Remarks

You can view and download the Terms and Conditions for FX and Precious Metal Margin Trading Services (effective May 2019) and Notice of Amendments (effective 28 April 2025) on or before 28 September 2025.

|

|

|

|

Low Trading Spread

FX rate spread as low as 6 basis points for online trading (online service is only applicable to personal customers and is not applicable to commercial customers).

|

Leverage Ratio Up to 15 times

Empower you with capital flexibility to capture opportunities with different strategies in line with your investment insights, making the most of the ups and downs of market trends!

|

Convenient Trading

Brief but comprehensive online trading page makes order placement direct and easy.

And you can trade through Hang Seng Personal e-Banking, mobile app and/or our Manned Trading Hotline (2913 3388).

|

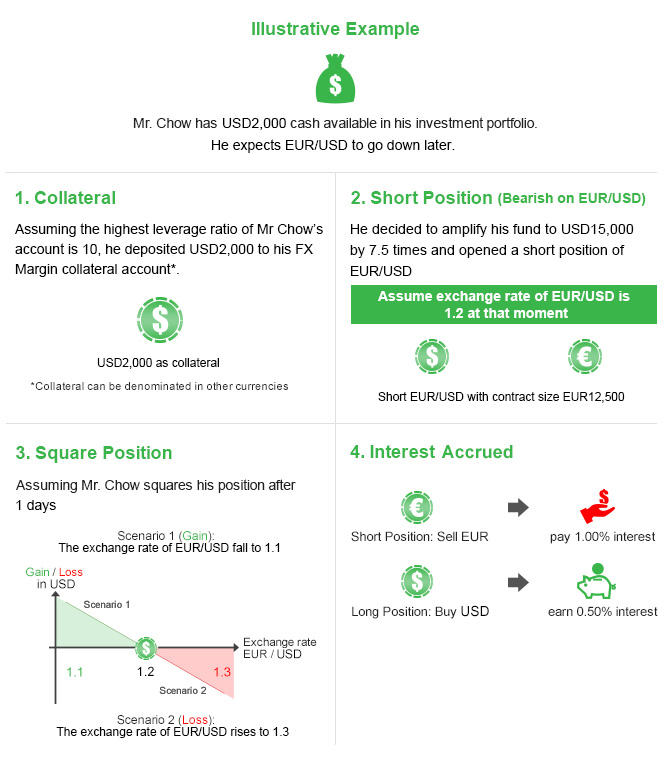

These examples are for reference only and shall not constitute any representation or warranty by us in respect of any possible gain or loss. You must not rely on them as any indication of the expected performance of any currency pair or precious metal. The following examples do not take into account any charges, expenses or commissions payable by you.

| All rollover interests and realized profit or loss will only be paid and received in USD only. | Assume the interest rate remains unchanged. |

|

Real-time trading Place conditional orders (Normal, Either-Or, If-Then and 2-in-1) Enquire orders, outstanding positions and transaction history Real-time streaming forex and precious metals quotes Real-time financial news and dynamic charts Daily focus provided by Mark Wan, Chief Analyst of Hang Seng Investment Services Ltd. |

Risk Disclosure

The risk of loss in leveraged foreign exchange and precious metal trading can be substantial. You may sustain losses in excess of your initial margin funds. Placing contingent orders, such as “stop-loss” or “stop-limit” orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your Account. You should therefore carefully consider whether FX and precious metal margin trading is suitable for you in light of your own financial position and investment objectives.

Renminbi (RMB) is subject to foreign exchange control by the PRC government. If your Margin Trading Contract involves Offshore Renminbi, you will be subject to foreign control and currency risk of RMB.

Trading on an electronic trading system may differ from trading on other trading systems or platforms. You will be exposed to risks associated with the system including the failure of hardware and software, which could result in your order not being executed according to your instructions or at all.

Investment involves risks. The above risk disclosure cannot disclose all the risks involved. You should read and understand all the relevant documents and risk disclosure (in particular, the Risk Disclosure Statement contained in the relevant application form) before making any investment decision.

The contents of this webpage have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to this webpage. If you are uncertain of or do not understand the nature of and the risks involved in leveraged foreign exchange and precious metal trading, you should seek independent professional advice.

Information prepared above is based on sources that are reasonably believes to be reliable. However, the Bank does not guarantee the accuracy, validity or completeness of such information, and no responsibility or liability is accepted in relation to the use of or reliance on any such information whatsoever contained in this website.