must be Prestige or Prestige Private; for customers with Hang Seng banking accounts, please visit our branches to apply this service.

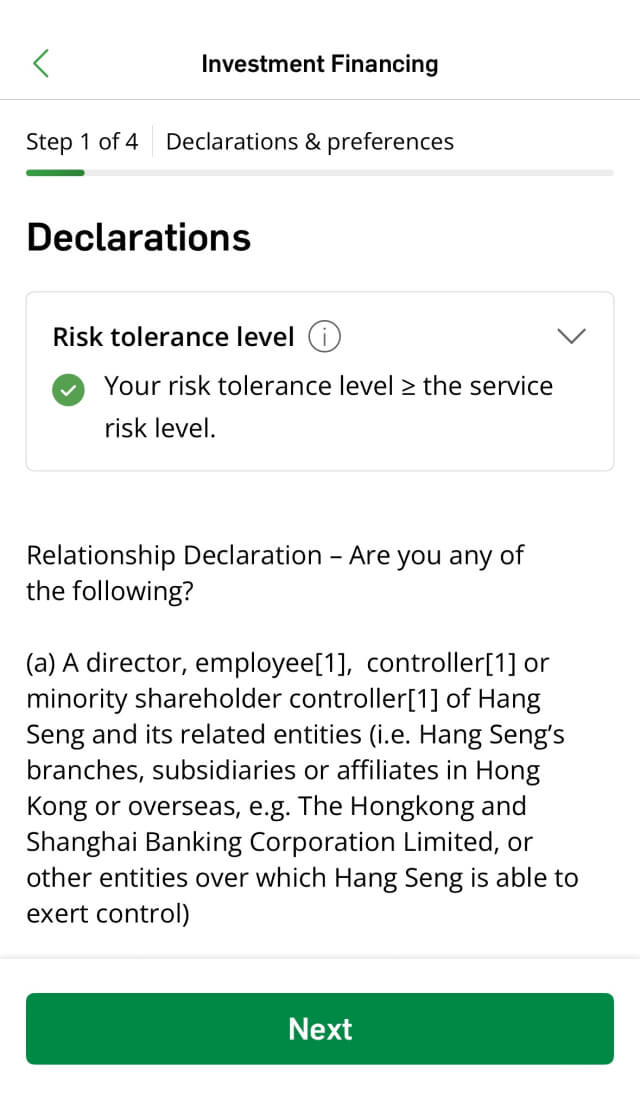

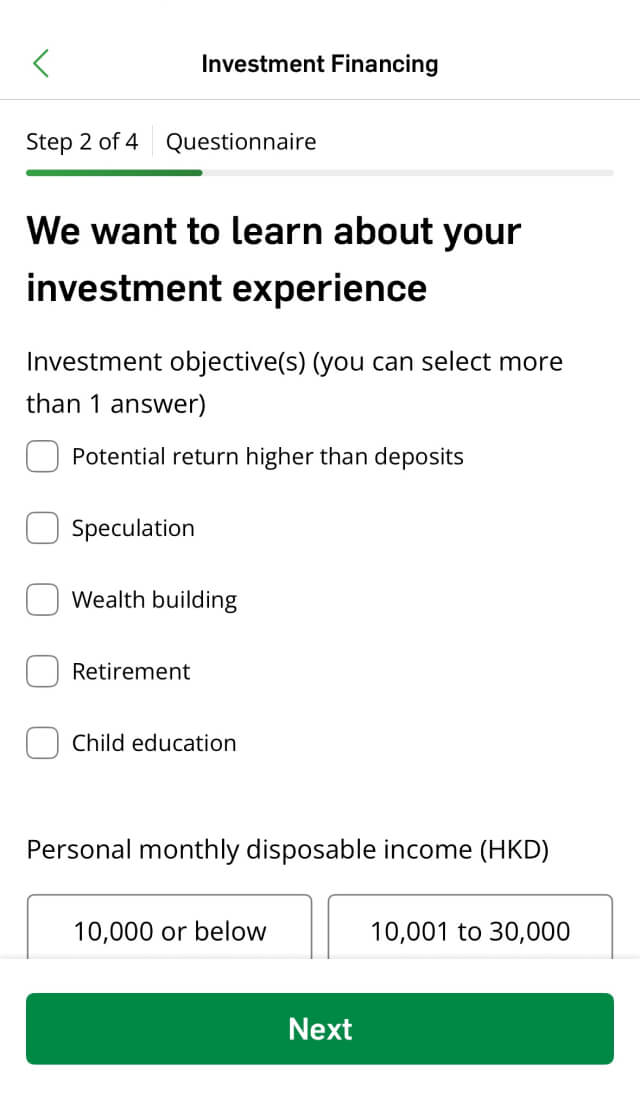

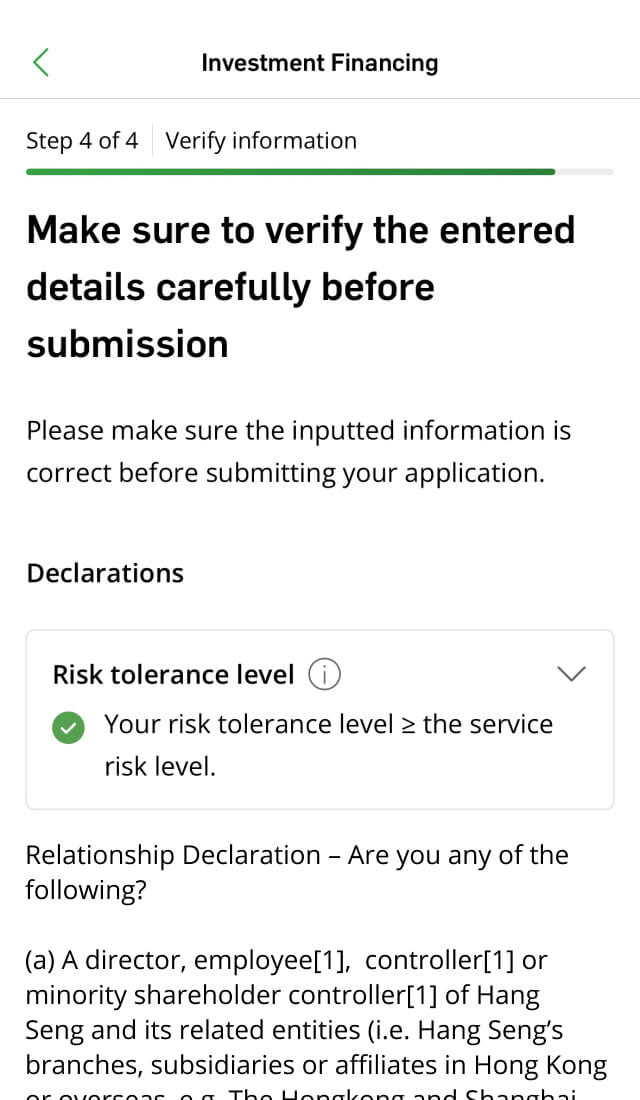

You must fulfil designated requirements such as account segment, age, residence identity and residency, risk tolerance level and with relevant Knowledge & Experience. For details, please refer to the Investment Financing Service Factsheet.

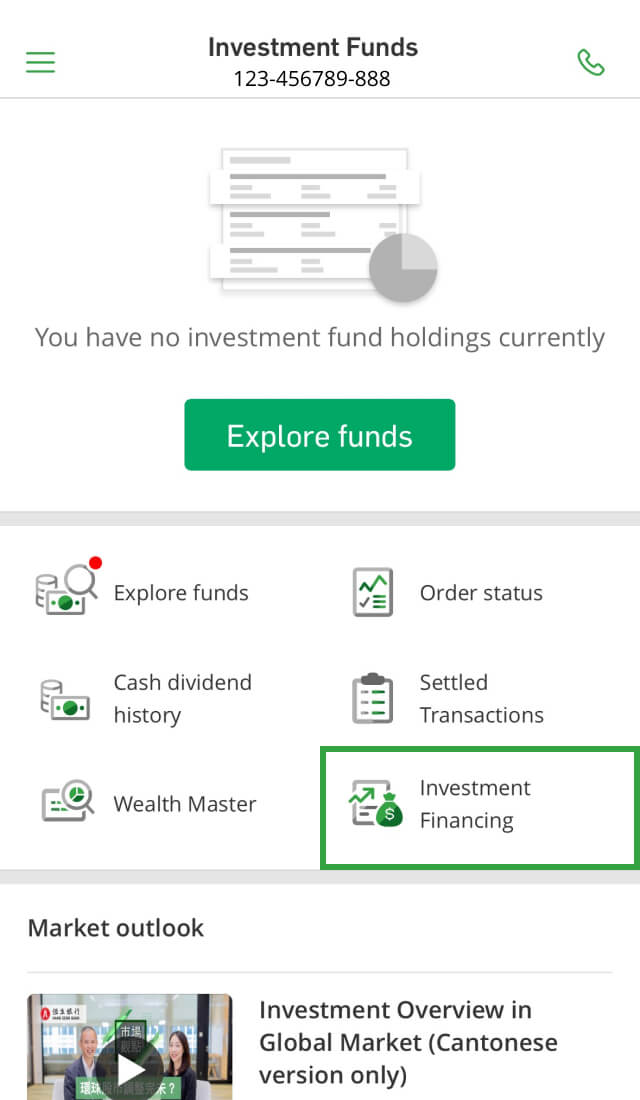

You can view the information via your Personal e-Banking account ("Investment" > "Investment Funds" > "Holdings & Trading" > "Select Investment Financing account"). Should you have any inquiries, please contact us for more details.

An SMS message will be sent to notify you that the outstanding loan amount exceeds the Available Limit or the PMR reaches the Margin Call threshold. If the situation of excessive amount lasts for a period of time, you may also receive a phone call from us as a reminder. We may get in touch with voicemail or email if you miss the phone call.

Please note that the Bank would not normally (but still may) give a Margin Call notification if the PMR has reached the Force Liquidation Threshold.

You are required to register for the "Instant Order Confirmation" service using a valid mobile number to receive Margin Call and Force Liquidation notification.

Please refer to Investment Financing Service Factsheet for relevant terminology.

You must settle the excess amount as soon as reasonably practicable (i.e. no later than the timeline prescribed by the Bank in the notification) to avoid unauthorised overdraft interests by depositing additional cash in your Investment Financing Settlement Account, or selling investment funds in your Investment Financing Trading Account and applying the sale proceeds to repay outstanding loan amount.

Force Liquidation would be triggered in accordance with the thresholds stated in the Investment Financing Service Factsheet.

No, an SMS will only be sent to inform you the transaction details after the Force Liquidation, therefore you should always keep track on the market situation and your account status. You should maintain your debit account balance within the Available Limit to avoid triggering the Force Liquidation Threshold.

Comprehensive investment experience is just a few steps away

To borrow or not to borrow? Borrow only if you can repay!

PLEASE READ THIS RISK DISCLOSURE STATEMENT CAREFULLY AND CONSULT YOUR OWN LEGAL ADVISER AND/OR OTHER PROFESSIONAL CONSULTANTS AS YOU CONSIDER APPROPRIATE BEFORE YOU DECIDE TO APPLY FOR INVESTMENT FINANCING SERVICE.

Below are the key risks associated with Investment Financing Service (the “Facility”) which are not exhaustive. The Facility is provided by Hang Seng Bank Limited (the “Bank”).

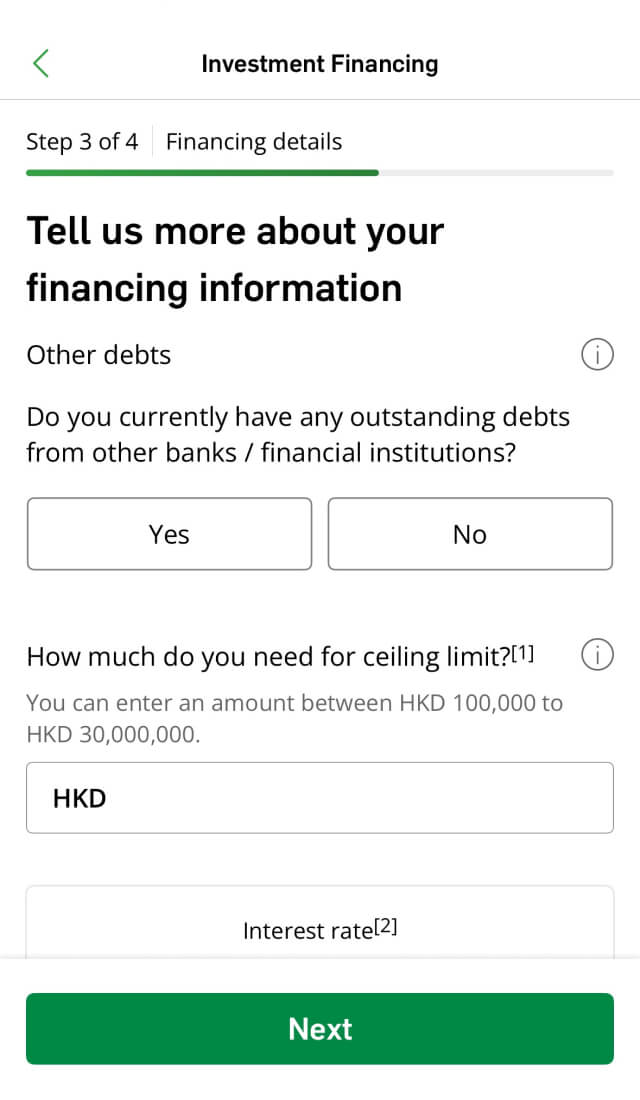

The Facility is a financing arrangement with margin requirements. The Available Limit of the Facility is determined by the aggregate of the market value of the investment products charged by you in favour of the Bank as collateral from time to time (“Charged Securities”) multiplied by the applicable Loan Ratio and capped at the Ceiling Limit. The Loan Ratio and the Ceiling Limit are set and may be varied by the Bank from time to time. If unauthorised overdraft occurs (i.e. when the loan amount exceeds the Available Limit) for any reasons, including but not limited to decrease in value of the Charged Securities, change of the Loan Ratio or termination of the Facility, interest on the unauthorised overdraft amount will be charged at the unauthorised overdraft interest rate(s) and you undertake to forthwith repay the unauthorised overdraft amount in cash or dispose of your investments and apply the proceeds towards repayment of the unauthorised overdraft amount.

If you do not act promptly upon receiving a Margin Call notice and do not take the required actions within a prescribed period, the Bank may exercise various rights, including the right to liquidate part or all of the Charged Securities, and the right to set-off any cash held in your account at the Bank towards any amount owing by you to the Bank under the Facility, in each case at any time and in any way the Bank considers appropriate without demand or notice to you (even if the market value of the Charged Securities drops drastically due to adverse market conditions). You will bear all losses and remain liable for any resulting deficit in your account and interest charged on your account. Commissions, fees and other charges applicable to the Facility may also increase your loss. You should therefore carefully consider whether such a financing arrangement is suitable in light of your own financial position and investment objectives.

Please refer to Investment Financing Service Factsheet for relevant terminology.